Property Tax Rate Myrtle Beach Sc

Youve gone back and forth about whether to buy a vacation home but finally you decided it was for you and better still you decided to buy a home in Myrtle Beach. Total taxes due 570.

Property 2964 Highway 90 Conway Sc 29526 Has 6 Bedrooms 5 Bathrooms With 5000 Square Feet Property Mansions Property For Sale

Property 2964 Highway 90 Conway Sc 29526 Has 6 Bedrooms 5 Bathrooms With 5000 Square Feet Property Mansions Property For Sale

Horry County Tax Myrtle Beach Property Taxes In South Carolina you will enjoy an average effective tax rate of just 057 the Fifth-Lowest property tax rate in the United States.

Property tax rate myrtle beach sc. Especially if youre earning a little money from the property. The average effective property tax rate in South Carolina is just 055 with a median annual property tax payment of 980. There are circumstances and factors which may prompt a property or owner to be eligible for special tax exemptions a special state of being free from an obligation imposed on others.

Homeowners insurance is another necessity and must also be counted in the breakdown of the holding costs you will face when selling your house with a Myrtle Beach real estate agent. North Myrtle Beach Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in North Myrtle Beach South Carolina. If you own a 10000 car based on the average millage rate your personal property tax would be 268.

The current ratio for primary home ownership is 4. All real property is assessed at a four percent owner occupied primary residence four or six percent. It must be your primary residence.

Owners of vacation or second homes are taxed at a slightly higher 6 rate which would work out to about 2400 annually on a 200000 home. Median Property Taxes No Mortgage 573. Tax Records include property tax assessments property appraisals and income tax records.

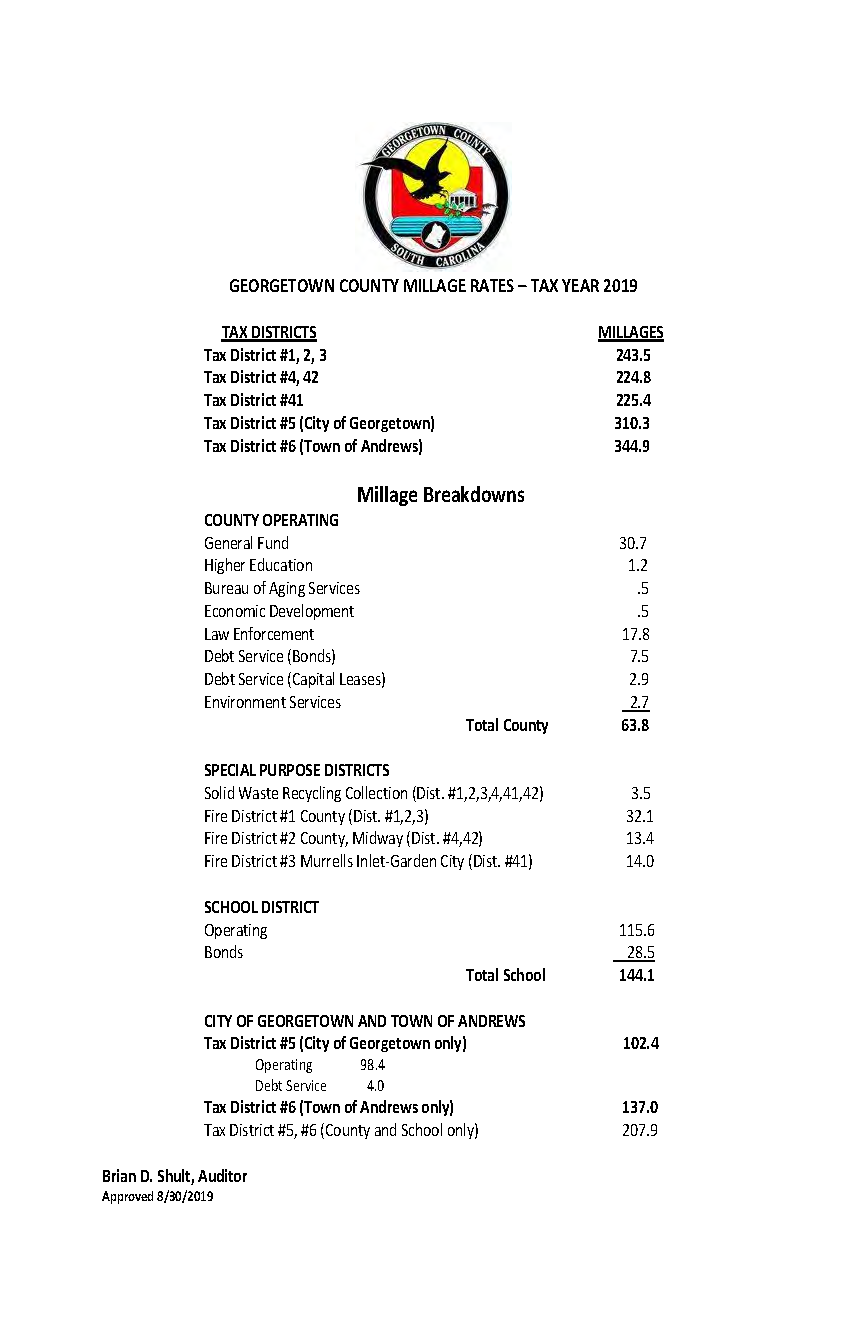

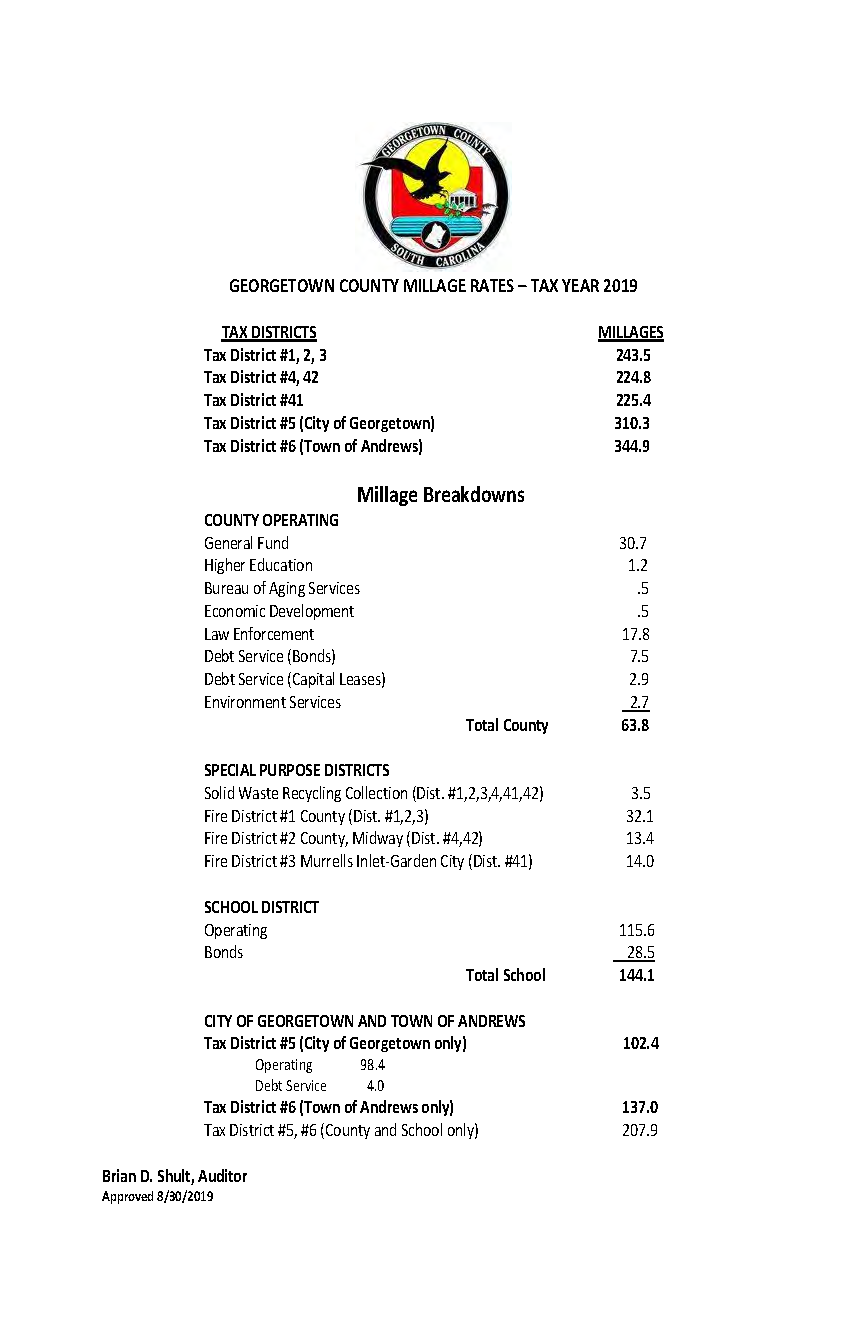

Millage Rates Horry Georgetown County South Carolina Millage Rates May Not Be Current Taxable Value x 04 Primary Residence Assessed Value x Millage Rate per your District Gross Tax. New Value of home 50000. Real Estate Tax Rates in Horry County.

Coming from the north where taxes were more than 3 times that I was happy and just went on with life. Horry County Property Tax -. Certain Tax Records are considered public record which means they.

Part of the reason taxes are so low is that owner-occupied residences get the benefit of a lower assessment rate than commercial and second residences. Median Property Taxes Mortgage 707. Vehicle Property Taxes Personal property tax is collected annually on cars trucks motorcycles recreational vehicles boats and airplanes based on their fair market value.

With this equation a 200000 owner-occupied residence will be assessed at 4 and with a millage rate of200 the property taxes owed would be 1600. Industrial ratio is 10. 423700 x 04 16948 x.

One mill equals 11000 of a dollar 001. Once youve purchased the home the last thing you want to think about is taxes. Assessed Value x 1049 School Credit Tax Credit.

This means you are assessed at the 6 tax rate instead of the 4 tax rate. You must be a legal resident of South Carolina for at least one year. If it is secondary residence rental commercial or land the ratio is 6.

Its never pleasant to raise taxes Mayor Marilyn Hatley said during Mondays City Council meeting. For additional information you can reach the Horry County Tax Assessors office at 843-915-5040. Upon passage the rate will rise to 45 mills.

Multiplied by 4 ratio 2000. Most people want to know what their real estate taxes will be when they purchase property. Whether you intend to live year-round or just visit you will almost certainly save on your annual tax bill.

When I bought my first property in Myrtle Beach back in 2006 I did not know this and my taxes on a townhome valued at 110000 were over 1900 per year. These formulas will give you an estimate on your real estate taxes in Horry County South Carolina. The County Assessor appraises real property the Auditor maintains the property tax rolls and calculates individual property taxes and the County Treasurer collects the property taxes.

Multiplied by millage x 285. It just isnt worth the risk to try to save money and many lenders require insurance in addition to PIP mortgage insurance if you still owe a balance of more. X 2415 General Myrtle Beach City Millage 0661 County Millage 1754 120750 Taxes Due.

Now you probably want know how to qualify. All property is appraised at its fair market value and is multiplied by the appropriate assessment ratio for the type of property. There are ways to reduce your tax liability and you may qualify for eligible tax credits.

The current property tax rate is 371 mills. Gross Tax - Tax Credit 96 Tax Fee Tax Owed.

North Myrtle Beach S New Budget Includes Tax Hike As Covid 19 Causes Uncertain Future North Myrtle Beach Myhorrynews Com

North Myrtle Beach S New Budget Includes Tax Hike As Covid 19 Causes Uncertain Future North Myrtle Beach Myhorrynews Com

Information On Property Taxes In Horry County Sc Myrtle Beach Real Estate For Sale Home And Condos

Information On Property Taxes In Horry County Sc Myrtle Beach Real Estate For Sale Home And Condos

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Myrtle Beach Images South Carolina Google Search In 2020 South Carolina South Carolina Homes South Carolina Travel

Myrtle Beach Images South Carolina Google Search In 2020 South Carolina South Carolina Homes South Carolina Travel

Please Make A Tax Deductible Donation To Tor The Republic Myrtle Beach Myrtle Beach Sc

Please Make A Tax Deductible Donation To Tor The Republic Myrtle Beach Myrtle Beach Sc

![]() Calculating Horry County Property Taxes

Calculating Horry County Property Taxes

Realestate Weichertrealtors Realtors Home Equity Laim Nouns

Realestate Weichertrealtors Realtors Home Equity Laim Nouns

Buying A Vacation Home In Myrtle Beach Keller Williams The Trembley Group Myrtle Beach Real Estate Vacation Home Vacation

Buying A Vacation Home In Myrtle Beach Keller Williams The Trembley Group Myrtle Beach Real Estate Vacation Home Vacation

Real Estate Tax Rates In Horry County

Real Estate Tax Rates In Horry County

Horry County Tax Myrtle Beach Property Taxes

Horry County Tax Myrtle Beach Property Taxes

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Vr Spirit Nights At Cavrn Virtual Reality Spirit Night Myrtle Beach How To Raise Money

Vr Spirit Nights At Cavrn Virtual Reality Spirit Night Myrtle Beach How To Raise Money

Property Taxes South Carolina Ranked 7th Lowest In The Country

Property Taxes South Carolina Ranked 7th Lowest In The Country

Property Taxes South Carolina Ranked 7th Lowest In The Country

Property Taxes South Carolina Ranked 7th Lowest In The Country

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Myrtle Beach South Carolina Cheapest Places Where You Ll Want To Retire Health Insurance Options Saving For Retirement Early Retirement

Myrtle Beach South Carolina Cheapest Places Where You Ll Want To Retire Health Insurance Options Saving For Retirement Early Retirement

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Understanding Taxes When Buying A Myrtle Beach Home Myrtle Beach Homes Carolina Forest Homes

Benefits Of Hoa Fee Infographic Myrtle Beach Hoa Property Buyers

Benefits Of Hoa Fee Infographic Myrtle Beach Hoa Property Buyers

Property Value Cartoon Estate Tax Property Tax Mortgage Payment

Property Value Cartoon Estate Tax Property Tax Mortgage Payment

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home