Property Tax Proration Calculator Ohio

Lake County Ohio - Property Tax Calculator. Title insurance rates are REGULATED by the State of Ohio therefore title insurance rates should not vary between title insurance companies.

Understanding Tax Prorations Sterling Land Title Agency

Understanding Tax Prorations Sterling Land Title Agency

Like I said tax proration can be confusing especially in Greene Montgomery Counties Ohio.

Property tax proration calculator ohio. In the long proration it corresponds to the actual days you owned the property. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Preble County. So a closing on August 15th would be prorated from July 1 to August 15.

1 - Madison Township 2 - Madison Village 3 - Perry Township 4 - Perry Village 5 -. Taxes are never required to. 100 x 1000 would equal 100000 in prorated compensationcredit from seller to buyer.

The states average effective property tax rate annual tax payments as a. This calculator should be useful for Ohio Realtors and OH home sellers. We then estimate the 2015 full year tax bill by simply multiplying the 2014 bill with 105.

With real estate taxes being a year behind in their collection purchase transactions require the Seller to provide a proration to the Buyer towards future tax bills that will come due after closing that will be the Buyers obligation to pay but represent a period the seller owned the real estate. In fact the typical homeowner in Kentucky pays just 1257 each year in property taxes which is much less than the 2578 national median. Tax estimates for tax year 2020 will be made available following the issuance of the new certified tax rates by the State of Ohio.

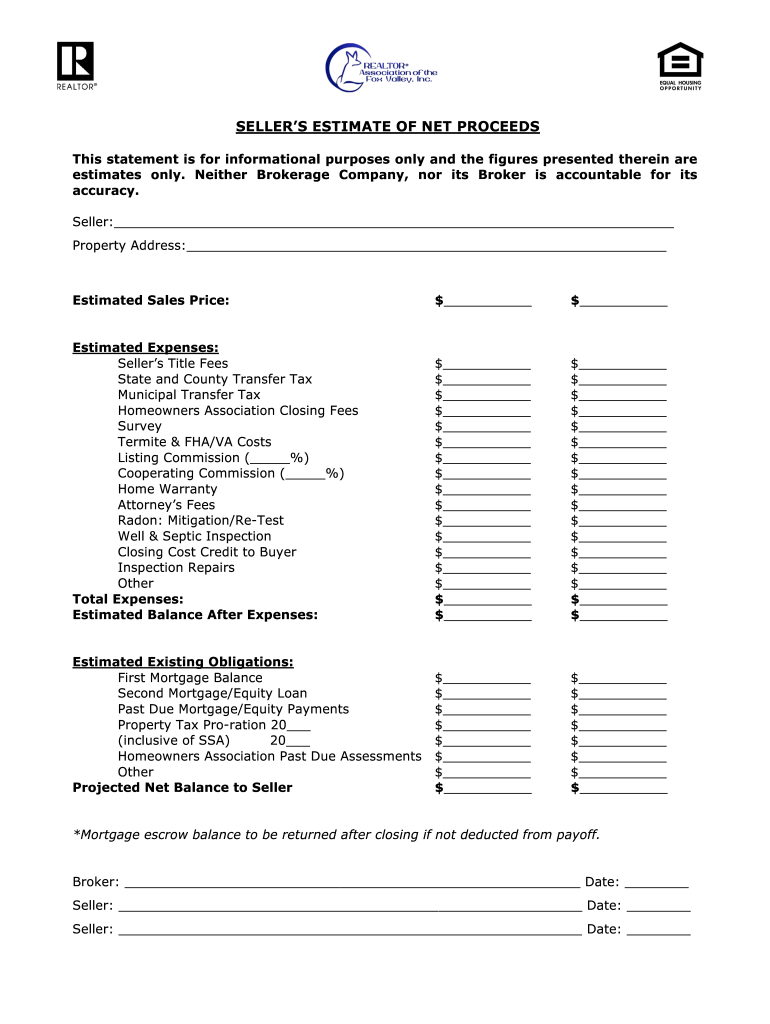

As an example if your taxes were 3650 a year or 10 a day the proration in the example above would be 45 days x 10 a. This calculator is designed to estimate the real estate tax proration between the home buyer seller at closing. Add or edit your Seller information closing costs Realtor commissions and other details.

Calculate the Ohio title insurance rate estimate the OH transfer tax known as the Ohio conveyance fee. Sellers can estimate their closing costs with the Seller Cost Calculator. Short Proration is calculated by multiplying the daily tax rate from the beginning of the current cycle to the present date.

So for example if your property is worth 100000 your assessed value should be 35000. For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900. Or to express it another way typically in Montgomery County and parts of Greene County the purchasers will be paying a prorated share of taxes for a time period that they did not live in the property.

Easily calculate property tax proration due at the close of a sale of real property in the State of Iowa. This data will be used to calculate the initial estimate. Or to express it another way typically in Montgomery County and parts of Greene County the purchasers will be paying a prorated share of taxes for a time period that they did not live in the property.

The median property tax on a 12350000 house is 135850 in Preble County. Iowa Tax Proration Calculator Todays date. The daily rate would be 1000day yearly taxes365.

In this contract the amount is 105. Simply close the closing date with the drop down box. Enter the General Information.

Taxes are considered current if the most recent bill is paid. Property Tax Proration Calculator. The median property tax on a 12350000 house is 129675 in the United States.

This service is being provided for informational purposes onlyDo not rely on the results from this calculator to make financial decisions. Taxes are considered current if the most recent bill is paid. 1 st Half of 2016 tax bill unknown Partial 2 nd Half of 2016 tax bill unknown The contract should call for a proration premium which is typically 105 or more.

You should check with your attorney or closing agent for a determination of the final tax prorate as the rules may vary slightly from one location to another. Annual property tax amount. This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year.

Annual taxes are 365000. Ohio Title Insurance Rates Conveyance Fee Calculator. The median property tax on a 12350000 house is 167960 in Ohio.

Property taxes in Kentucky are relatively low. To put it all together take your assessed value and subtract any applicable exemptions for which youre eligible and you get the taxable value of your property. This calculator will estimate the Ohio title insurance premium Ohio conveyance fee transfer tax and seller assist cost if applicable.

This is because taxes are six months in arrears in Ohio. Multiply the daily rate by the number of days from June 20. This is because taxes are six months in arrears in Ohio.

All tax estimates are based on 2019 tax year rates. Appraised values should equal 100 of market value. No matter which method is used it is important that there is a mutual agreement and understanding between the parties regarding the method of tax proration.

Click the Calculate button to continue. Lets assume this takes place in a year in which this adds up to 100 days. All estimates are for tax year 2020 taxes paid in 2021.

However assessed values in Ohio the amounts on which property taxes are based are calculated at 35 of appraised value.

How Property Tax Prorations Work In Ohio Carlos Scarpero Va Mortgage Specialist Nmls 1674385

How Property Tax Prorations Work In Ohio Carlos Scarpero Va Mortgage Specialist Nmls 1674385

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

Seller Closing Costs Net Calculator Tutorial

Allegheny County Property Tax Assessment Search Lookup

How Property Tax Prorations Work In Ohio Carlos Scarpero Va Mortgage Specialist Nmls 1674385

How Property Tax Prorations Work In Ohio Carlos Scarpero Va Mortgage Specialist Nmls 1674385

Buyers Vs Sellers Who Pays For What Vic Green Realty

Buyers Vs Sellers Who Pays For What Vic Green Realty

Allegheny County Assessment And Property Tax Calculator

Proration And Adjustment Of Tax Data At An Escrow Closing

Proration And Adjustment Of Tax Data At An Escrow Closing

Allegheny County Property Tax Assessment Search Lookup

Will Lenders Pay Closing Costs

How To Compute Real Estate Tax Proration And Tax Credits Illinois

How To Compute Real Estate Tax Proration And Tax Credits Illinois

Http Help Softprocorp Com Articles Classic Short 20and 20long 20tax 20prorations Pdf

Real Estate Net Sheet Template Fill Online Printable Fillable Blank Pdffiller

Real Estate Net Sheet Template Fill Online Printable Fillable Blank Pdffiller

Wisconsin Seller Closing Costs Net Proceeds Calculator Closing Costs Title Insurance Seller

Wisconsin Seller Closing Costs Net Proceeds Calculator Closing Costs Title Insurance Seller

Understanding Tax Prorations Sterling Land Title Agency

Understanding Tax Prorations Sterling Land Title Agency

Allegheny County Property Tax Assessment Search Lookup

How To Calculate Property Tax Prorations Ask The Instructor Youtube

How To Calculate Property Tax Prorations Ask The Instructor Youtube

Property Tax Proration Calculator Calculate Tax Per Diem Estate Tax Mortgage Payoff Property Tax

Property Tax Proration Calculator Calculate Tax Per Diem Estate Tax Mortgage Payoff Property Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home