Real Property Tax Legal Definition

Some of the reasons for appealing a tax assessment include. 1 all land structures firmly attached and integrated equipment such as light fixtures or a well pump anything growing on the land and all interests in the property which may be the right to future ownership remainder right to occupy for a period of time tenancy or life estate the right to drill for oil the right to get the property back a reversion if it is no longer used for its current purpose such as.

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Interest rates on court-ordered property tax refunds.

Real property tax legal definition. Standards for electronic real property tax administration. The property that will be subject to reassessment is any Interest in Real Property located in California that is owned or held under lease under certain circumstances by the acquired legal entity and any of its subsidiaries as of the date of the change in control. Real Property Tax Law and Legal Definition.

While materials such as wood metal or other building materials arent real property on their own they can become real property if they are attached to land. Property tax is a tax paid on property owned by an individual or other legal entity such as a corporation. 1 all land structures firmly attached and integrated equipment such as light fixtures or a well pump anything growing on the land and all interests in the property which may be the right to future ownership remainder right to occupy for a period of time tenancy or life estate the right to drill for oil the right to get the property back a reversion if it is no longer used for its current purpose.

New York States property tax cap. The property may be assessed at full value which is presumably the price that the owner could sell it for in the current market or using some other valuation method. Real property taxes are governed by state laws which vary by state.

Appraisals which are the basis for property values can generally be appealed according to local rules. Local law definitions are not controlling for purposes of determining the meaning of the term real property. Legal memos papers and miscellaneous laws.

Most commonly property tax is a real estate ad-valorem tax which can be considered a. Such rolls are prepared by tax assessors. Property tax and assessment news.

However if a legal entity has undergone a change in ownership the interest in real property is only property previously excluded from reassessment under. Real property tax is a tax based on the value of the property. Real property is the land everything that is permanently attached to the land and all of the rights of ownership including the right to possess sell lease and enjoy the land.

A taxpayer qualifies as a real estate professional if 1 more than one-half of the personal services the taxpayer performs in trades or businesses during the tax year are in real property trades or businesses in which the taxpayer materially participates and 2 hours spent providing personal services in real property trades or businesses in which the taxpayer materially participates total more than 750 during. Legal Questions Answered. As used herein the term real property tax shall include any form of real estate tax or assessment general special ordinary or extraordinary and any license fee commercial rental tax improvement bond or bonds levy or tax other than inheritance personal income or estate taxes imposed on the Premises by any authority having the direct or indirect power to tax including any city state or federal government or any school agricultural sanitary fire street drainage or other.

A real property tax is a local tax on the value of real estate. The term real property means land and improvements to land. The taxing agency such as a county city town or village sets a tax rate which is multiplied by the assessed value of each property to determine the tax due on that.

Land includes water and air space superjacent to land and natural products and deposits that are unsevered from the land. Assessment roll is a record of taxable persons and property in a taxing jurisdiction. That is why you sometimes hear land referred to as real estate or realty.

Real Property Taxes means i any fee license fee license tax business license fee levy charge real estate taxes special or metro district assessment penalty or tax imposed by any taxing authority against the Property and Premises and ii any tax or charge for fire protection streets sidewalks road maintenance refuse or other services provided to the Property by any. Interest rate on late payment of property taxes. Local laws and resolutions.

An assessment roll of a town for example includes each individual tract of land within its taxing jurisdiction and shows the assessed value of each. Real propertyis land or things attached to land.

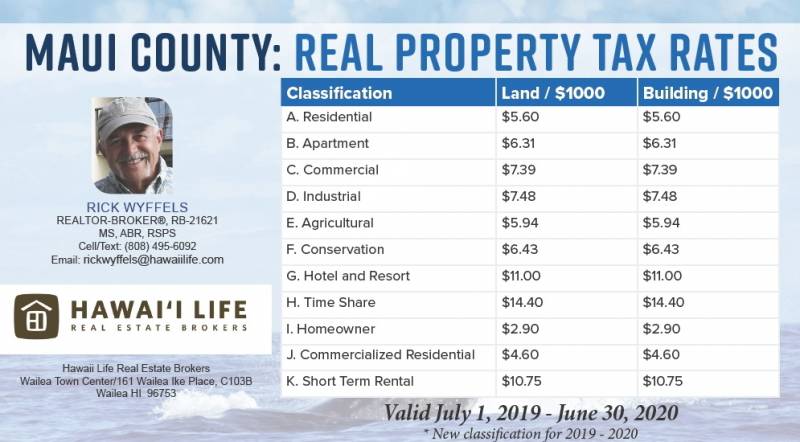

Real Property Taxes On Maui Hawaii Real Estate Market Trends Hawaii Life

Real Property Taxes On Maui Hawaii Real Estate Market Trends Hawaii Life

Fast Facts What You Should Know About Real Property Tax Federal Land Inc

Fast Facts What You Should Know About Real Property Tax Federal Land Inc

Long Term Capital Gains Tax For Real Estate Millionacres

Long Term Capital Gains Tax For Real Estate Millionacres

Honolulu Property Tax 2020 21 Fiscal Year

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Honolulu Property Tax 2020 21 Fiscal Year

5 Types Of Real Property Taxes Schorr Law A Professional Corporation

5 Types Of Real Property Taxes Schorr Law A Professional Corporation

Real Estate Taxes Vs Property Taxes H R Block

Real Estate Taxes Vs Property Taxes H R Block

Real Estate Investing Tax Strategies Millionacres

Real Estate Investing Tax Strategies Millionacres

What Is Freehold Property Meaning Benefits And Owner S Rights

What Is Freehold Property Meaning Benefits And Owner S Rights

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg) Taking Advantage Of Property Tax Abatement Programs

Taking Advantage Of Property Tax Abatement Programs

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

Federal Ministry Of Finance German Real Property Tax Reform Simple Socially Equitable And Compatible With The Constitution

Federal Ministry Of Finance German Real Property Tax Reform Simple Socially Equitable And Compatible With The Constitution

Property Tax Definition History Administration Rates Britannica

Property Tax Definition History Administration Rates Britannica

Florida Property Tax H R Block

Florida Property Tax H R Block

How To Become A Real Estate Professional For Tax Purposes Mark J Kohler

How To Become A Real Estate Professional For Tax Purposes Mark J Kohler

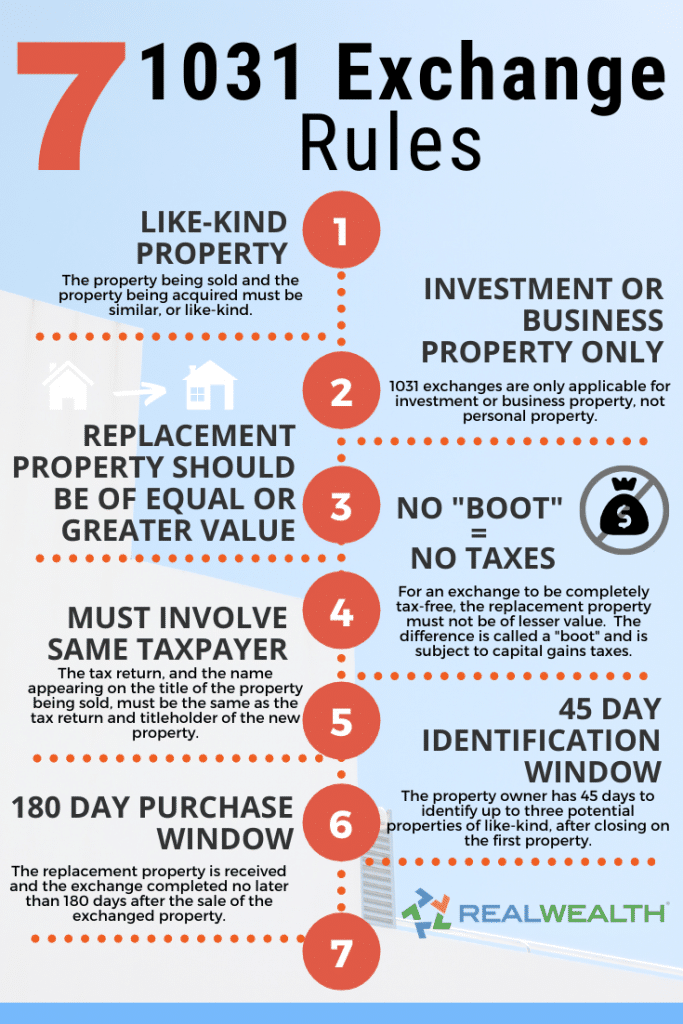

1031 Exchange Rules Success Stories For Real Estate Investors 2021

1031 Exchange Rules Success Stories For Real Estate Investors 2021

:max_bytes(150000):strip_icc()/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home