Franklin County Ks Property Tax Search

John Smith Street Address Ex. The Citys Property Tax Web Portal has information available for review AFTER property tax bills have been produced and is updated after property tax payments are processed.

Ottawa Kansas Ks 66067 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Perform a free Franklin County KS public record search including arrest birth business contractor court criminal death divorce employee genealogy GIS inmate jail land marriage police property sex offender tax vital and warrant records searches.

Franklin county ks property tax search. Please provide a current mailing address. Use the as a wild card to match any string of characters for example. Second half unpaid personal property taxes are sent to the Sheriff for collection in August.

Delinquent tax refers to a tax that is unpaid after the payment due date. If the taxes remain unpaid by October 1 per Kansas statute the district court clerk assesses a judgment fee. Franklin Appraiser 785 229 - 3420.

Second Half Property Tax Online Payments. Type in the full name or a part of the full name into the Name box. Franklin county tax assessor po box 70 mt.

The month of April is includes dump days for all Franklin County communities and a weekend of FREE disposal at the Franklin County Transfer Station. Franklin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Franklin County Kansas. The Franklin County Public Records Kansas links below open in a new window and take you to third.

To use this Web Portal enter complete Owner Address or Parcel ID information and click Search for Parcels or hit Enter and you will be directed to that property tax. Go to Data Online. Go to Data Online.

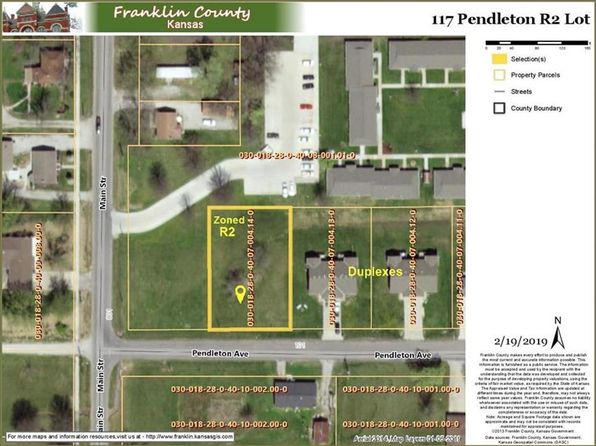

The Tax Office is charged with collecting all current and delinquent taxes on this property. 123 Main Parcel ID Ex. The GISMapping department serves as a clearinghouse and central distributor of geographic information for Franklin County while.

If the first half taxes are paid in December the second half is due May 10th. Mail in your tax payment or vehicle registration and we will mail your recipt or vehicle registration to you. For questions or concerns regarding your 2020 Tax Statement please refer to our Tax Statement FAQ or contact the.

Welcome to the Office of the Franklin County Appraiser. The Appraisers Office main responsibility is to locate identify list classify and uniformly appraise all real estate personal property and oil gas reserves located within the county except for utility owned property as prescribed by Kansas Statutes. Certain types of Tax Records are available to the general public while some Tax Records are only.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Go to Data Online.

If total tax remains unpaid for four years the property being taxed becomes subject to tax foreclosure suit by the County. Property Search by Address Property Search by Parcel Number Advanced Property Search Tax Bill Search Map Search Disclaimer. Franklin Register of Deeds 785 229 - 3440.

Vehicle registration 903 537-4383. Historic Aerials 480 967 - 6752. Search Franklin County property tax records by owner name address or legal description including GIS maps.

Property tax 903 537-2358. Assessor Appraiser Franklin County Appraiser 315 South Main St Ottawa KS 66067 Phone 785229-3420 Fax 785229-3430. Franklin Treasurer 785 229 - 3450.

The Franklin County Tax Office is responsible for listing appraising and assessing all real estate personal property and registered motor vehicles within Franklin County. Dont forget to recycle. Real estate taxes are due either in half or full on or before December 20th with the 2nd half being due on or before May 10th the following year.

The County assumes no responsibility for errors in the information and does not guarantee that the. For current year assessment information go to the Assessor Department page. Please contact the Franklin County Tax office for specific current information regarding your inquiry.

This web page is for informational purposes only and is not necessarily the most current information available. Search for a Property Search by. Yearly median tax in Franklin County The median property tax in Franklin County Kansas is 1536 per year for a home worth the median value of 117100.

The property then can be sold at public auction. Registered Users Login. Main Ottawa KS 66067.

These records can include Franklin County property tax assessments and assessment challenges appraisals and income taxes. Franklin Mapping GIS. Franklin County 315 S.

In an effort to keep everyone safe the Franklin County Treasurers office encourages using alternate payment methods. Franklin County collects on average 131 of a propertys assessed fair market value as property tax.

Kansas Department Of Revenue Property Valuation Data By County

Kansas Department Of Revenue Property Valuation Data By County

Franklin County Schools Bibliography Kansas Historical Society

Franklin County Schools Bibliography Kansas Historical Society

Franklin County Real Estate Franklin County Ks Homes For Sale Zillow

Franklin County Real Estate Franklin County Ks Homes For Sale Zillow

Franklin County Kansas Kansapedia Kansas Historical Society

Franklin County Kansas Kansas Historical Society

Franklin County Kansas Kansas Historical Society

Franklin County Ks Official Website

Franklin County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Franklin County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Peoria Township Franklin County Kansas Wikipedia

Peoria Township Franklin County Kansas Wikipedia

Ottawa Kansas Ks 66067 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Healthy Is Franklin County Kansas Us News Healthiest Communities

How Healthy Is Franklin County Kansas Us News Healthiest Communities

Franklin County Schools Bibliography Kansas Historical Society

Franklin County Ks Official Website

Franklin County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Franklin County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Franklin County Kansas Kansapedia Kansas Historical Society

Franklin County Kansas Kansapedia Kansas Historical Society

Franklin County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Franklin County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home