Ventura County Property Tax Due Dates

Steven Hintz Ventura Countys Treasurer-Tax Collector announced today that beginning April 11 2020 he will accept taxpayer applications for waiver of late-payment penalties and fees for the second installment of the - 2019 2020 secured property tax billings. Redwood City CA 94063.

Http Assessor Countyofventura Org Pdfs 502 D R8 05 14 Pdf

Revenue Taxation Codes.

Ventura county property tax due dates. The first is due November 1. The taxes became due on January 1 2019 but the 20192020 property tax bill will not be available until approximately October 1 2019. Department of Labor there were more than 66 million jobless claims in the week ending March 28 as more and more people stay home1 Coronavirus infections and COVID-19 have devastated the US.

If the applications are granted the new payment due date will be August 31 2020. Pay Your Taxes - Ventura County. Please make your selection below.

Annual taxes are payable in two installments. Taxes become a lien on all taxable property at 1201 am. I We understand that the 20192020 property tax bill will reference the name of the January 1 2019 assessee.

Record on January 1 2019. 1st Installment is due November 1st delinquent after December 10th. Once paid the Tax Collector will not remove the payment.

The Aggregate Tax Reporting form is due by the 14 th day following the last day of. The second installment is due February 1 and becomes delinquent if not paid by April 10. First day to file affidavit and claim for exemption with assessor but on or before 500 pm.

All operators who transport or stockpile and sell aggregate materials within Carver County are required to report quantities and remit the appropriate tax to the county. We accept major credit card and debit card payments over the telephone. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700.

During this challenging time your patience is appreciated while our. 1st Floor 555 County Center. It becomes delinquent if not paid by December 10.

Ventura County collects on average 059 of a propertys assessed fair market value as property tax. To pay by telephone call toll-free 18884730835Your Secured Property Tax Bill contains your Assessors Identification Number AIN Year and Sequence which you will need to complete the transaction. Secured Property Taxes in Ventura County are paid in two installments.

All online payments will have penalties if past the delinquency date. Ventura County 2020-21 Secured Property Taxes are due November 1 2020. December 10 - First installment payment deadline.

If December 10 or April 10 is a Saturday Sunday or legal holiday the delinquency date is the following business day. Annual secured property tax bill that is issued in the fall is based on ownership and value as of this date. Ventura county property tax due date Coronavirus COVID-19 Impact on Your Property Taxes According to the US.

2nd Installment is due February 1st delinquent after April 10th. DUE DATES - Ventura County. 2021 property tax statements for real estate and mobile homes were mailed on March 25th.

The Tax Collector does not have the ability to change or alter the amount to be paid online. If you believe you have a case for a penalty waiver DO NOT PAY ONLINE. A 10 penalty is added as of 5 pm.

Property taxes not paid on or before December 10 2020 will become delinquent and property taxes paid after December 10 2020 will be assessed a late payment penalty fee of 10. November 1 - First installment is due Secured Property Tax and delinquent Unsecured accounts are charged additional penalties of 1½ until paid. Ventura County has one of the highest median property taxes in the United States and is ranked 123rd of the 3143 counties in order of median property taxes.

Vita Tax Preparer 2020 2021 United Way Of Ventura County

Private Property Roads Frequently Asked Questions Ventura County Public Works Agency

Private Property Roads Frequently Asked Questions Ventura County Public Works Agency

Second Installment Of 2020 21 Ventura County Secured Property Taxes Due Now 10 Penalty Plus 30 Cost Assessed After April 12 2021

Second Installment Of 2020 21 Ventura County Secured Property Taxes Due Now 10 Penalty Plus 30 Cost Assessed After April 12 2021

Deferred Compensation Ventura County Human Resources

Deferred Compensation Ventura County Human Resources

Interactive Maps Ventura County Public Works Agency

Pay Property Taxes Online County Of Ventura Papergov

Pay Property Taxes Online County Of Ventura Papergov

Ventura County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Ventura County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

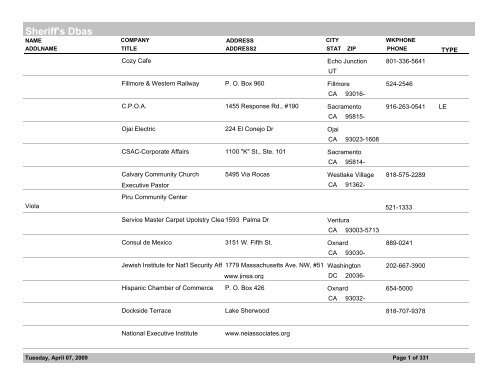

Sheriff S Dbas Ventura County Star

Sheriff S Dbas Ventura County Star

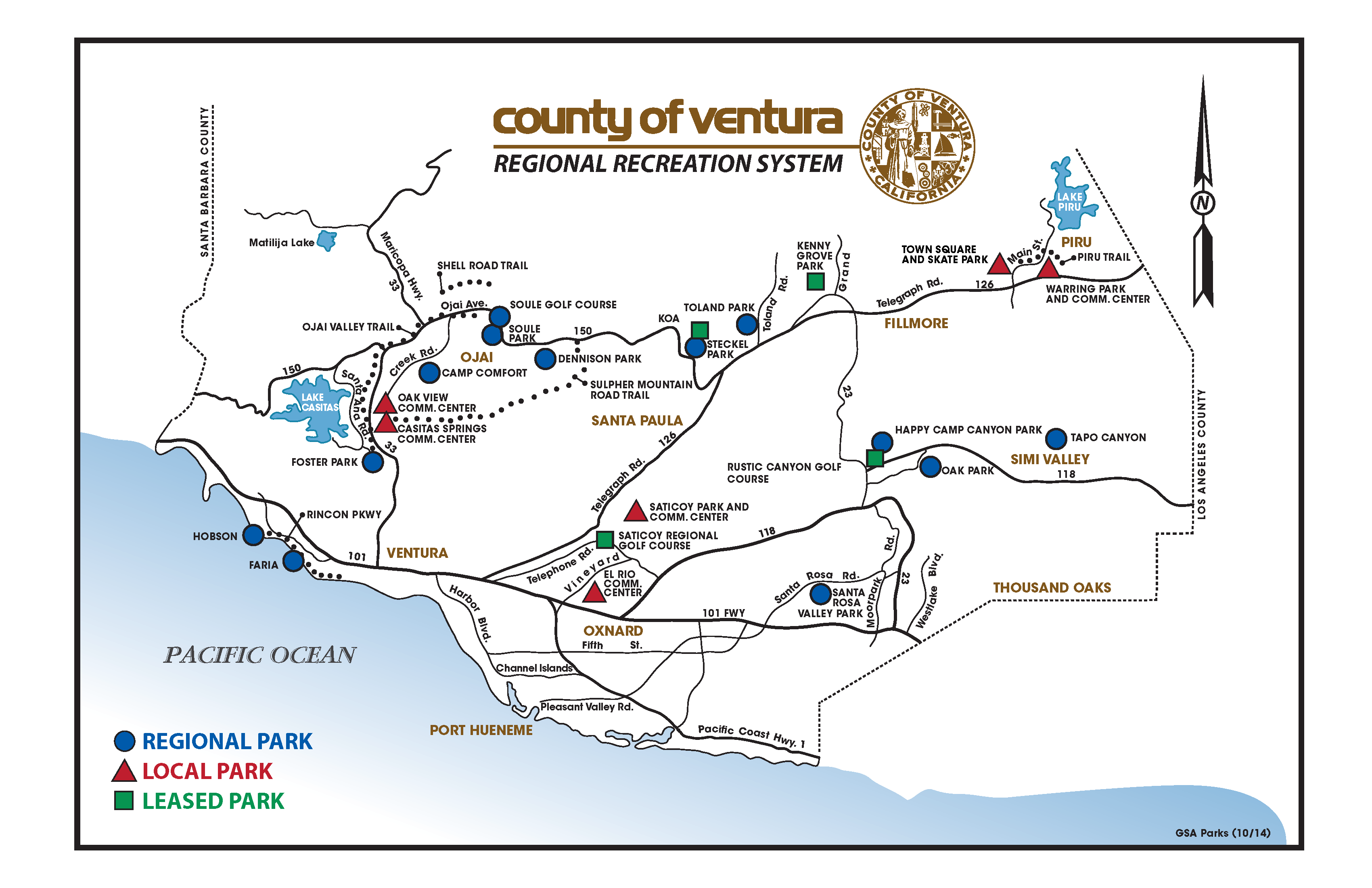

Parks System Map Ventura County

Parks System Map Ventura County

Ventura And Los Angeles County Property And Sales Tax Rates

County Of Ventura Webtax Secured Tax Payment

County Of Ventura Webtax Secured Tax Payment

Ventura California Ca 93003 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Pay Property Taxes Online County Of Ventura Papergov

Pay Property Taxes Online County Of Ventura Papergov

Ventura County Seller S Permits Ca Business License Filing Quick And Easy

Ventura County Seller S Permits Ca Business License Filing Quick And Easy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home