Ohio Property Tax For Schools Unconstitutional

State over 20 years ago. COLUMBUS Ohio AP State lawmakers proposing an overhaul of how Ohio funds schools said Monday that it would more fairly split local and state shares and.

Inequitable School Funding A Persistent Problem In Ohio The Beachcomber

Inequitable School Funding A Persistent Problem In Ohio The Beachcomber

Property Taxes Are Illegal and Unconstitutional Submitted by Dave Hodges on Sunday September 22 2019 - 1955.

Ohio property tax for schools unconstitutional. 632 PM EDT March 25 2019. Income Taxes and the Military. The first major change to Ohios property tax system came in 1976 with the passage of HB.

Ohio school districts may enact a school district income tax with voter approval. This tax is in addition to and separate from any federal state and city income or property taxes. This case made it all the way to the Ohio Supreme Court on three occasions.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Ohio Townships do not have the power to levy taxes. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year.

Find Your School District. School District Income Tax. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected.

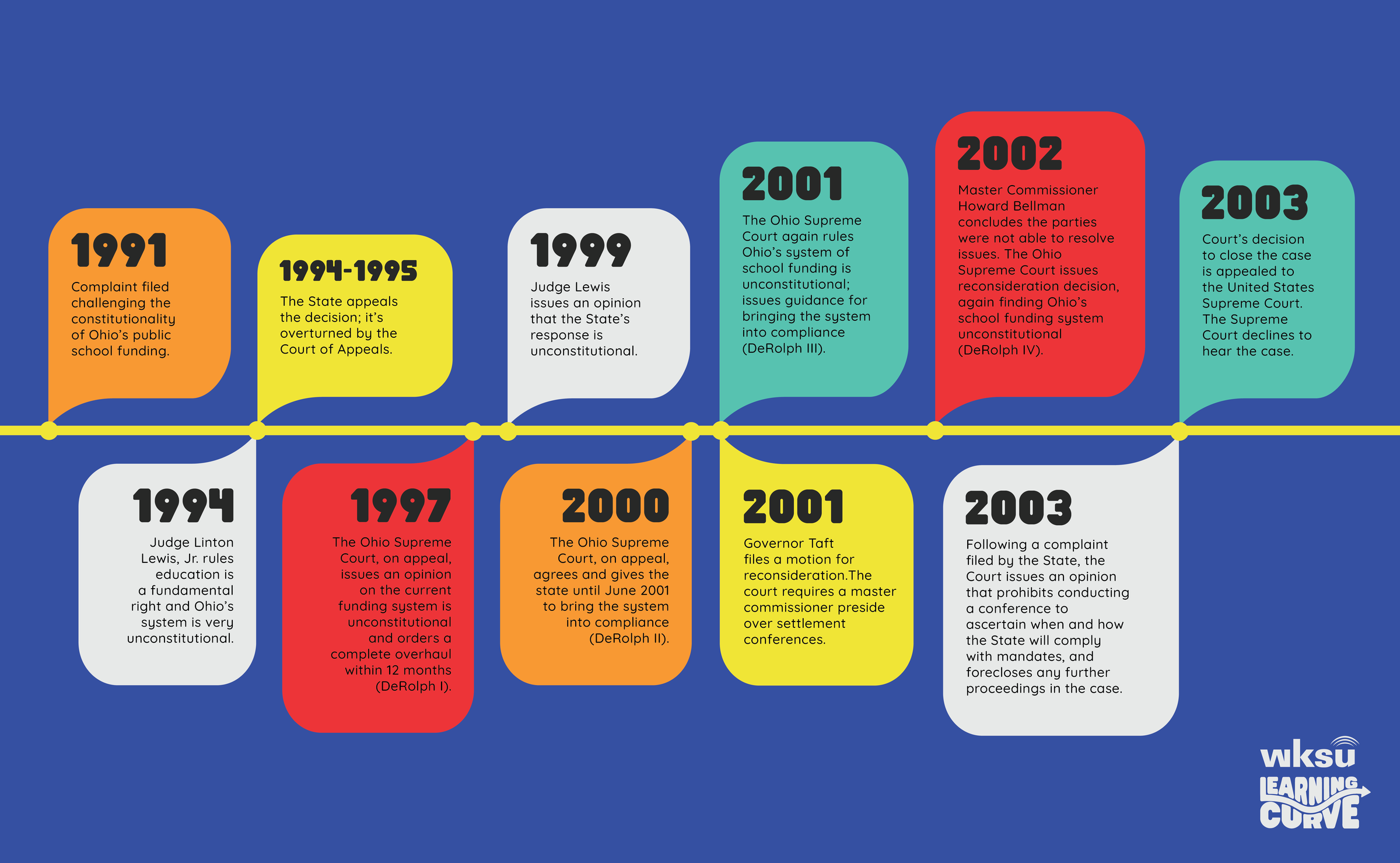

The Ohio school district income tax generates revenue to support school districts who levy the tax. May 11 2000 117 PM CBS The Ohio Supreme Court declared Thursday its system of funding schools is still unconstitutional because the dependence on local property taxes. Beginning in 1997 the Ohio Supreme Court ruled four times that Ohios education funding is unconstitutional.

920 created a mechanism of tax reduction factors that reduced real property tax rates in the aftermath of increases in property values due to property reappraisal. Ohios school funding formula largely relies on. Property taxes are evil but most of all they are unconstitutional.

Reacting to large inflationary increases in home values HB. ODT collects and administers the tax on behalf of the school districts. Find Ohio public school district income tax information for all addresses in the State of Ohio.

The Ohio Supreme Court has never said that property taxes are unconstitutional or that it is unconstitutional to use property taxes to fund our public schools. Legally being applied or not. However in 1825 the Ohio legislature did implement a tax on real estate to help support public schools in the state.

The state was found to have failed to provide a. Twenty years later the Ohio Supreme Court ruled school funding based on property taxes was unconstitutional and that lawmakers needed to fix it. The premise is that for a personal property tax on a free sovereign private individual to be legal it must be Constitutional and applied as the Constitution regulates it.

Tax amount varies by county. The Supreme Courts decision was this. Any other means makes the tax void in law.

Thats why they call them fees This case argues that fees on new homeowners and developers are. This misconception arose from a lawsuit called DeRolph v. Why are we tolerating this illegal tax upon our property.

As a general rule Ohio state officials avoided implementing property or income taxes. The Ohio Supreme Court ruled that the states school funding method was unconstitutional in the landmark case DeRolph vs. At this time the state government financed public education with a half-mil property tax.

COLUMBUS Ohio AP - The Ohio Supreme Court declared the states school funding system unconstitutional for the third time in 11 years Wednesday because it. As of January 2021 208 school districts impose an income tax. The issue of real and personal property taxation is long overdue to be challenged.

Https Www Jstor Org Stable 40704238

Educators Pass School Funding Reform Now The Lima News

Educators Pass School Funding Reform Now The Lima News

After A Generation Is There Finally A Fix For School Funding Wvxu

After A Generation Is There Finally A Fix For School Funding Wvxu

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Chronology Of The Derolph V Ohio School Funding Litigation

Chronology Of The Derolph V Ohio School Funding Litigation

Guest Column School Groups Praise Answer To Derolph Ruling The Lima News

Guest Column School Groups Praise Answer To Derolph Ruling The Lima News

Local School Leaders Join In Lobbying For New Ohio School Funding Law

The Kasich Education Record Innovation Ohio

Ohio School Funding Remains Mysterious The Columbus Dispatch 9 22 2017

Q A Ohio School Funding Reforms With Oea President Scott Dimauro Wosu Radio

Q A Ohio School Funding Reforms With Oea President Scott Dimauro Wosu Radio

Five Questions About Kasich S School Funding Proposal Innovation Ohio

10th Period Kids In 100 Ohio School Districts Lose Overall Funding To Charter Schools National Education Policy Center

10th Period Kids In 100 Ohio School Districts Lose Overall Funding To Charter Schools National Education Policy Center

Lawmakers Unveil Proposal To Overhaul Ohio S School Funding Wkyc Com

Lawmakers Unveil Proposal To Overhaul Ohio S School Funding Wkyc Com

Https Www Lsc Ohio Gov Documents Reference Current Membersonlybriefs 133 20derolph 20v 20state 20school 20funding Pdf

Overview Of School Funding Ohio Department Of Education

School Funding Formula Debuts In Ohio House Galion Inquirer

School Funding Formula Debuts In Ohio House Galion Inquirer

Https Www Clevelandheights Com Documentcenter View 6315

Ohio Media Spreads Myths About School Funding The Thomas B Fordham Institute

Ohio Media Spreads Myths About School Funding The Thomas B Fordham Institute

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home