How To Calculate Property Tax Franklin County Ohio

This estimator is provided to assist taxpayers in making informed decisions about real estate taxes and to anticipate the impact of property value fluctuations. Pay Franklin County Ohio property taxes online using this service.

3 Reasons Every Homeowner Needs Title Insurance Title Insurance Liberty Tax Bank Statement

3 Reasons Every Homeowner Needs Title Insurance Title Insurance Liberty Tax Bank Statement

This includes the 1 per 1000 fee set by the state and the 2 per 1000 set by the Franklin County Board of Commissioners who last updated the fee in August 2019.

How to calculate property tax franklin county ohio. A tax return must be filed even if no income was earned or if no tax is due with the return. Tax filing is mandatory for the City of Franklin. Please note that it usually takes the County Treasurer 2-4 days to process your payment once it is made.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Franklin County. 750 Is this data incorrect The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. If you have any questions or need assistance with your city taxes please call the Franklin Income Tax Division at 937-746-9921.

Annual Interest Rate By October 31 of each year the interest rate that will apply to overdue municipal income taxes during the next calendar year will be posted herein as required by Ohio Revised Code Section 71827F. Taxes for a 100000 home in. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work.

The median property tax on a. The following lists the formulas that the State of Ohio has authorized for the calculation of property taxes. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property.

If either January 20th or. Starting in 2005 Ohios state income taxes saw a gradual decrease each year. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies. Generally property taxes are due in January and June. Franklin County collects on average 167 of a propertys assessed fair market value as property tax.

Multiply the market value of the property by the percentage listed for your taxing district. The median property tax on a 13460000 house is 183056 in Ohio. The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300.

When are real estate taxes due in Franklin County Ohio. You can visit their website or call 614-525. 100000 x35 35000 Assessed Value x Tax Rate1000 Current Real Estate TaxYear.

The median property tax on a 15530000 house is 259351 in Franklin County. The median property tax on a 15530000 house is 211208 in Ohio. For the 2020 tax year which you file in early 2021 the top rate is 4797.

The due date of City of Franklin tax returns. Taxpayers under the age of 18 years of age are required to file if the income exceeds zero after the 6500 deduction of total wages. So for example if your property is worth 100000 your assessed value should be 35000.

3850 cents per gallon of regular gasoline and 4700 cents per gallon of diesel. Certain property tax liens are handled by the Franklin County Treasurer others are the result of filings with the Clerk of Courts. It is recommended you obtain a case number from the reporting agency.

A simple percentage used to estimate total property taxes for a property. However assessed values in Ohio the amounts on which property taxes are based are calculated at 35 of appraised value. Appraised values should equal 100 of market value.

Unpaid State of Ohio Income Tax Liens may require you to contact another agency. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues.

Hilliard - 100000 x 208 208000. Yearly median tax in Franklin County. In Franklin County that fee is 3 per every 1000 of the sale price with a 3 minimum and a 050 per parcel transfer tax.

The median property tax on a 15530000 house is 163065 in the United States. 148 average effective rate. This tool is updated after our office receives the effective tax rates from the State each year.

Delinquent tax refers to a tax that is unpaid after the payment due date. Whitehall - 100000 x 172 172000. Be sure to look up your county tax rate on the Ohio Department of Taxation website.

Market Value x 35 Assessed Value Example. Columbus - 100000 x 148 148000. When the grantor receives the homestead property tax exemption the fee is reduced to a total of 1 per every 1000.

Simply multiply the sum of the figures from Steps 1 and 2 by your local tax rate. Taxes are collected by the Franklin County Treasurers Office FCT. For additional information on your tax bill or to pay your taxes please contact the Franklin County Treasurers office directly.

The FCAO does not levy or collect any taxes. Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in order of median. Tax rates are established for the next year by the State of Ohio Department of Taxation.

Real Estate property taxes are due semi-annually each January 20th and June 20th.

Franklin County Auditor Tax Estimator

Franklin County Auditor Tax Estimator

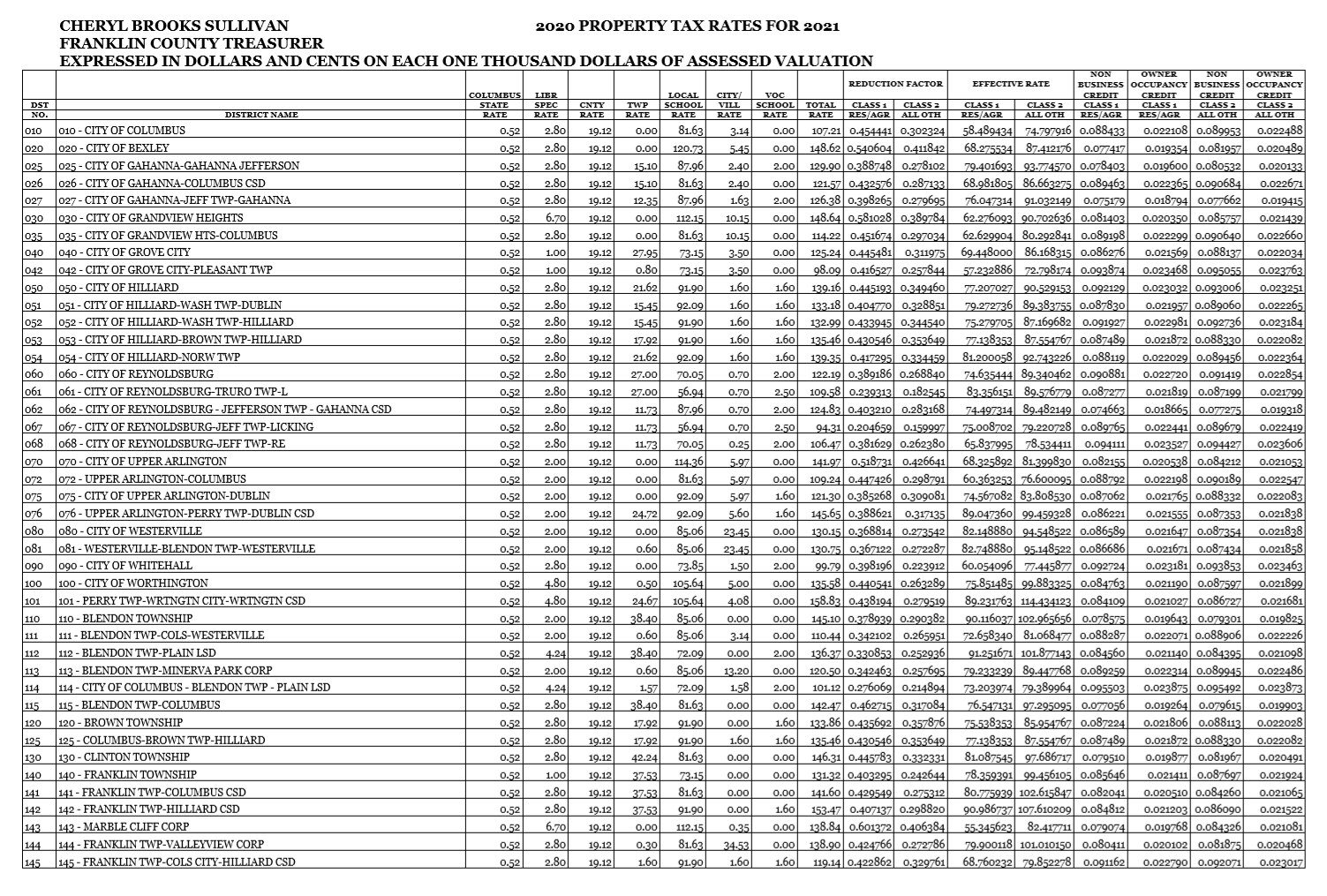

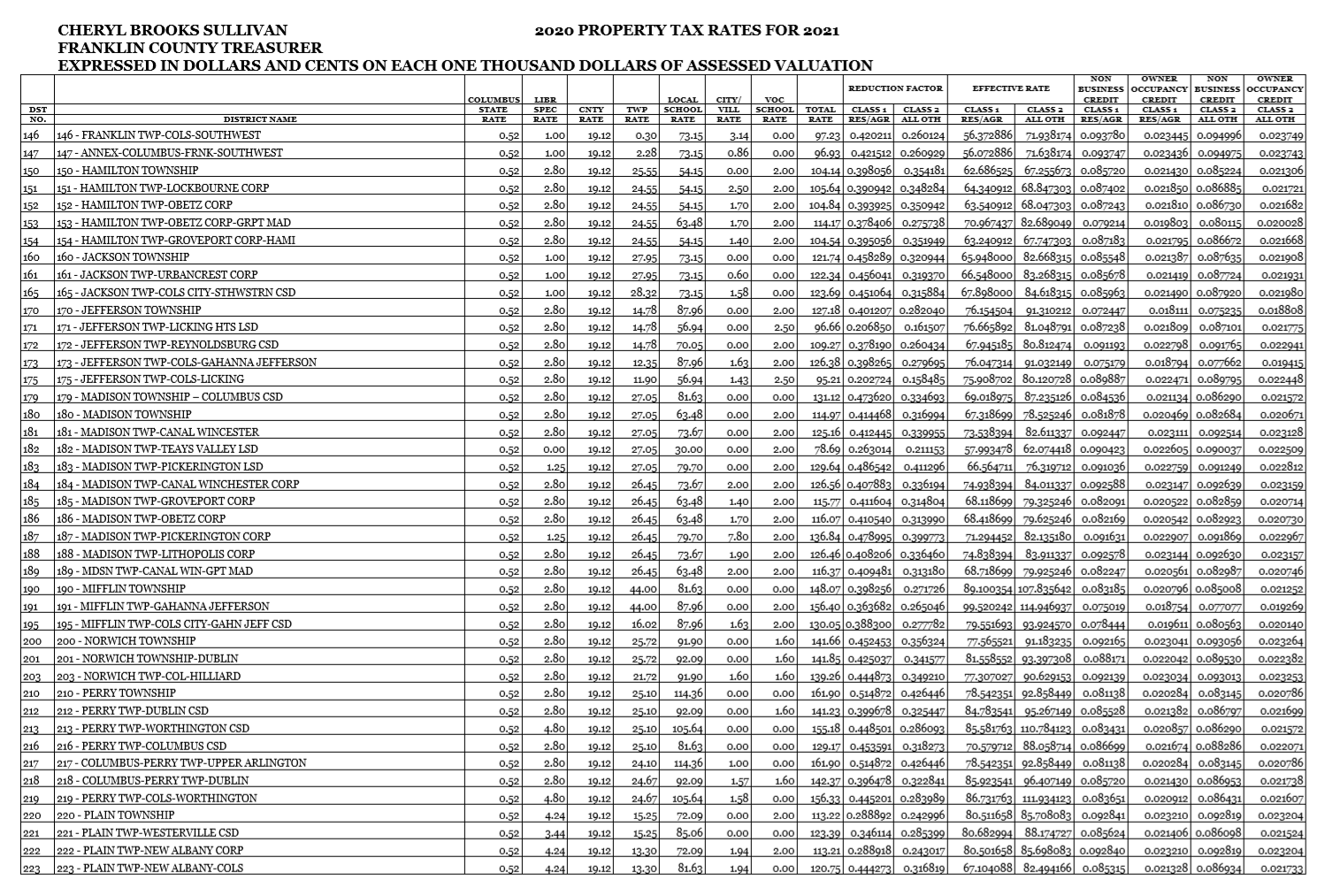

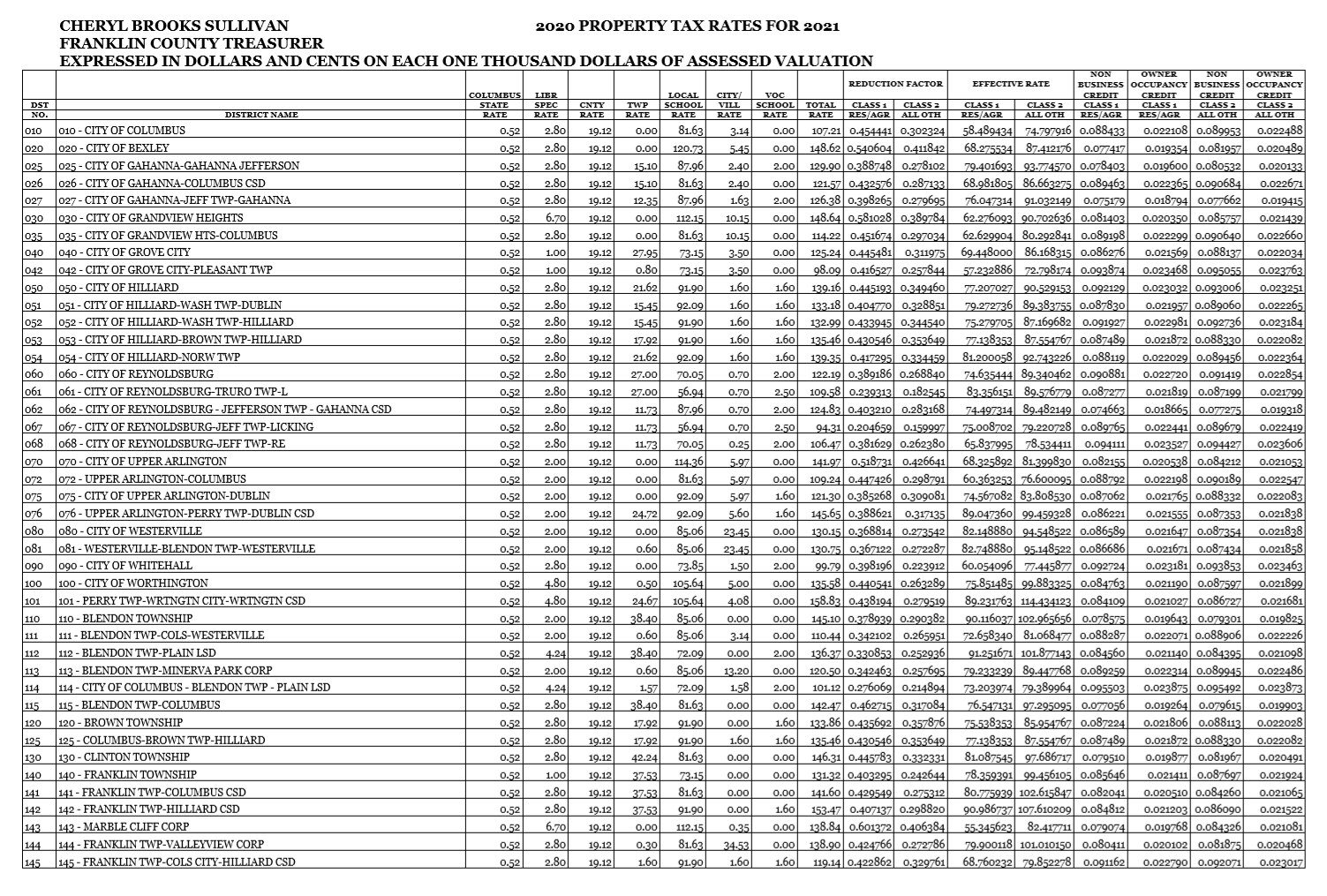

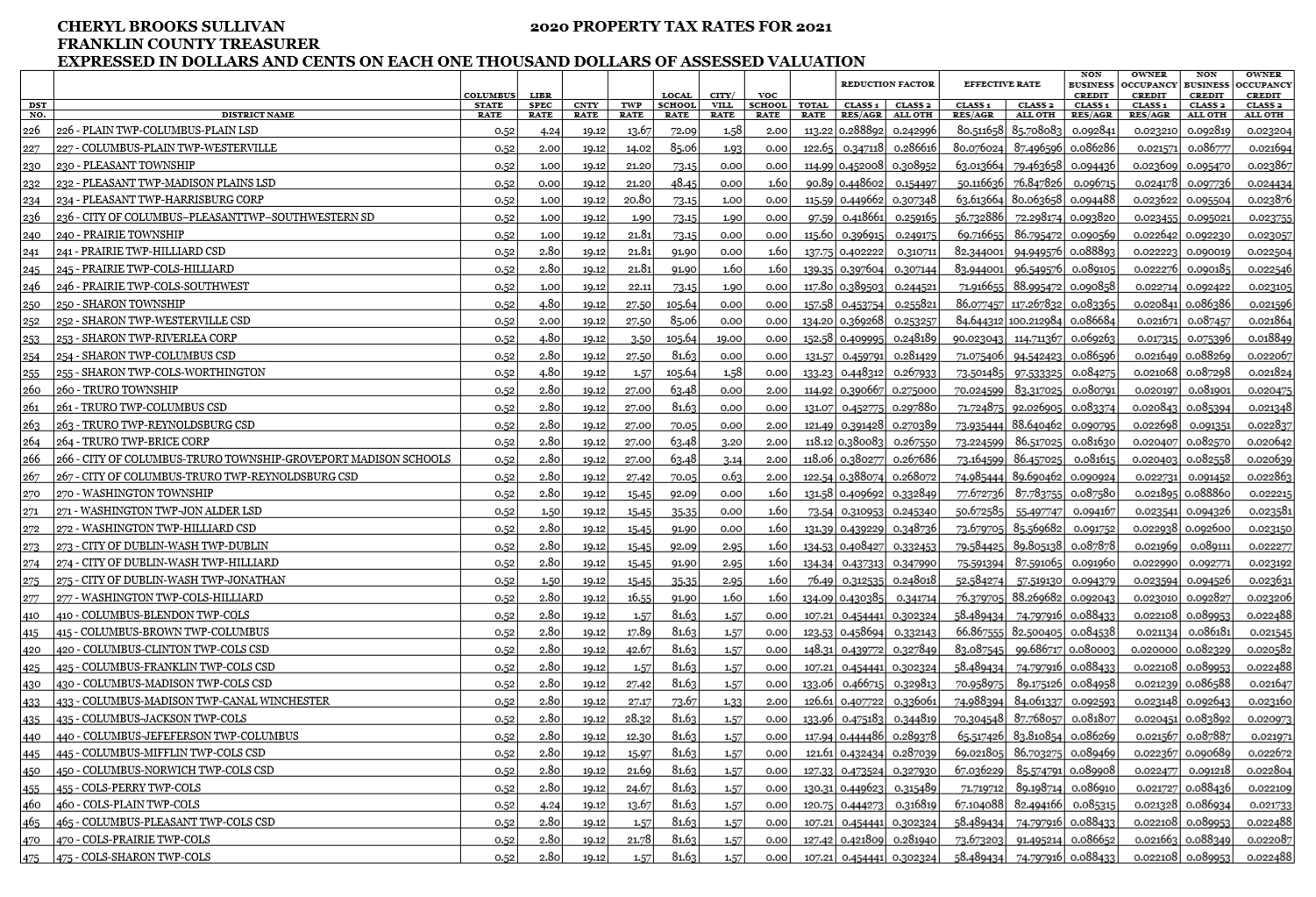

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Timeline To The Closing Table Explained Kate Ladwig Enid Ok Realtor Coldwell Banker Rea Real Estate Infographic Mortgage Marketing Real Estate Marketing

Timeline To The Closing Table Explained Kate Ladwig Enid Ok Realtor Coldwell Banker Rea Real Estate Infographic Mortgage Marketing Real Estate Marketing

Stone House Love Stone House Old Houses For Sale Old Houses

Stone House Love Stone House Old Houses For Sale Old Houses

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

How To Know When To Appeal Your Property Tax Assessment Bankrate

How To Know When To Appeal Your Property Tax Assessment Bankrate

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Flowchart For Home Buying Mortgage Loans Mortgage Offer And Acceptance

Flowchart For Home Buying Mortgage Loans Mortgage Offer And Acceptance

Focus On The Essence Of Your Business Let Us Take Care Of The Rest Get Your Free Trial Today Www Eats365pos Food Smoked Salmon And Eggs Gourmet Recipes

Focus On The Essence Of Your Business Let Us Take Care Of The Rest Get Your Free Trial Today Www Eats365pos Food Smoked Salmon And Eggs Gourmet Recipes

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Today S Market By The Numbers Listing With Ted Marketing Real Estate Tips Today

Today S Market By The Numbers Listing With Ted Marketing Real Estate Tips Today

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home