Do Veterans Get A Property Tax Break In Ny

A New York State property tax break applicable for the residences of veterans who served during the Cold War. New York state has three different property tax exemptions are based on your military service with additional benefits based upon degree of service-connected disability.

Military Retirees Retirement Military Retirement Military

Military Retirees Retirement Military Retirement Military

Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief STAR program.

Do veterans get a property tax break in ny. Additional deductions may apply for combat and disabled veterans. The Internal Revenue Service is committed to helping all Veterans. Authorized by Real Property Tax Law section 458-a.

We work with community and government partners to provide timely federal tax-related information to Veterans about tax credits and benefits free tax preparation financial education and asset-building opportunities available to Veterans. The exemption applies to county city town and village taxes. When you purchase property with certain funds you may be able to get a tax exemption on part of the purchase price.

As a result of their service some Veterans are wounded or disabled in the line of duty. Qualifying veterans and their family members are eligible for property tax breaks in New York City. Alternative Veterans Tax Exemption The Alternative Veterans tax exemption is available to eligible veterans of foreign wars expeditionary medalists veterans with honorable discharges spouseswidow ers of veterans and Gold Star parents.

If you are a senior citizen or a disabled person with an income of 58399 or less a veteran the spousewidow of a veteran an active clergy member or if youve received School Tax Relief STAR benefits you could be eligible for a tax break on your property taxes. Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying persons with disabilities. There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces.

Or you may write to me at the Nassau County Department of Assessment 240 Old Country Road Mineola New York 11501. New York veterans may be eligible for one of three property tax exemptions for a veteran-owned primary residence. An increase in the veterans percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or the combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability.

Available only on residential property of a veteran who served during the Cold War period. If you are a veteran you may qualify for a real property tax exemption. Veterans Property Tax Breaks The NY State Monroe County Veterans Tax Exemption Veterans and their surviving spouses may be eligible for an exemption on local city town village andor county property taxes.

Cold War veterans exemption. The exemption amount varies based on type of service and disability as determined by the New York State Division of Veterans Affairs. Deservedly the state and federal government provide special discounts or assistance to our disabled warriors one such benefit being a property tax exemption.

Exemptions may apply to school district taxes. Disabled veterans may be eligible to claim a federal tax refund based on. Veterans can receive one of the three following exemptions.

Like the Alternative Veterans Exemption certain municipalities within the state may or may not offer the tax break. To qualify persons with disabilities generally must have certain documented evidence of their disability and meet certain income limitations and other requirements. Most of the exemptions are not specifically aimed at disabled veterans but additional discounts or considerations apply for those with VA-rated disabilities.

THE CURRENT VETERANS EXEMPTION LAW State law provides that Nassau County veterans applying for the first time for a Veterans Real Property Tax Exemption shall receive an exemption based on the type of service they rendered to their country during wartime. A disabled veteran in New York may receive a property tax exemption on hisher primary residence. Counties cities towns villages and school districts have the option to offer this exemption to qualified veterans.

Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes. Real Property Tax Exemption.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

All Veteran Property Tax Exemptions By State And Disability Rating Vlaggen

All Veteran Property Tax Exemptions By State And Disability Rating Vlaggen

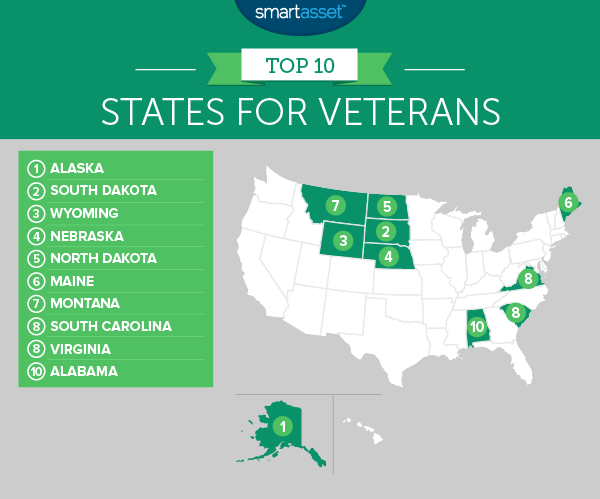

The Best States For Veterans Smartasset

The Best States For Veterans Smartasset

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

7 Qualities The Army Instilled In Me That Helped Me Launch A Business Army Soldier Us Army Soldier Army

7 Qualities The Army Instilled In Me That Helped Me Launch A Business Army Soldier Us Army Soldier Army

Veterans Property Tax Exemption By State Pro Tips

Veterans Property Tax Exemption By State Pro Tips

All The Nassau County Property Tax Exemptions You Should Know About

All The Nassau County Property Tax Exemptions You Should Know About

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

In This Episode We Ll Discuss Propertytaxes For Illinoisveterans With Disabilities What Benefits Are Availabl Tax Exemption Property Tax Disabled Veterans

In This Episode We Ll Discuss Propertytaxes For Illinoisveterans With Disabilities What Benefits Are Availabl Tax Exemption Property Tax Disabled Veterans

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Real Estate Articles Estate Tax

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Real Estate Articles Estate Tax

Sign In Property Tax Real Estate Infographic Infographic

Sign In Property Tax Real Estate Infographic Infographic

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

There Are Three Different Property Tax Exemptions Available To Veterans Who Have Served In The United States Armed Forces T Property Tax Tax Exemption Veteran

There Are Three Different Property Tax Exemptions Available To Veterans Who Have Served In The United States Armed Forces T Property Tax Tax Exemption Veteran

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home