Property Tax Estimator San Diego

Generally your tax amount is 1 of the net value of your property but thats not all. San Diego County collects on average 061 of a propertys assessed fair market value as property tax.

San Diego Property Tax County Tax Collector And Assessor

San Diego Property Tax County Tax Collector And Assessor

The final property tax is calculated by taking the mill levy figure and multiplying it by the assessed value of the San Diego home.

Property tax estimator san diego. The San Diego County Assessor is responsible for determining the value for all homes which is crucial as far as property taxes go. Center 1600 Pacific Hwy Room 162 San Diego CA 92101. Information for Taxpayers.

However because assessed values rise to the purchase price when a home is sold new homeowners can expect to pay higher rates than that. Yearly median tax in San Diego County The median property tax in San Diego County California is 2955 per year for a home worth the median value of 486000. The value of your home is assessed by the San Diego County Assessors Office.

The final exchange of Property Tax for Cities and County Sales and Use Tax authorized under Assembly Bill 1766 was made in Fiscal Year 2015-2016. The median property tax on a 48600000 house is 359640 in California. You are now leaving the San Diego County AssessorRecorderClerks website and will be taken to a website hosted by ParcelQuest a v endor under contract with the.

Dan McAllister Treasurer-Tax Collector San Diego County Admin. The average effective property tax rate in San Diego County is 073 significantly lower than the national average. Please choose to search by either Assessor Parcel Number Supplemental Bill Number Escape Bill Number Mailing Address or Unsecured Bill Number to display a list of matching or related records.

8 AM - 500 PM. 1450 Court St Suite 227 Redding CA 96001. San Diego Real Estate tax is ad valorem Latin for according to value.

This is because in San Diego the taxes are calculated through the assessed value of a home. General County Information 858 694-3900 2-1-1 San Diego Board of Supervisors Department Contacts. The base tax rate used to calculate your bill is 1 of the net value plus any voter-approved bonds.

4 County of San Diego County of San Diego. The San Diego County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in San Diego County. There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes.

Reports Auditor and Controller. Property Tax Relief for Seniors and Disabled. Property Tax Relief from a Calamity.

In our calculator we take your home value and multiply that by your countys. Property Tax Sale Search. Choose a city from the drop down box enter a propertyprice in the space provided then press the Calculate button.

Dan McAllister Treasurer-Tax Collector San Diego County Admin. The assessed value of the California property is assigned by an assessor via three possible calculations including the sales value of the home how much it would cost to replace the property. Values from the Supplemental Tax Estimator are only estimates and may differ from actual values.

The higher your homes assessed value the more taxes you pay. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in. Try our FREE income tax calculator.

1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. The San Diego County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. BOX 121750 SAN DIEGO CA 92112- 1750 619 237 -0502 FAX 619 557-4155 06092017.

This Supplemental Tax Estimator is intended for changes in ownership only and not for situations where assessed value is added due to new construction. SAN DIEGO COUNTY ASSESSED VALUES PROPERTY CHARACTERISTICS AND MAPS. The levies are then added together and the total mill rate is acquired.

The median property tax on a 48600000 house is 296460 in San Diego County. Please note that we can only estimate your property tax based on median property taxes in your area. TAX DAY NOW MAY 17th - There are 30 days left until taxes are due.

Heres how it works. The Supplemental Tax Estimator provides an estimate of supplemental taxes along with an estimate of property tax liability for the following tax year. The Fizber Property Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in any city nationwide.

1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. Each levy is calculated for the tax jurisdiction. Search Property Tax Information This page allows you to search for San Diego County secured unsecured and defaulted properties.

Start filing your tax return now. The median property tax on a 48600000 house is 510300 in the United States. Center 1600 Pacific Hwy Room 162 San Diego CA 92101.

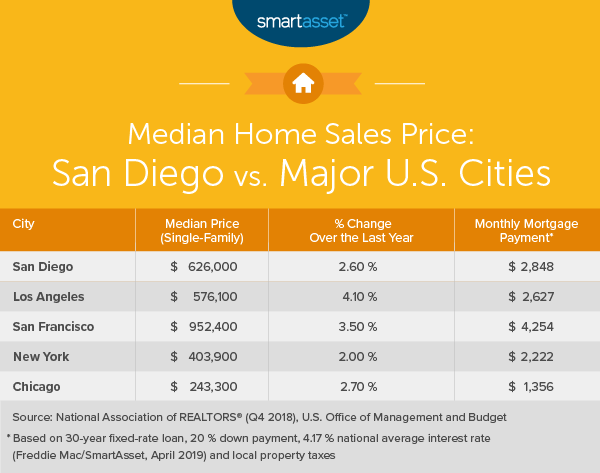

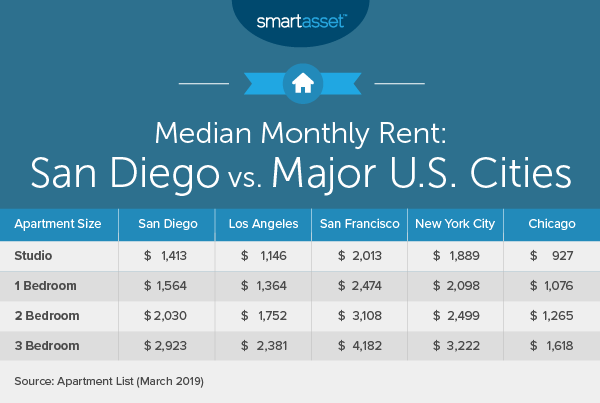

The Cost Of Living In San Diego Smartasset

The Cost Of Living In San Diego Smartasset

Transfer Tax In San Diego County California Who Pays What

Transfer Tax In San Diego County California Who Pays What

The Cost Of Living In San Diego Smartasset

The Cost Of Living In San Diego Smartasset

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Understanding California S Property Taxes

Understanding California S Property Taxes

San Diego County Ca Property Tax Faq S In 2021

San Diego County Ca Property Tax Faq S In 2021

San Diego County Ca Property Tax Rates In 2021

San Diego County Ca Property Tax Rates In 2021

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

San Diego Property Tax Rate San Diego Real Estate Taxes Welcome To San Diego

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

San Diego County Ca Property Tax Rates In 2021

San Diego County Ca Property Tax Rates In 2021

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home