How To Look Up Property Tax Bill Online

In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. State funding for certain school districts.

Bills are generally mailed and posted on our website about a month before your taxes are due.

How to look up property tax bill online. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. PROPERTY SEARCH View Tax Bill Get information on a Franklin County property and view your tax bill. Property tax bills and receipts contain a lot of helpful information for taxpayers.

The information on the bill can also help you determine whether your assessment is accurate. For best search results enter a partial street name and partial owner name ie. Click on the blue OnCor symbol at the bottom of any page on the Ontario County website.

Search by address Search by parcel number. Where does your property tax go. If you encounter a problem accessing a website on this list you will need to contact the office of the Board of Tax Assessors or the Tax Commissioner in the county.

Office Closed in Observance of Memorial Day. Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due. The list below has links to county websites where property records can be searched online or property tax payments can be made online.

The assessment of property setting property tax rates and the billing and. View Your Tax Bill. You can also find property information on the State Librarys website Montana Cadastral.

The Street Name field MUST contain a partial or complete street name. 124 Main rather than 124 Main Street or Doe rather than John Doe. In 2018 the Legislature made additional changes to lower the levy rate for taxes in 2019.

Search for personal property data. The owners agent assignee or attorney. For example if you want to search for.

If you need help registering please follow the instructions provided on the help portal or you can always contact our office at 509 574-2800. Propertymtgov is an easy-to-use tool for finding property information. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance.

For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. Please read the following terms. For example if the address is 123 Main St try inputting 123 Main You can also try using part of your last name instead of your full first and last name.

The Board of Tax Assessors is responsible for property valuations and the Tax Commissioner is responsible for collecting property taxes. Look Up Your Propertys Tax Assessment. Various sections will be devoted to major topics such as.

Any person that wants to pay on behalf of the owner by making a charitable gift. Payments by Electronic Check or CreditDebit Card. If you do not know the entire street name you may enter only the beginning letters.

Property taxes make up at least 94 percent of the. Search for a Property Search by. Review the tax balance chart to find the amount owed.

Several options are available for paying your Ohio andor school district income tax. Choose options to pay find out about payment agreements or print a payment coupon. Search for your property.

Property taxes imposed by the state. When the Welcome to OnCor. If you would like to sign up for paperless billing please locate on your annual tax statement under the Parcel Number your unique authorization code.

The County assumes no responsibility for errors in the information and does not guarantee that the. If a bank or mortgage company pays your property taxes they will receive your property tax bill. A real property tax lien that is sold under article 3 of this chapter may be redeemed by.

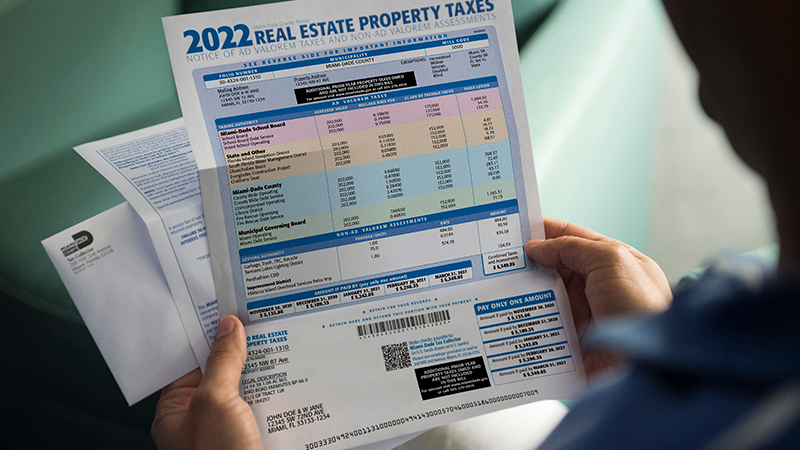

Our property records tool can return a variety of information about your property that. Beyond the amount of taxes you owe the bills indicate where your taxes are going and how much more is being collected by your local governments each year. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number.

Try a partial search by using just the street name without direction or type. 123 Main Parcel ID Ex. The Department of Revenue works hard to ensure we process everyones return as.

Enter the address or 9-digit OPA property number. Office Closed in Observance of Juneteenth. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Any person who has a legal or equitable claim in the property including a certificate of purchase of a. Click on the blue OnCor Property App link and then click Ok to agree to the disclaimer. Voter-approved property taxes imposed by school districts.

John Smith Street Address Ex. Here are the instructions to find your property tax bills in OnCor. Second-Half Real Estate Tax Payments Due.

This bill makes changes to. Start the search by clicking on the ENTER button. Use our free Ohio property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

Pay Property Tax Online. To find and pay property taxes. Use this convenient online service to view details about your tax bill upcoming due dates balances and more.

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Current Payment Status Lake County Il

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Pay Personal Property Tax Help

Pay Personal Property Tax Help

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property Taxes Property Tax Illinois Financial Information

Property Taxes Property Tax Illinois Financial Information

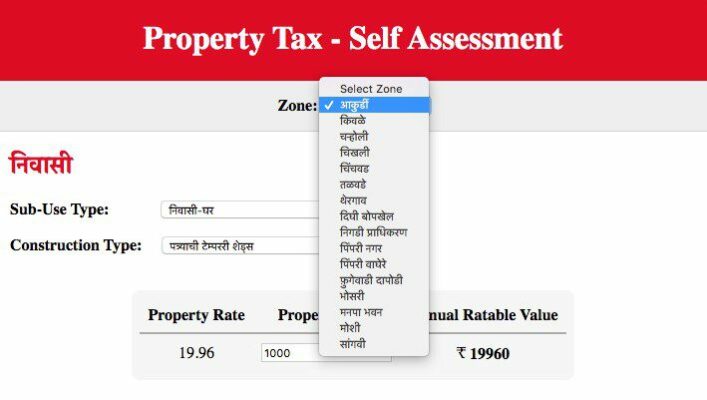

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Pay Personal Property Tax Help

Pay Personal Property Tax Help

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home