How To Look Up Property Taxes In Texas

To check department records for tax liens you may view homeownership records online or call our office at 1-800-500-7074 ext. The property tax account is being reviewed prior to billing.

What Are The Best And Worst States For Property Taxes Property Tax Property Tax

What Are The Best And Worst States For Property Taxes Property Tax Property Tax

See what the tax bill is for any Texas property by simply typing its address into a search bar.

How to look up property taxes in texas. Renaissance Tower - 1201 Elm Street Suite 2600 Dallas TX 75270. Assessor Collector Delinquent Taxes Foreclosures Elections. If the property owner cant pay the liens the new owner can foreclose on the property.

Most questions about property appraisal or property tax should be addressed to your countys appraisal district or tax assessor-collector. 203 Bay City TX 77414. Property Tax Assistance Texas has no state property tax.

In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. Compare that to the national average which currently stands at 107. The typical Texas homeowner pays 3390 annually in property taxes.

This program is designed to help you access property tax information and pay your property taxes online. The Public Records Online Directory is a Portal to official state web sites and those Tax Assessors and Recorders offices that have developed web sites for the retrieval of. The Comptrollers office does not have access to your local property appraisal or tax information.

Available information includes property classification number and type of. Property taxes in Texas are the seventh-highest in the US as the average effective property tax rate in the Lone Star State is 169. Search Matagorda County property tax and assessment records by owner name property address or account number.

Please be prepared to provide the complete serial number and HUD Label or Texas Seal number of the home. Matagorda County Tax Assessor and Collector. WELCOME TO TARRANT COUNTY PROPERTY TAX DIVISION.

Free Property Records Search Find residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records. Quickly identify tax rates in your area and see how much your neighbors are paying in property taxes. Enter at least the first two letters of the last name in the format Last name space first name.

Tarrant County has the highest number of property tax accounts in the State of Texas. Thats up to local taxing units which use tax revenue to provide local services including schools streets and roads police and fire protection and many others. 1700 7th St Rm.

Both of these are sales of homes with unpaid property taxes. Texas State Property Tax Exemptions httpscomptrollertexasgovtaxesproperty-taxexemptions View Texas property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions applications and program details. Additionally our staff is available to answer questions by calling 1-800-321-2274 Monday-Friday 800 am.

See Texas tax rates tax exemptions for any property the tax assessment history for the past years and more. In a tax deed sale a property owner with unpaid taxes is forced to sell their property. In a tax lien sale the lien is auctioned to the highest bidder.

Alternatively you can find your county on. 214 653-7811 Fax. The Comptrollers office does not collect property tax or set tax rates.

The 2020 property taxes are. Perform a free public property records search including property appraisals unclaimed property ownership searches lookups tax records titles deeds and liens. Use our free Texas property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements. Our property records tool can return a variety of information about your property that affect your property tax. Search by owner name and account type.

Texas Property Taxes By County You can choose any county from our list of Texas counties for detailed information on that countys property tax and the contact information for the county tax assessors office.

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

6 Tips To Reduce Property Tax How To Reduce Property Tax Steps To Reduce Property Tax Tips To Reduce Property Tax Property Tax Tax Reduction Tax Consulting

6 Tips To Reduce Property Tax How To Reduce Property Tax Steps To Reduce Property Tax Tips To Reduce Property Tax Property Tax Tax Reduction Tax Consulting

Average Property Tax As A Share Of Home Price Five Year Average 2007 2011 Property Tax Real Estate Infographic Real Estate Articles

Average Property Tax As A Share Of Home Price Five Year Average 2007 2011 Property Tax Real Estate Infographic Real Estate Articles

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Your Guide To Property Tax Exemptions For Seniors In Texas Dallasfortworthseniorliving Com Tax Exemption Property Tax Tax

Your Guide To Property Tax Exemptions For Seniors In Texas Dallasfortworthseniorliving Com Tax Exemption Property Tax Tax

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Harris County Tx Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

What To Do When Your Tax Appraisal Comes In High Property Tax Appraisal Home Appraisal

What To Do When Your Tax Appraisal Comes In High Property Tax Appraisal Home Appraisal

1813 La Mesa Lane Property Tax Property Texas Homes

1813 La Mesa Lane Property Tax Property Texas Homes

Paradym Fusion Viewer San Angelo Texas Texas Homes Real Estate

Paradym Fusion Viewer San Angelo Texas Texas Homes Real Estate

New Texas Home Owners Don T Forget To File Your Homestead Exemption It Will Save You On Your Property Ta Real Estate Branding Homeowner Texas Real Estate

New Texas Home Owners Don T Forget To File Your Homestead Exemption It Will Save You On Your Property Ta Real Estate Branding Homeowner Texas Real Estate

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

There Were Some Recent Changes To The Death Tax In Texas So Take A Look And Keep Yourself Informed For More Information On E Death Tax Estate Planning Death

There Were Some Recent Changes To The Death Tax In Texas So Take A Look And Keep Yourself Informed For More Information On E Death Tax Estate Planning Death

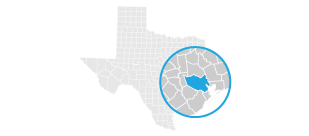

Where Are Lowest Property Taxes In North Texas Property Tax Tax Consulting Tax Payment

Where Are Lowest Property Taxes In North Texas Property Tax Tax Consulting Tax Payment

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Best Property Management Services Texas Property Manager Texas Westrom Group Property Management Property Management Euless Tenant Screening

Best Property Management Services Texas Property Manager Texas Westrom Group Property Management Property Management Euless Tenant Screening

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Labels: look

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home