Tennessee Property Tax Davidson County

All dates are subject to change. To figure the tax simply multiply the assessed value 25000 by the tax rate of 4221 or 3788 per hundred dollars assessed.

Increased Property Values Mean Different Things For Property Taxes

Increased Property Values Mean Different Things For Property Taxes

1 day agoThe Davidson County Election Commission voted Saturday to use the August election to determine the number of signatures needed on a tax petition.

Tennessee property tax davidson county. Another complete set of exemption application documents needs to be sent to Davidson County Assessors Office Attn. 17 rows Pay Your Property Taxes at First Horizon formerly First Tennessee In cooperation with. Box 196305 Nashville TN 37219-6305 Physical.

Davidson County has one of the highest median property taxes in the United States and is ranked 705th of the 3143 counties in order of median property taxes. The median property tax on a 16470000 house is 158112 in Davidson County. This office also administers the State of Tennessee Tax Relief ProgramTax Deferral Program Tax Freeze Program collects and processes Delinquent Taxes Central Business Improvement District Taxes Gulch Central Business Improvement District Taxes.

Davidson Countys different tax rate districts Davidson County has two primary tax rate districts the General Service District GSD and the Urban Service District USD. Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. Comptroller of the Treasury Jason E.

But Davidson Countys Assessor of Property Vivian Wilhoite opposes the move and said it could open the flood gates for others to try and leave the county to avoid paying higher property taxes. Submit a report online here or. Pursuant to tennessee code annotated section 67-5-2501 the following properties will be sold for delinquent real property taxes penalties interest court costs attorneys fees and other liens of the metropolitan government in the jury assembly rm ground floor of the metropolitan davidson county courthouse one public square nashville tn 37201.

700 2nd Ave S Suite 210 Nashville TN 37210 For ADA assistance. The Tax Freeze Act of 2007 permits local governments to implement the program and Metropolitan Nashville-Davidson County became the first jurisdiction in the state to establish a tax freeze program. If you or someone you know is 65 years of age or older a disabled veteran or physically disabled they may qualify for tax relief.

Please contact Kristina Ratcliff at 615 862-6998. The median property tax on a 16470000 house is 111996. 700 2nd Ave S Suite 210 Nashville TN 37210 For ADA assistance.

Urban Services District Tax Rate 4221. 615 862-6057 Open Monday - Friday 800 am- 430 pm Except Holidays Mailing. The tax freeze program was approved by Tennessee voters in a November 2006 constitutional amendment referendum.

The USD tax covers the more extensive services provided to property owners such as garbage pick-up street lights and sidewalks provision not provided to those in the GSD. Box 196305 Nashville TN 37219-6305. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

The Trustee in Davidson County collects Real Property Personalty and Public Utility Taxes. 25000 100 250 x 3788 94700 or. 25000 100 250 x 4221 105525 or 25000 x 04221 105525 for a tax bill of 105525.

In-depth Davidson County TN Property Tax Information. Please contact Kristina Ratcliff at 615 862-6998. 615 862-6057 Open Monday - Friday 800 am- 430 pm Except Holidays Mailing.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Davidson County Tax Appraisers office. The median property tax in Davidson County Tennessee is 1587 per year for a home worth the median value of 164700. General Services District Tax Rate 3788.

Box 196305 Nashville TN 37219-6305 Physical. The Office of the Trustee is a Constitutional office that was established as a tax collection agency for each county in the state of Tennessee. Income and age-eligible households who need financial assistance with their property taxes may apply for help through the Property Tax Relief Assistance program or the Property Tax Freeze program administered through the Office of the Metropolitan Trustee.

You are also encouraged to retain a complete set of exemption application documents for your records. Davidson County collects on average 096 of a propertys assessed fair market value as property tax.

Andrew Jackson S Home Explore Jimbowen0306 S Photos On Fli Hermitage Nashville Andrew Jackson Home Historic Homes

Andrew Jackson S Home Explore Jimbowen0306 S Photos On Fli Hermitage Nashville Andrew Jackson Home Historic Homes

An Open Letter To Nashville About Property Taxes Civic Analytics

An Open Letter To Nashville About Property Taxes Civic Analytics

Belle Meade Homeowners To See Property Tax Changes In 2019 20 Community Impact Newspaper

Belle Meade Homeowners To See Property Tax Changes In 2019 20 Community Impact Newspaper

Ranking Of Best Places To Buy A House Based On Home Values Property Taxes Home Ownership Rates And Real Estate Home Ownership Houses In America Property Tax

Ranking Of Best Places To Buy A House Based On Home Values Property Taxes Home Ownership Rates And Real Estate Home Ownership Houses In America Property Tax

Pictometry Property Assessor Of Nashville Davidson County Tn

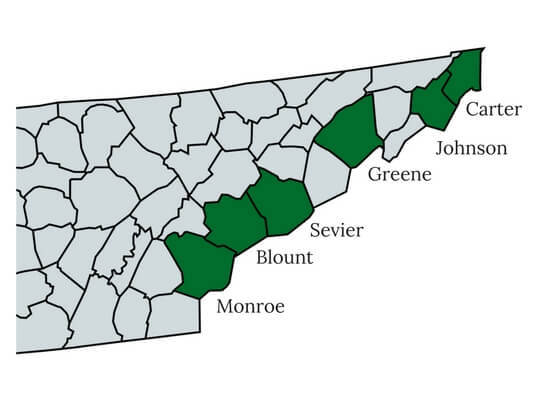

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Free Tennessee Property Surveys Online Bryant Fence Company

Free Tennessee Property Surveys Online Bryant Fence Company

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

Produce Place Nashville Guru Places Outdoor Decor Cherokee Park

Produce Place Nashville Guru Places Outdoor Decor Cherokee Park

Pay Williamson County Tn Property Tax Property Walls

Pay Williamson County Tn Property Tax Property Walls

Love A Wrought Iron Door To Give Definition To The Wine Cellar Space Hughes Edwards Home Nashville Tn Home Wine Cellars Wine Closet Wine Cellar

Love A Wrought Iron Door To Give Definition To The Wine Cellar Space Hughes Edwards Home Nashville Tn Home Wine Cellars Wine Closet Wine Cellar

Increased Property Values Mean Different Things For Property Taxes

Increased Property Values Mean Different Things For Property Taxes

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

Metro Council Approves 34 Percent Property Tax Increase As Part Of New Budget News Wsmv Com

Metro Council Approves 34 Percent Property Tax Increase As Part Of New Budget News Wsmv Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home