How To Avoid Property Tax In California

You cant avoid state income taxes simply by working in a tax-free state. After April 1 2021 under Prop 19 Seniors 55 and severely disabled persons have the ability to purchase a new principal residence anywhere in California up to 3 times and transfer their lower property tax basis from their existing property to their new property.

Understanding California S Property Taxes

Understanding California S Property Taxes

For example using the case where the IRS interactive tax assistant calculated a standard tax deduction of 24800 if you and your spouse earned 24000 that tax year you will pay nothing in taxes.

How to avoid property tax in california. Transfers Between Parents and Children RT 631. 14 So if you dont happen to live in a state where theres no income tax youll have to pay tax to your home state on your income regardless of where you earned it. The rules for executing a 1031 exchange are complicated.

A transfer of a principal personal residence and up to 1000000 of assessed value before death of other ie. If you want to avoid paying taxes youll need to make your tax deductions equal to or greater than your income. For some people a substantial inheritance could result in that persons estate exceeding the lifetime exemption amount meaning they would ultimately owe taxes on their estate.

Capital gain is taxed the same and even if you never set foot in California you might have to pay tax here. Here are 5 rules everyone. The key with 1031 exchanges is that you defer paying tax on the propertys appreciation but you dont get to avoid it entirely.

Instead of worrying about paying high property taxes or avoiding states and counties where taxes are really high wouldnt it be better to learn how to avoid paying property taxes altogether or at least cut your property tax bill way way down. Try lowering your California property taxes by filing an appeal with your countys tax assessor. To avoid property tax reassessment do not transfer real property from individuals to a legal entity unless the individuals have the same proportionate interest in the legal entity as they did in the real property.

No exclusion will apply if Mom and Dad as 100 owners transfer real property to an LLC owned 45 Mom 45 Dad and 10 Son. The appeal process is complicated. Commercial real property is exempt for reassessment if the proper forms are filled out on a timely basis.

Plus the ability to avoid property tax reassessment on certain investment properties that have revenue potential. The current exemption amount is 545 million. Failure To File Proposition 8 Appeal By September 15 Of Each Tax Year The easiest but most commonly overlooked action.

You may want assistance. 10 Commonly Overlooked Ways To Reduce California Real Property Taxes 1. When you sell the new property later on youll have to pay taxes on the gain you avoided by doing a 1031 exchange.

Residents need more opportunities in a depressed economy like were in now to drive revenue not less. Some clients decide to disclaim an inheritance in order to avoid the potential of owing estate taxes when they die. With a top income tax rate of 133 California taxes hurt.

Solutions like inheriting property taxes in California 2021 need to be expanded statewide and legally strengthened. Youd also have to be a resident of a tax-free state. Of course it would.

Change in Ownership Exceptions. Failure To File Appeal Of Supplemental Or Escape Assessment Within 60 Days Of Mailing Whenever you.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Home Closing Costs For Sellers In California Explained New Venture Escrow

Home Closing Costs For Sellers In California Explained New Venture Escrow

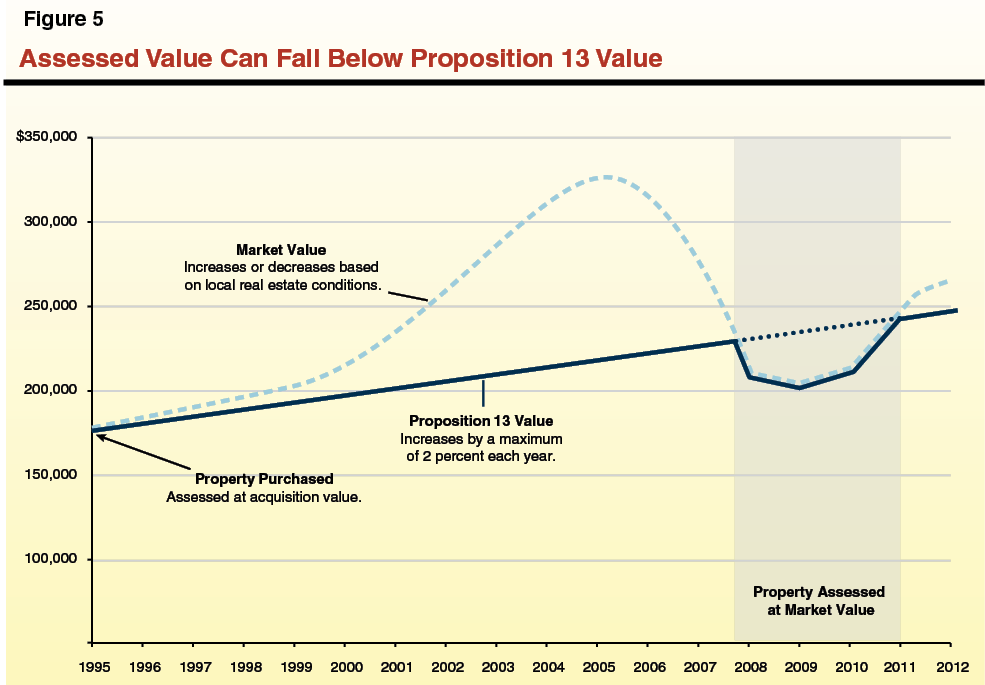

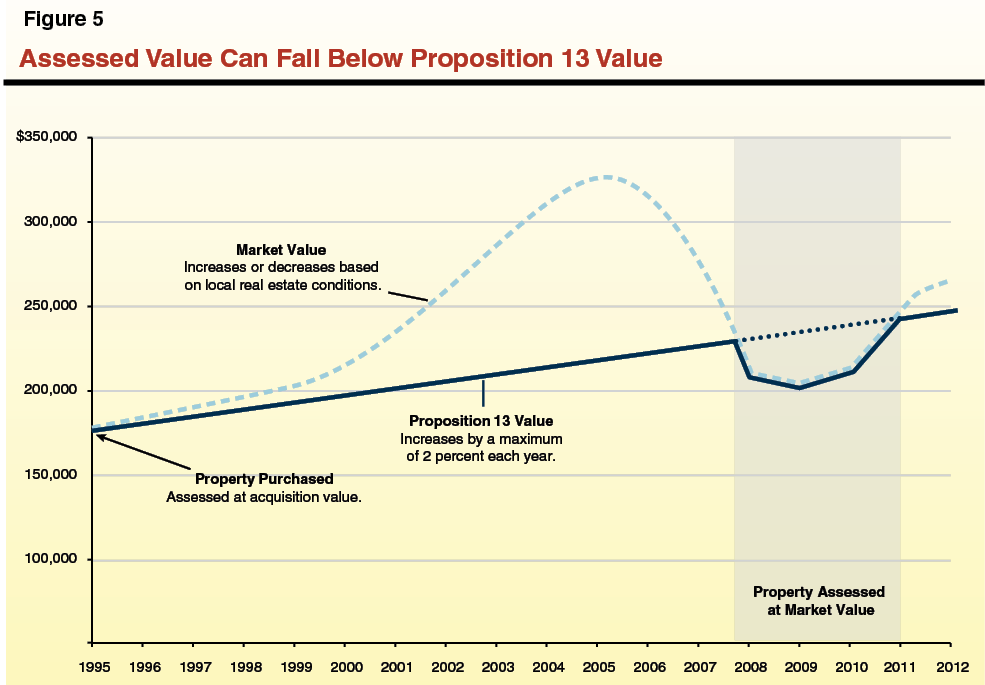

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Labels: california, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home