Nj Property Tax Credit Qualifications

This benefit is administered by the local municipality. Eligibility Requirements With respect to the 250 Veterans Property Tax Deduction the pretax year is October 1 2020 with the deduction applied to the property taxes for Calendar Year 2021.

Https Www Peqtwp Org Documentcenter View 544 Handbook For New Jersey Assessors Pdf

Homeowners and tenants who pay property taxes on a primary residence main home in New Jersey either directly or through rent may qualify for either a deduction or a refundable credit when filing an Income Tax return.

Nj property tax credit qualifications. Almost 25 of eligible New Jerseyans never apply for NJEITC. Any tax credit the owner may receive eg the eligible senior citizen veteran or homestead credit Next years first half tax Payment instructions Instructions for finding out how much state. The higher your income the lower the percentage.

New Jersey cannot provide any information about the amount eligibility or when you may receive a payment. You met the 2017 income requirements. To qualify as of October 1 of the pretax year you must.

If your annual income exceeds 250000 you will not qualify for any rebate or credit. 150000 or less for homeowners age 65 or over or blind or disabled. The deduction will reduce the taxable income used to calculate your tax.

Your gross income must be more than 20000 10000 if filing status is single or marriedCU partner filing separate return OR you and or your spousecivil union partner if filing jointly were 65 or older or blind or disabled on the last day of the tax year. You can deduct your property taxes paid or 15000 whichever is less. For Tax Year 2020 eligible NJ residents will receive 40 of the federal EITC.

This latest increase will put an average of 882 back into taxpayers pockets. Billing Information Property ID information Property value calculation Tax allocation Net taxes. See Eligibility Requirements.

Have a qualifying child or. December 31 2021 Details. Property Tax DeductionCredit Eligibility.

Be a legal resident of New Jersey. Was your principal residence a unit in a multiunit property you owned. For example if you own a and occupy one of the units as your principal residence answer Yes However if you own a condominium unit or a unit in a co-op or continuing care retirement community answer No You are not.

Be a resident of this state who works or earns income. You have only one domicile although you may have more than one place to live. Those making over 100000 up to 150000 could get a 25 credit.

NJEITC is a cash-back tax credit that puts money back into the pockets of working families and individuals including the self-employed who earn low- to moderate-income. Or 75000 or less for homeowners under age 65 and not blind or disabled. Must be an existing home your principal residence.

Eligible seniors or disabled people with New Jersey gross income of up to 100000 would get a credit worth 5 of their 2006 property taxes. Annual deduction of up to 250 from property taxes for homeowners 65 or older or disabled who meet certain income and residency requirements. And Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent.

These stimulus payments are not subject to Income Tax in New Jersey and should not be reported on your New Jersey Income Tax return. Other Property Tax Benefits Annual Property Tax Deduction for Senior Citizens Disabled Persons. If you were not a homeowner on October 1 2017 you are not eligible for a Homestead Benefit even if you owned a home for part of the year.

For more information see the instructions for filing Form NJ-1040-HW. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021. Many New Jersey homeowners are entitled to a rebate or credit thats a percentage of the first 10000 in property tax that they paid last year.

And eligibility for property tax deductions and credits. To be eligible for the NJEITC you must. Property Tax DeductionCredit Eligibility.

10 of cost up to 500 or a specific amount from 50-300. You are eligible for a property tax deduction or a property tax credit only if. The percentage depends on the owners annual income.

Domicile is the place you consider your permanent home the place where you intend to return after a period of absence eg vacation business assignment educational leave. And seniors or disabled people werent eligible for any credit if they made more than 150000. New construction and rentals do not apply.

Or perhaps your income did not qualify. Property Tax DeductionCredit Eligibility. The property tax deduction reduces your taxable income.

You may claim only one of the benefits. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year. Certain senior or blinddisabled residents who are not required to file a tax return can use the Property Tax Credit Application Form NJ-1040-HW to apply for the credit.

Under the programs current rules senior and disabled homeowners with a household income of up to 150000 are eligible as are others making up to. See the tax return instructions for information on calculating your deductioncredit. Did you get the NJ property tax deduction instead.

Claim and be allowed or would claim and be allowed if you met the age limit a federal Earned Income Tax Credit for the same tax year. Residents of New Jersey that pay property tax on the home they own or rent may qualify for a refundable tax credit or a deduction on their return.

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

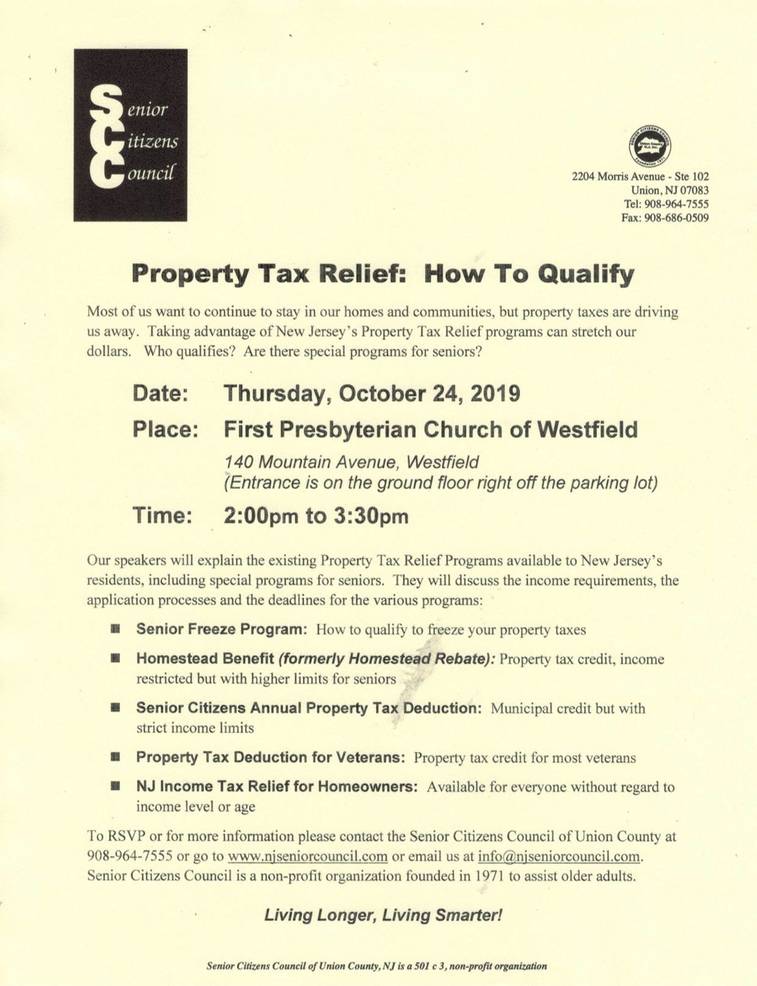

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Property Tax Relief For Seniors Property Walls

Https Neptunetownship Org Sites Default Files 2019 20sr 20freeze 20ins Pdf

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Solar Incentives Nj Solar Tax Credit Sunrun

New Jersey Solar Incentives Nj Solar Tax Credit Sunrun

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Property Tax Relief For Seniors Property Walls

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Property Tax Relief For Seniors Property Walls

Determining Eligibility For The Solar Investment Tax Credit Geoscape Solar

Determining Eligibility For The Solar Investment Tax Credit Geoscape Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

New Jersey Property Tax Relief For Seniors Property Walls

New Jersey Property Tax Relief For Seniors Property Walls

What Is The Salt Deduction H R Block

What Is The Salt Deduction H R Block

Https Www State Nj Us Treasury Taxation Pdf Homestead Hownerappins Pdf

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Labels: credit, property, qualifications

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home