Average Property Tax In Knoxville Tn

The median annual property tax paid by homeowners in Tennessee is 1220 about half the national average. This website provides tax information for the City of Knoxville ONLY.

Where Do You Summer Mansions Lake House Luxury Life

Where Do You Summer Mansions Lake House Luxury Life

Box 70 Knoxville TN 37901 Phone.

Average property tax in knoxville tn. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Tax amount varies by county. Taxes in Knoxville Tennessee are 325 cheaper than Annapolis Maryland.

This chart shows the households in Knoxville TN distributed between a series of property tax buckets compared to the national averages for each bucket. The rate for Knox County is 232 for each 100 of assessed value and the rate for the city itself is 27257 also based on 100 of assessed value. County Appraisal Calculate.

Property Assessor City County Building Suite 204 400 Main Street Knoxville TN 37902. The average household income in the Skyline Dr area is 48900. In Tennessee only businesses pay personal property taxes not individuals or private citizens.

Sales Tax State Local Sales Tax on Food. With an average property tax of over 2800 nationwide the median rate paid by Knoxville residents is slightly more than half that amount 1477. 24638 per 100 assessed value.

In Knoxville TN the largest share of households pay taxes in the 800 range. Real property tax on median home. The average property tax on Westland Gardens Blvd is 1527yr and the average house or building was built in 2016.

City of Knoxville Revenue Office. In Knoxville TN the largest share of households pay taxes in the 800 - 1499 range. Knoxville TN 37902.

Links are provided at the bottom of this page for the counties not included here which are Bradley Chester Davidson Hamilton Hickman Knox. Cost of Living Indexes. Demographics history of Knoxville media maps volunteer info chamber and visitors center Knoxvilles Urban Wilderness Outdoor adventure area where you can hike bike climb paddle in the woods in the heart of the city.

Real property tax on median home. Tennessee has the eleventh or twelfth lowest property tax burden in the United States depending on which study you look at. RE trans fee on median home over 13 yrs Auto sales taxes.

Knoxville residents pay both city and county taxes. Mailing Address Knox County Trustee PO. The average household income in the Westland Gardens Blvd area is 130825.

We found 40 address and 59 property on Westland Gardens Blvd in Knoxville TN. 400 Main Street. Monday - Friday 800 am - 430 pm Department Email.

Questions regarding information provided here can. 068 of home value. For comparison the national average hovers around 11 percent.

The average price for real estate on Westland Gardens Blvd is 71015. This chart shows the households in Knoxville TN distributed between a series of property tax buckets compared to the national averages for each bucket. The average property tax on Skyline Dr is 797yr and the average house or building was built in 1954.

We found 150 address and 154 property on Skyline Dr in Knoxville TN. VmHomeInit vmHomeerrorMessage. Assessment Tax Rate.

Tennessee has some of the lowest property taxes in the US. The average home owner in the Knoxville real estate market paid about 075 percent of their homes value in property taxes. Sales Tax State Local Sales Tax on Food.

212 per 100 assessed value. County Property Tax Rate. 925 7 state 225 local City Property Tax Rate.

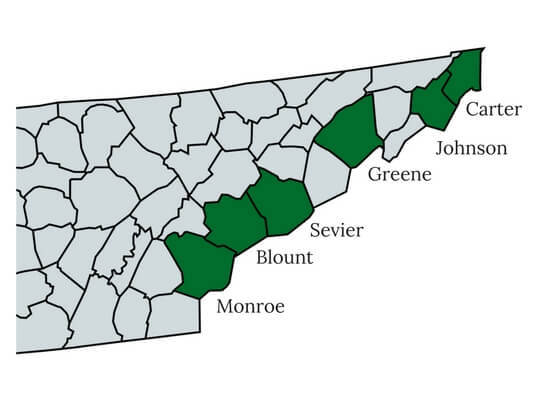

Tennessee has one of the lowest median property tax rates in the United States with only nine states collecting a lower. The average effective property tax rate in Tennessee is 064. Data on this site exists for 84 of Tennessees 95 counties.

The median property tax in Tennessee is 93300 per year for a home worth the median value of 13730000. Counties in Tennessee collect an average of 068 of a propertys assesed fair market value as property tax per year. The average price for real estate on Skyline Dr is 17369.

The information presented on this site is used by county Assessors of Property to assess the value of real estate for property tax purposes.

9 States With No Income Tax Income Tax Income Tax

9 States With No Income Tax Income Tax Income Tax

2021 Most Diverse Suburbs In Tennessee Niche

2021 Most Diverse Suburbs In Tennessee Niche

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

Christie 39 S International Luxury Real Estate In Middletown New Jersey Represented By Geralyn Behring Of Gloria Nilson Co Real Mansions Navesink Riverfront

Christie 39 S International Luxury Real Estate In Middletown New Jersey Represented By Geralyn Behring Of Gloria Nilson Co Real Mansions Navesink Riverfront

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

The Best Worst Metros For Dating 2020 Rentonomics Richmond College Fun Dating Girls

The Best Worst Metros For Dating 2020 Rentonomics Richmond College Fun Dating Girls

Better To Own Near Walmart Or Target Where To Save Money And Expect More Home Buying Real Estate Infographic Home Selling Tips

Better To Own Near Walmart Or Target Where To Save Money And Expect More Home Buying Real Estate Infographic Home Selling Tips

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Knoxville Tn South Waterfront Bicycle Pedestrian Bridge Pedestrian Bridge Waterfront Bridge Design

Knoxville Tn South Waterfront Bicycle Pedestrian Bridge Pedestrian Bridge Waterfront Bridge Design

Extraordinary French Normandy Estate In Hidden Hills Mansions Mansions Luxury Luxury Exterior

Extraordinary French Normandy Estate In Hidden Hills Mansions Mansions Luxury Luxury Exterior

205 2nd Anita Dr For Sale Los Angeles Ca Trulia House Luxury Homes House Styles

205 2nd Anita Dr For Sale Los Angeles Ca Trulia House Luxury Homes House Styles

Best Electrical Service In Knoxville Tennessee Electricity Tennessee Knoxville

Best Electrical Service In Knoxville Tennessee Electricity Tennessee Knoxville

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

1262 Tom Garrison Rd Evensville Tn 37332 Mls 20205432 Zillow Garrison Zillow Sweet Home

1262 Tom Garrison Rd Evensville Tn 37332 Mls 20205432 Zillow Garrison Zillow Sweet Home

10 Least Tax Friendly States For Retirees 2016 Retirement Preparing For Retirement Tax

10 Least Tax Friendly States For Retirees 2016 Retirement Preparing For Retirement Tax

1326 Jones Street Greenville Tx 75401 I Buy Houses Llc Real Estate Investing Real Estate Investor Home Buying

1326 Jones Street Greenville Tx 75401 I Buy Houses Llc Real Estate Investing Real Estate Investor Home Buying

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home