Property Tax Write Off Limit 2020

Mortgage interest deduction in 2020 If your home was purchased before Dec. Now the total of state and local taxes eligible for a.

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

The inflation-adjusted maximum for tax years beginning in 2020 is 104 million.

Property tax write off limit 2020. Deduct Property Taxes. Qualified energy efficiency improvements include the following qualifying products. This is what is known as SALT or State and local taxes This is a big deal for those who pay above 10000 in annual property taxes because that cost could be offset by tax deductions in years past.

Instead you add the 1375 to the cost basis of your home. Those taxes can include state and local personal property taxes state and. Illinois property you sold - You may figure a credit for Illinois property you sold in 2020 by combining the 2019 property tax paid in 2020 as well as a portion of the 2020 tax paid based on the time you owned and lived at the property during 2020.

Starting in 2018 the TCJA Tax Cuts and Jobs Act. For federal purposes your total itemized deduction for state and local taxes paid in 2020 is limited to a combined amount not to exceed 10000 5000 if married filing separate. In addition you can no longer deduct foreign taxes you paid on real estate.

Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point. The property tax deduction is now limited to 10000 combined with your state and local taxes. If your property taxes are included in your monthly mortgage bill you can deduct them after your lender has paid the tax to the assessor on your behalf.

Because paying a cash lump-sum for a home is out of reach for most buyers it is important to take advantage of every tax deduction available. You can no longer deduct the entire amount of property taxes you paid on real estate you own. Property Taxes Paid Through Escrow You can deduct property tax payments that you make directly to the taxing authority as well as payments made into an escrow account that are included in your mortgage payments.

This deduction was unlimited until the Tax Cuts and Jobs Act TCJA imposed an annual cap of 10000 effective tax year 2018. Can You Write off Property Taxes. If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your.

Property taxes are still deductible in 2020 but they are limited. For the 2019 and 2020 tax years the traditional IRA contribution limit is 6000 per person with an additional 1000 catch-up contribution allowed for individuals who are 50 years old or. Property taxes are deductible in the year in which you pay them.

If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. Taxes on foreign property tax reform has suspended this deduction for tax years 2018 through 2025 Other tidbits. In 2018 2019 and 2020 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

The Restoring Tax Fairness for States and Localities Act would eliminate the 10000 limit on state and local tax deductions for 2020 and 2021. The limit is only 5000 if youre married but file a separate return and property taxes for personal foreign real property have been eliminated entirely. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

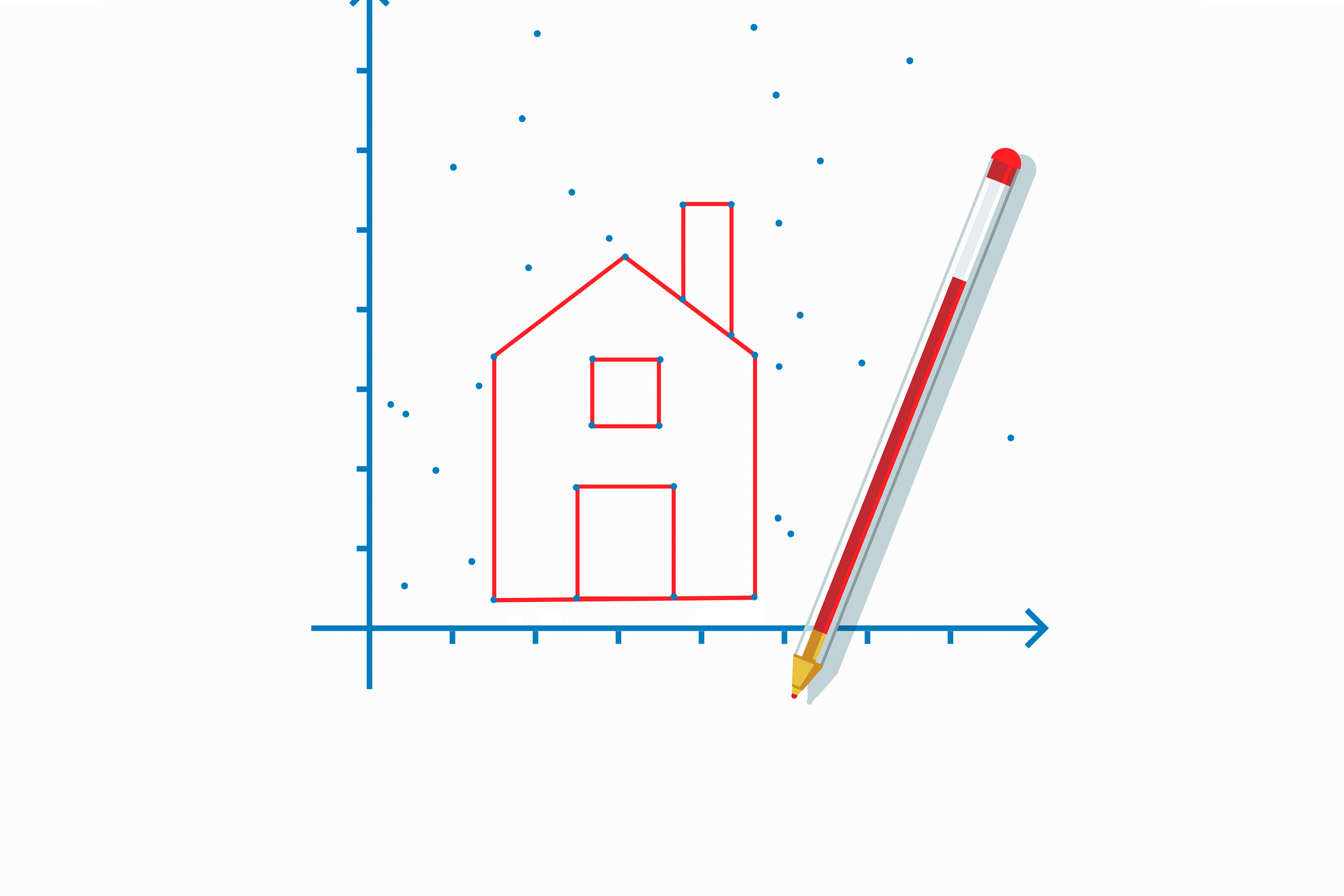

How do property tax deductions work in 2020. You owned the home in 2020 for 243 days May 3 to December 31 so you can take a tax deduction on your 2021 return of 946 243 366 1425 paid in 2021 for 2020. Property taxes offer another way to lower your tax bill.

The Section 179 deduction privilege potentially allows you to deduct the entire cost of. You cant deduct any of the taxes paid in 2020 because they relate to the 2019 property tax year and you didnt own the home until 2020. Filers may deduct taxes paid in 2020 up to 10000 5000 if married filing separately.

State and local tax deduction. Contact your lender to find out when they submit your property tax payments. You may not take a credit on your 2020 return for property sold during 2019.

16 2017 you can deduct the mortgage interest paid on your first 1 million in.

Salt Tax Deduction 2020 Changes What Changed Millionacres

Salt Tax Deduction 2020 Changes What Changed Millionacres

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Real Estate Tax Deductions Guides Resources Millionacres

Real Estate Tax Deductions Guides Resources Millionacres

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Real Estate Tax Deductions Guides Resources Millionacres

Real Estate Tax Deductions Guides Resources Millionacres

Mortgage Interest Deduction Or Standard Deduction Houselogic

Mortgage Interest Deduction Or Standard Deduction Houselogic

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

Irs Section 179 And Qualifying Property What You Need To Know 2020

Irs Section 179 And Qualifying Property What You Need To Know 2020

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Maximum Mortgage Tax Deduction Benefit Depends On Income

Maximum Mortgage Tax Deduction Benefit Depends On Income

Charitable Deductions On Your Tax Return Gifts As A Tax Return Deduction

Charitable Deductions On Your Tax Return Gifts As A Tax Return Deduction

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home