House Tax Exemption For Defence Personnel In Maharashtra

Sebastian applied for property tax exemption in October 2006 in accordance to the Government Order. Partial exemption of House Tax within Agartala Municipality.

Armed Forces Personnel Exempted From House Tax In Chandigarh Hindustan Times

Armed Forces Personnel Exempted From House Tax In Chandigarh Hindustan Times

However the exemption is granted to only one house property if both the members have different house properties on their names.

House tax exemption for defence personnel in maharashtra. Major Navdeep Thanks for the information u give in the blog. Most of the defence personnel in India are not using this opportunity. House building grant to disabled and boarded out EXSMWidows of jawans killed in action and died in harness enhancement of house building grant and income limit.

The only stipulation is that the property should be in the name of the ex-service staff or in the name of the staff currently serving the forces. This law is in effect throughout several states of India. Allotment of land financial and employment assistance to the dependents of defence personnel killed in action at Kargil sector GOMSNo8999Hsg.

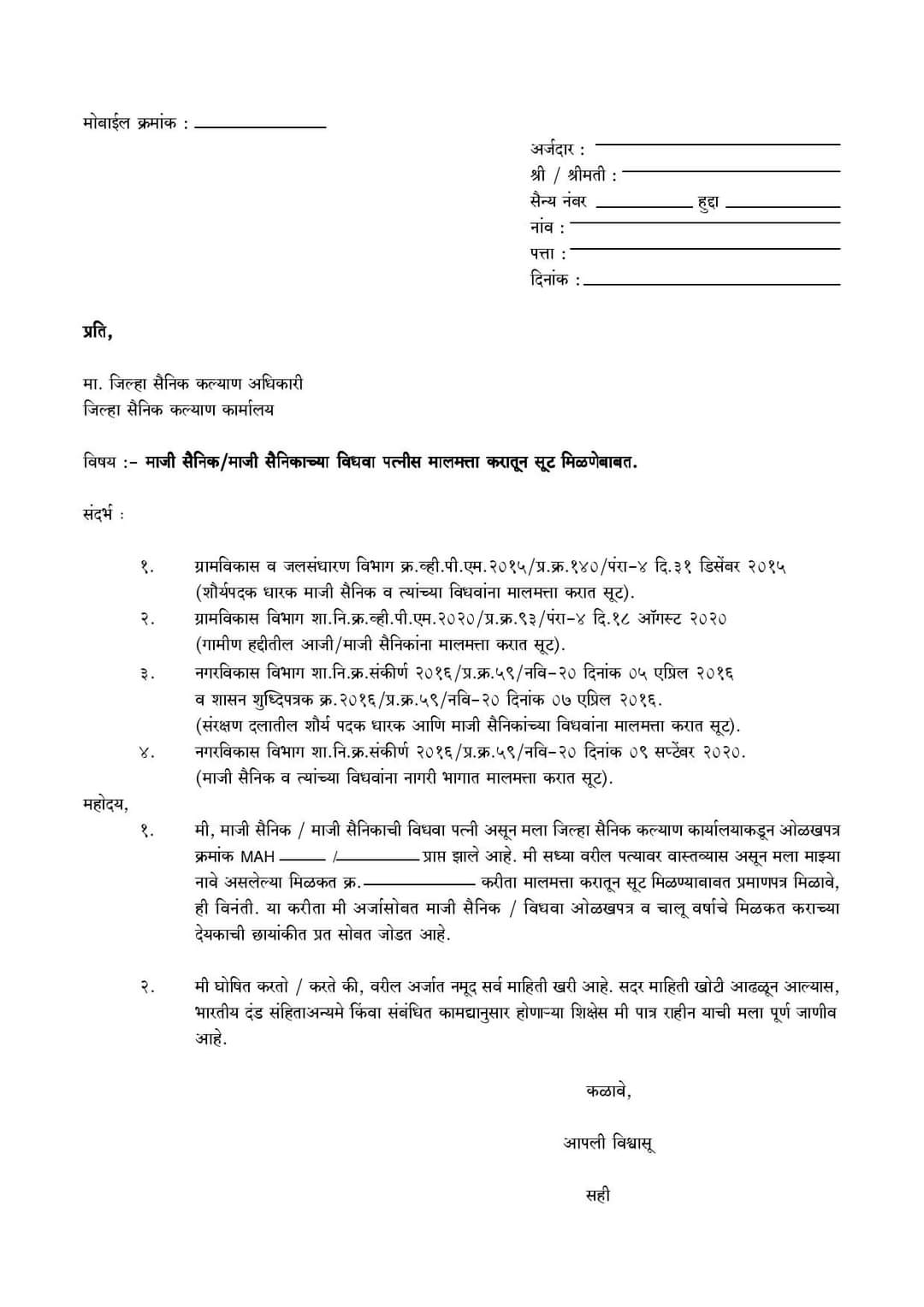

The Maharashtra government has decided to waive the property tax of retired ex-servicemen under the scheme named as Balasaheb Thackeray Maji Sainik Sanman Yojana बलसहब ठकर मज सनक सममन यजन Through which a person who has served in Defence Security Corps the General Reserve Engineering Force the Lok Sahayak Sena and Paramilitary forces. As per the orders of the erstwhile Andhra Pradesh State government all serving army personnel and ex-servicemenwidows are exempted from paying property tax for any one house owned by them. Here is the eligibility criteria.

Sir kindly send me any policy letter which exempts property tax for serving defense personnel holding house in Pune to my e-mail id tripuramallu_123yahoocoin Thank u January 19 2011 at 1036 PM. As a welfare measure in India all states are exempting property tax house tax for defence personnel ArmyNavyAir force. It may be due to lack of awareness or dont know how to proceed.

House tax is exempted for only one house. The members of the MC general house had a few months ago unanimously passed an agenda to give 100 exemption to defence personnel and sent it to the UT administration for approval. Those serving in the defence forces will soon have a reason to cheer.

The Maharashtra government has decided to exempt all former servicemen in the jurisdiction of urban local bodies across the state from paying property tax. 10 percent reservation of House Flats for Ex-Servicemen War widows widows of Defence personnel. Dreamstime In what could be deemed as a good news for former servicemen and families of martyrs from the Indian Army Border Security Force BSF police service Central Reserve Police Force CRPF and fire brigade the Nagpur Municipal Corporation NMC has announced clear exemption from property tax for them.

June 16 2016 Ankit Rajdutta. State rural development minister Hasan Mushrif on Wednesday said that the property tax of a residential structure owned by all the serving and retired defence personnel has been waived off. House members were of the view that since defence personnel served the.

According to the civic proposal Discount will be given to widows of ex-servicemen. Rent Control Act and Land Tenancy Act have been amended to facilitate resumption of landhouses to Ex-Servicemen. Residents living in houses without any condition of storeys measuring 50 sq yd or below or in single-storey residential houses inclusive of mumti and water tanks measuring 125 sq yd or below.

The house property should be either on the name of the Ex-Servicemen Serving personnel or his wife. It really helps to our defense personnel. The state government recently exempted serving as well as retired defence personnel from paying property tax in rural areas.

As per the recent notification on the property tax received by municipal corporation MC both serving as well as former defence personnel have. The Pune Municipal Corporation PMC is proposing a scheme that will benefit them in terms of a waiver in property tax. Ex-servicemen as well as defence staff who are currently in employment of the Indian armed forces are exempt from paying property tax in Maharashtra.

Application for exemption filed in 2006 Mr. According to the recent notification on.

Esic Wasted Rs 10 000 Cr By Starting 22 Medical Colleges Cag Medical College Medical Education Medical

Esic Wasted Rs 10 000 Cr By Starting 22 Medical Colleges Cag Medical College Medical Education Medical

Mc Notice Leaves Exempted Defence Personnel Fuming

Mc Notice Leaves Exempted Defence Personnel Fuming

Mahabank Cares Contribute And Help India Fight Win Against Corona Donate To Pm Cares Fund Bankofmaharashtra Mahabank Pmc Fund Contribution Fight

Mahabank Cares Contribute And Help India Fight Win Against Corona Donate To Pm Cares Fund Bankofmaharashtra Mahabank Pmc Fund Contribution Fight

The Latest Bangladesh Enforces Weeklong Virus Lockdown Ap National The Brunswick News

The Latest Bangladesh Enforces Weeklong Virus Lockdown Ap National The Brunswick News

Maharashtra Ex Servicemen Exempted From Property Tax Know How To Avail This Facility Punekar News

Maharashtra Ex Servicemen Exempted From Property Tax Know How To Avail This Facility Punekar News

Covid 19 India Record Over 68 000 Cases In Biggest 1 Day Surge Since October

Covid 19 India Record Over 68 000 Cases In Biggest 1 Day Surge Since October

Https Irnews Mmc Com Static Files 0d09eda7 0040 4f5c A504 3befca355f6a

Army Personnel Seek Clarity On Toll Exemption The Hindu

Maharashtra Serving Former Soldiers Exempted From Panchayat Property Tax Business Standard News

Maharashtra Serving Former Soldiers Exempted From Panchayat Property Tax Business Standard News

Live News Updates Maharashtra Reports 6 112 New Covid 19 Cases 20 87 632 Total Cases

Live News Updates Maharashtra Reports 6 112 New Covid 19 Cases 20 87 632 Total Cases

Borders Sealed Complete Lockdown In Maharashtra The Hindu

Maharashtra Ex Servicemen Exempted From Property Tax Know How To Avail This Facility Punekar News

Maharashtra Ex Servicemen Exempted From Property Tax Know How To Avail This Facility Punekar News

Section 80g Income Tax Deductions For Donations Mymoneysage Blog

Section 80g Income Tax Deductions For Donations Mymoneysage Blog

Petition Stamp Duty Exemption To Defence Personnel While Purchasing Residential House Change Org

Petition Stamp Duty Exemption To Defence Personnel While Purchasing Residential House Change Org

Petition Income Tax Exemption For Serving Soldiers And Ex Servicemen Change Org

Petition Income Tax Exemption For Serving Soldiers And Ex Servicemen Change Org

Labels: defence, house, maharashtra, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home