Ca Llc Tax Due Date 2020

To ensure the timely and proper application of the payment to. The due date to file and pay taxes and fees owed to the California Department of Tax and Fee Administration CDTFA originally due between December 15 2020 and April 30 2021 has been extended by three months.

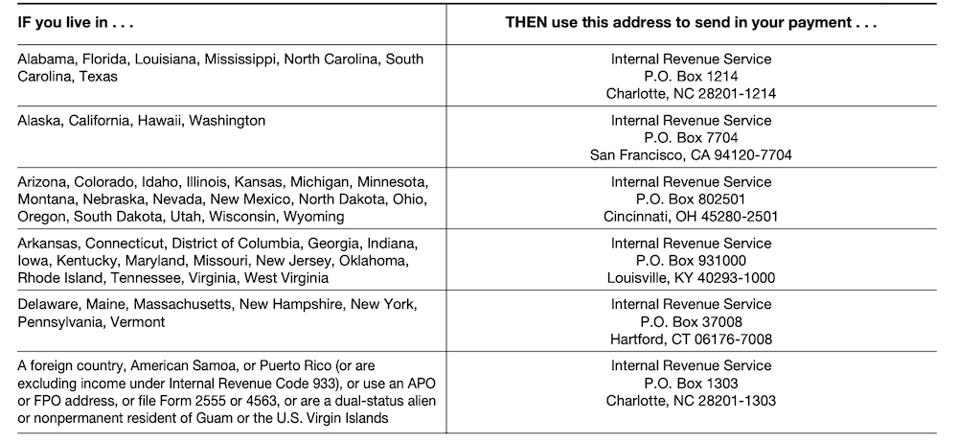

How To Pay Your Tax Bill In 2020

How To Pay Your Tax Bill In 2020

For more information on due dates for prepayments and other filing instructions please refer to form CDTFA 367 Filing Instructions for Sales and Use Tax Accounts.

Ca llc tax due date 2020. LLCs taxed as corporations should file Form 1120 by April 15 2020 on a calendar tax year. The due date for the 2020 Schedule C is May 17 2021 because Schedule C is filed with the owners individual Form 1040. 19 rows If your filing or payment due date falls between 3152020 and 7152020 then your due date.

The 15th day of 3rd month after end of their tax year. 100-ES Form PDF 100-ES Instructions. Use Underpayment of Estimated Tax by Farmers and Fishermen form FTB 5805F 27.

Year begins on June 1 2020 the annual LLC tax is due by September 15 2020 the 15th day of the 4th month of the short-period taxable year. For more information on tax relief for businesses impacted by COVID-19 please visit COVID-19 State of Emergency. Sole proprietors file Schedule C with their personal tax returns to arrive at their net taxable business incomes.

To know if you paid the required estimated tax. This is the amount you expect to enter on the LLCs 2020 Form 568 Limited Liability Company Return of Income Side 1 line 2 Limited Liability. Last updated November 20 2020 Beginning 2021 California LLCs dont have to pay 800 franchise tax for the 1st year.

This would be equal to the 15th of the fourth month after the end of the fiscal tax year. File your tax return for 2020 on or before March 1 2021 and pay the total tax due. The annual tax payment is due with LLC Tax Voucher FTB 3522.

For an LLC that has just been founded the due date is three months after the LLC was founded. A single-member LLC filing Schedule C has an extension until Oct. Enter all the information requested using black or blue ink.

The limited liability company annual tax is 800. As the fee owed for 2020 may not be known by the 15th day of the 6th month of the current taxable year you may estimate your 2020 fee by. Find your filing frequency below for your due dates.

When Is the Annual LLC Tax Due. 565 Partnership Booklet Instructions included 568 Limited Liability Company Tax Booklet Instructions included December 15 2021. Due Dates for Income Tax Return Filing and Audit Report for FY 2020-21 AY 2021-22 Time limits reduced for Belated Revised returns as amended by Finance.

The California LLC tax due date is when LLCs in California are required to have their tax returns filed. After that the due date is April 15 of every year3 min read 1. Returns of excise taxes or forms 4720 and 6069 have automatic six-month extensions starting from the filing deadline.

03182020 Sacramento The Franchise Tax Board FTB today announced updated special tax relief for all California taxpayers due to the COVID-19 pandemic. Extended due date for 2020 Partnership and LLC Income Tax returns for calendar year filers. The annual franchise tax is due on April 15 for LLCs operating on a calendar year basis and 15th day of the fourth month for those that use a fiscal year.

For example an S Corporations 2020 tax return due date is. To be subject to the tax the limited liability company must for a least one day during the year be. Doing Business is defined as actively engaging in any transaction for the purpose of financial gain or.

If you did not pay your required estimated tax. But there is an exception to this due date for a corporation that runs on a fiscal tax year that ends June 30th. Your annual LLC tax will be due on September 15 2020 15th day of the 4th month Your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of your taxable year.

California LLC Annual Fee Your California LLC has to pay annual fees to the state to remain in good standing and be able to do business in California. 2021 fourth quarter estimated tax payments due for corporations. 16 while the extended due date for a multi-member LLC filing as a partnership is Sept.

Our due dates apply to both calendar and fiscal tax years. If the due date is a weekend or public holiday it will be moved to the following business day. FTB is postponing until July 15 the filing and payment deadlines for all individuals and business entities for.

This extension is generally granted. Doing business in California andor. There is a difference between how California treats businesses vs federal.

Registered with the California Secretary of State.

California Ftb And Irs Estimated Tax Payments Abbo Tax Cpa

When Are 2019 Tax Returns Due Every Date You Need To File Business Taxes In 2020

When Are 2019 Tax Returns Due Every Date You Need To File Business Taxes In 2020

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Business Tax Renewal Instructions Los Angeles Office Of Finance

Business Tax Renewal Instructions Los Angeles Office Of Finance

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

Itr Due Date Extended Itr Ay 2019 20 New Due Date Latest Update On Itr A Due Date Informative Dating

Itr Due Date Extended Itr Ay 2019 20 New Due Date Latest Update On Itr A Due Date Informative Dating

Rectification U S154 How To File Itr After Receiving Intimation U S 143 File Income Tax Receiver Informative

Rectification U S154 How To File Itr After Receiving Intimation U S 143 File Income Tax Receiver Informative

Itr2 Changes In Itr 2 Ay 2020 21 Itr 2 For Individuals And Hufs Not Havi In 2020 Individuality Huf Informative

Itr2 Changes In Itr 2 Ay 2020 21 Itr 2 For Individuals And Hufs Not Havi In 2020 Individuality Huf Informative

How To Pay Your Tax Bill In 2020

How To Pay Your Tax Bill In 2020

Mobile E Mail Validation Before Itr Filing Managing Finances Best Money Saving Tips Income Tax

Mobile E Mail Validation Before Itr Filing Managing Finances Best Money Saving Tips Income Tax

California S 15 Day Rule For Corporations And Llcs Lawinc

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

All 2020 Tax Filing Deadlines Are Not Created Equal Filing Taxes Tax Filing Deadline Deferred Tax

All 2020 Tax Filing Deadlines Are Not Created Equal Filing Taxes Tax Filing Deadline Deferred Tax

When Are 2019 Tax Returns Due Every Date You Need To File Business Taxes In 2020

How To Fill Schedule 112a Bulk Upload Import Excel To Java Utility Detai Equity Excel Schedule

How To Fill Schedule 112a Bulk Upload Import Excel To Java Utility Detai Equity Excel Schedule

All About Advance Tax How To Compute Advance Tax Liability A Y 2020 21 Advance Tax Explain In Hindi Youtube Tax Liability Income Tax

All About Advance Tax How To Compute Advance Tax Liability A Y 2020 21 Advance Tax Explain In Hindi Youtube Tax Liability Income Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home