Property Tax In Walnut Ca

This compares well to the national average which currently sits at 107. 1622 Hallgreen Dr Walnut CA 91789-3426 is currently not for sale.

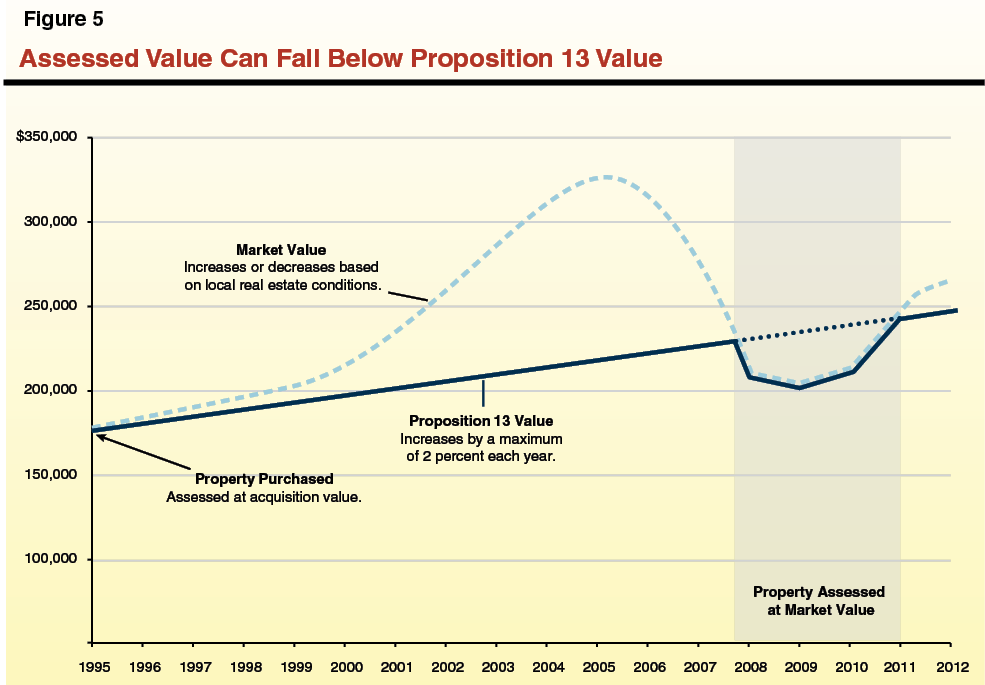

Understanding California S Property Taxes

Understanding California S Property Taxes

If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500.

Property tax in walnut ca. Property Record Research Locations Listings. Coldwell Banker Northern California. As of June 28 2019 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with California Government Code Sections.

Room 101 E Visalia CA 93291. Services the Tax Collector provides to the public and government agencies. 760 The property tax rate shown here is the rate per 1000 of home value.

The average effective property tax rate in Orange County is 069 while the median annual property. Public Records Registries Real Estate Record Services CA Property Records in Walnut 91788 Real Estate Record Services in Walnut CA Gain access to the deeds in Walnut CA including how to block public access to documents and how to determine the parcel number by getting in touch with the real estate record locations listed in our. Search for other Tax Return Preparation in Walnut Creek on The Real Yellow Pages.

Enter your income and we will give you your estimated taxes in Walnut Creek California we will also give you your estimated taxes in Los Angeles California. These two rules combine to keep Californias overall property taxes below the national average which in turn keeps your bills low. Tax amount varies by county.

The Williams Firm provides legal services to its clients in the areas of business transactions business litigation corporate law real. To build the countywide tax roll and allocate and account for property tax apportionments and assessments for all jurisdictions in the county. This is the effective tax rate.

A Law Firm practicing Property Tax law. Single-family home is a 4 bed 20 bath property. Property Tax Rate.

559-636-5280 221 South Mooney Blvd. The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. Diablo Boulevard Suite 340 Walnut Creek CA 94596-4447.

Orange County CA Property Tax Calculator. California Walnut Abogado Avenue Acaso Drive Alder Lane Amber Ridge Lane Amber Valley Drive Amberwood Drive Amhurst Drive Apache Way Ash Meadow Lane Avenida Alipaz. Its also one of the richest counties in the nation.

Overview of Orange County CA Taxes. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County.

Use our free directory to instantly connect with verified Property Tax attorneys. Property Tax Lawyers at 1850 Mt. View more property details sales history and Zestimate data on Zillow.

To assist in the issuance and administration of the Tax and Revenue Anticipation Notes and other bond programs. This home was built in 1969 and last sold on 11272013 for 539000. Walnut Creek city rate s 825 is the smallest possible tax rate 94595 Walnut Creek California The average combined rate of every zip code in Walnut Creek California is 825.

When looking to view Walnut Creek CA property transaction records you can use our property tax record website to locate them. Get reviews hours directions coupons and more for Comprehensive Property Tax Service at 1371 Oakland Blvd Walnut Creek CA 94596. Compare the best Property Tax lawyers near Walnut CA today.

The median property tax in California is 283900 per year for a home worth the median value of 38420000. Orange County is the one of the most densely populated counties in the state of California. The average effective property tax rate in California is 073.

The purpose of the Property Tax Division is. You can also find info about tax values and MLS listings. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes.

California Property Taxes Viva Escrow 626 584 9999

California Property Taxes Viva Escrow 626 584 9999

Understanding California S Property Taxes

Understanding California S Property Taxes

Everything You Need To Know About The Property Taxes In San Gabriel Valley Ca Cristal Cellar

Everything You Need To Know About The Property Taxes In San Gabriel Valley Ca Cristal Cellar

Everything You Need To Know About The Property Taxes In San Gabriel Valley Ca Cristal Cellar

Everything You Need To Know About The Property Taxes In San Gabriel Valley Ca Cristal Cellar

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Https Www Ci Hercules Ca Us Home Showdocument Id 11228

Contra Costa County Property Tax Anderson Advisors Asset Protection Tax Advisors

Contra Costa County Property Tax Anderson Advisors Asset Protection Tax Advisors

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

What You Should Know About Contra Costa County Transfer Tax

What You Should Know About Contra Costa County Transfer Tax

Orange County Ca Property Tax Calculator Smartasset

Orange County Ca Property Tax Calculator Smartasset

Understanding California S Property Taxes

Understanding California S Property Taxes

Http Www Mikemcmahon Info Prop13taxanalysis2010 Pdf

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Contra Costa County Property Tax Anderson Advisors Asset Protection Tax Advisors

Contra Costa County Property Tax Anderson Advisors Asset Protection Tax Advisors

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home