Property Tax Value Bexar County

The total market value of real property and personal property in Bexar County in 2018 was 368000000. The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100.

Taxes And Incentives Bulverde Spring Branch Texas Edf

Instead property taxes are paid to local governments school districts and other taxing entities.

Property tax value bexar county. Tax statements are then sent to all property owners. Bexar County 2018 property taxes are estimated to total 4 billion based on an effective tax rate of 24 including homestead exemptions. The homeowners property tax is based on the county appraisal districts appraised value of the home.

The Bexar County Appraisal District BCAD sets property values and is a separate organization from the Bexar County Tax Assessor-Collectors office. This is a 533 increase over 5 years. 2020 and prior year data current as of Apr 2 2021 653AM.

In order to determine the tax bill your. Online Credit Card Payments. The 10-Month Payment Plan applies to a property the person occupies as a residential homestead with one of the following exemptions.

The Bexar County Tax Assessor-Collectors Office is the only County in the State of Texas with a 10-month payment plan. Credit card payments may be paid through JetPay the authorized agent of the Bexar County Tax Assessor-CollectorThere is a convenience charge of 210 added by JetPay to cover the processing cost. Protest Your Property Taxes San Antonio Texas 2014.

The market value of Bexar County taxable property rose from 120 billion in 2014 to 184 billion in 2018. The Bexar County Appraisal District is beginning to mail out 540000 notices to property owners whose property has increased in appraised value from the prior year. For more information on property values.

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets. For property information contact 210 242-2432 or 210 224-8511 or email. Bexar County Tax Assessor-Collector.

San Antonio is home to most Bexar County residents with a population of 15 million living in the city. Lisa Anderson PCC Chief Deputy of Administration and Operations Stephen W. Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of median property taxes.

Technically a Texas homesteads assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110 of the appraised. For website information contact 210 242-2500. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Bexar County Tax Appraisers office.

The median property tax on a 11710000 house is 248252 in Bexar County. There is no property tax or income tax assessed by the State of Texas. The median property tax on a.

Palacios CPA PCC Chief Deputy of Financial Reporting Department and Operations Marilyn Gonzales Director Motor Vehicle Registration Department. Bexar County collects on average 212 of a propertys assessed fair market value as property tax. 2021 data current as of Apr 16 2021 123AM.

The tax rate varies from year to year depending on the countys needs. Gutierrez PCC Director Property Tax Department Richard Salas Esq. 3 rows In-depth Bexar County TX Property Tax Information.

The Tax Assessor Collector of Bexar County applies these rates to the values of the properties within the county. There is no state property tax in Texas. Property Values are Going Up And so are most homeowners property tax assessments.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. A Texas county appraisal distict may not increase the appraised value of a homestead by more than 10 in a given tax year. Other major cities in Bexar County include Alamo Heights Castle Hills and Converse.

Bexar County Property Tax Payments Annual Bexar County Texas. 92 rows The median property tax also known as real estate tax in Bexar County is 248400 per.

Everything You Need To Know About Bexar County Property Tax

Everything You Need To Know About Bexar County Property Tax

Bexar Appraisal District Expecting Record Number Of Property Tax Protests Kabb

Https Www Bexar Org Documentcenter View 26900 Whats New At The Tax Office May 2020 Pdf Bidid

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Public Service Announcement Residential Homestead Exemption

Public Service Announcement Residential Homestead Exemption

Bexar County Property Tax Protest Tips 2018

Bexar County Property Tax Protest Tips 2018

Https Www Bexar Org Documentcenter View 21644 Tax Assessor Mtb 4 11

Property Tax Protests On The Rise As Home Values Increase Community Impact Newspaper

Property Tax Protests On The Rise As Home Values Increase Community Impact Newspaper

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Https Www Bexar Org Documentcenter View 26900 Whats New At The Tax Office May 2020 Pdf Bidid

Tax Rates Bexar County Tx Official Website

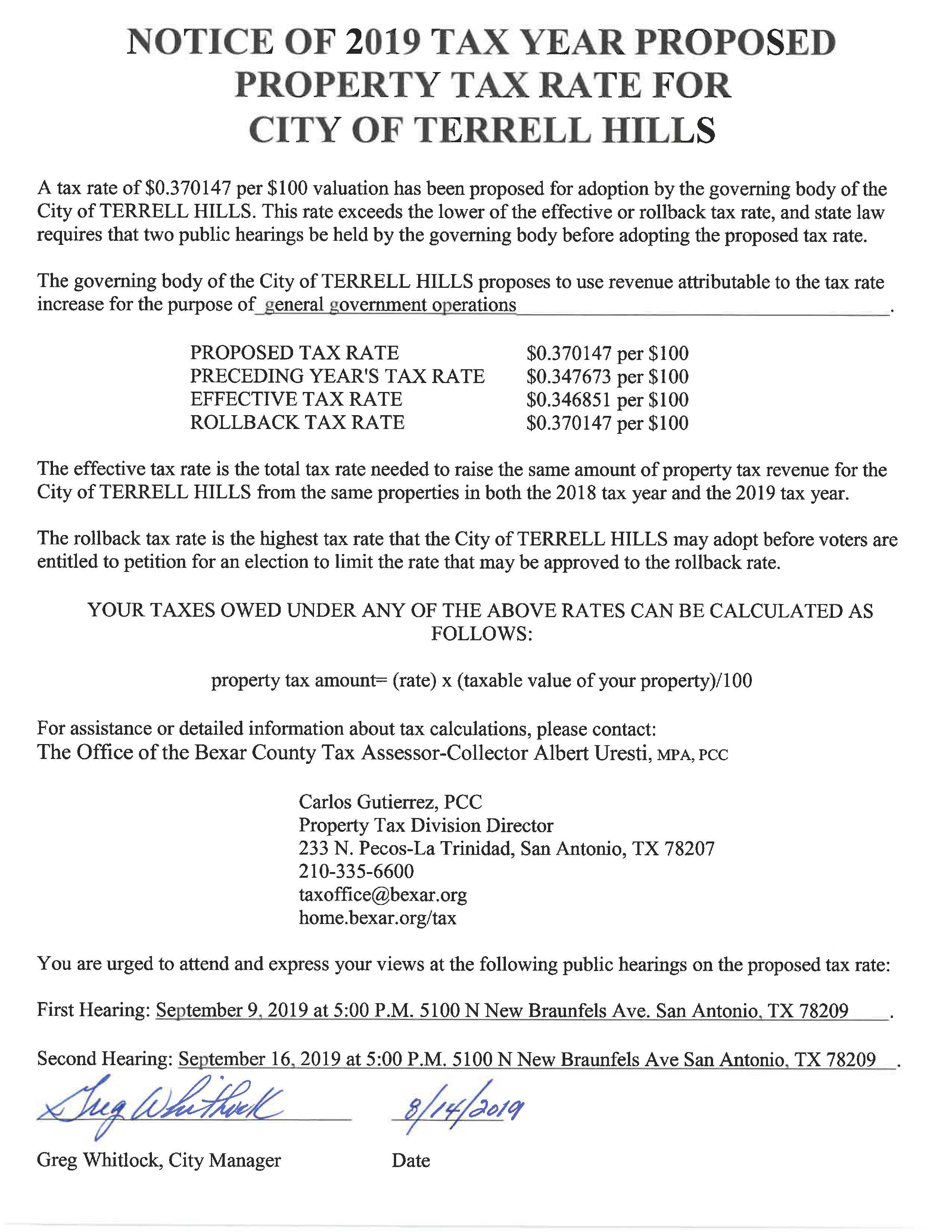

Notice Of 2019 Tax Year Proposed Property Tax Rate

Notice Of 2019 Tax Year Proposed Property Tax Rate

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Everything You Need To Know About Bexar County Property Tax

Everything You Need To Know About Bexar County Property Tax

Tax Rates Bexar County Tx Official Website

Bexar County Texas Property Search And Interactive Gis Map

Bexar County Texas Property Search And Interactive Gis Map

Video Tips On Protesting Property Taxes And A Glimpse At What S Behind Rising Valuations Nowcastsa

Video Tips On Protesting Property Taxes And A Glimpse At What S Behind Rising Valuations Nowcastsa

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home