Why Are Property Taxes So High In Bridgeport Ct

See reviews photos directions phone numbers and more for Pay Property Taxes locations in Bridgeport CT. I thought that is high but not until I looked at other property in CT and the taxes are so high.

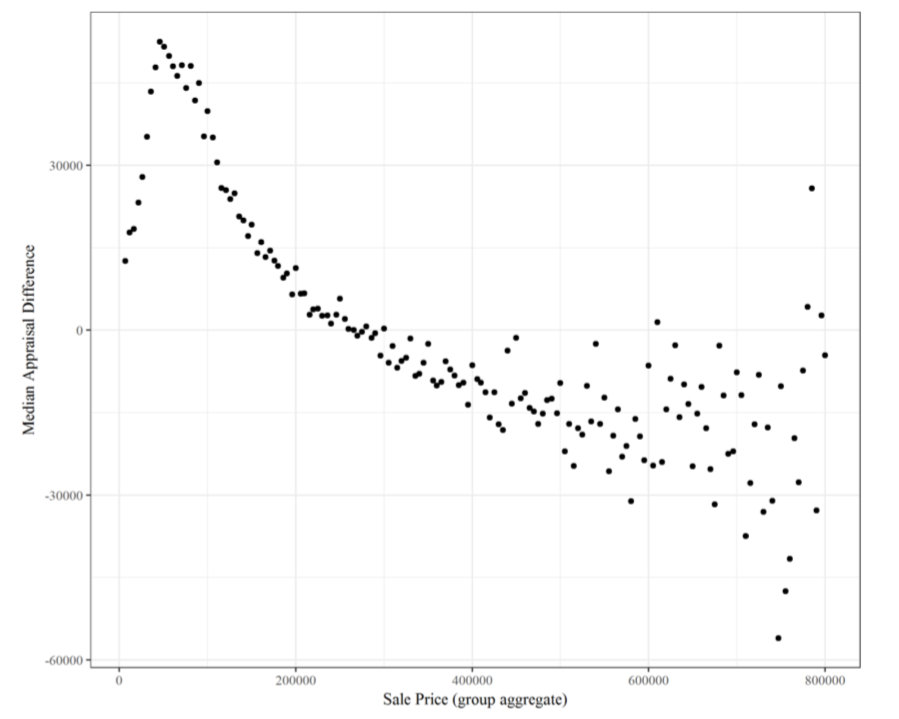

Report Finds Municipalities Over Taxing Low Value Homes Yankee Institute For Public Policy

Report Finds Municipalities Over Taxing Low Value Homes Yankee Institute For Public Policy

Connecticut Effective Real-Estate Tax Rate.

Why are property taxes so high in bridgeport ct. BRIDGEPORT CITY OF - FINANCE - TAX COLLECTOR. For instance Bridgeport Connecticut has the highest property tax rate but no local sales or income taxes. And was used to calculate home values and property burdens by the Office of Revenue Analysis.

For states like Connecticut with high taxes the. In a citywide reassessment last year the value of Bridgeports taxable property fell by a staggering 1 billion to 6 billion. The story of Bridgeport unfortunately as with so many old.

Meanwhile the poverty rate in Connecticuts largest city Bridgeport is still rising. I am looking house prices from 600-900k and the taxes are 9000 to 16k a. Also can provide information about property taxes owed and property taxes paid.

The so-called Gold Coast in southwest Connecticut is one of the richest places in the world. Listing Results Page 1 - 50 of 98. One mill is equal to one dollar of tax per 1000 of assessed property value.

Property Tax Information and Collection Information provided by. Local property taxes are the highest taxes Connecticut businesses pay and represent 72 of city and town revenues. Distribution of the tax burden.

Display Listings per. Bridgeport CT Tax Liens and Foreclosure Homes. Heres why your property taxes may be so high and what you can do if they keep going up each year.

Nearly 60 percent of Connecticut cities and towns increased property taxes this fiscal year with most of those tax hikes outpacing the rate of inflation according to a new analysis. 12-62 property revaluations must occur every 5 years. 6 of 30 7 of 30 HIGHEST REAL ESTATE PROPERTY TAXES 6.

283 rows Real estate taxes are the primary revenue source for Connecticuts towns and cities. The City of Bridgeport which conducted its last City-wide revaluation for the Grand List of October 1 2008 Bridgeport filed for an extension in. 191 Annual Taxes on 176K Home.

CCM says of the 122 cities and towns with no revaluations in fiscal 2019 79 raised property taxes for the 2020 fiscal year with 59 increasing rates above the states 16 inflation rate. In the high-property-tax cities of Bridgeport Danbury and New Haven the likelihood of higher taxes is even greater. As of April 15 Bridgeport.

However the metro area which includes affluent Fairfield County is wealthier than much of the US. To calculate the property tax multiply the assessment of the property. I live in Maryland and I am currently paying 5000k a year in property taxes.

United Way of Connecticut The Tax Collector is responsible for collecting local business property and real estate tax payments. Nebraskas figure for median property taxes paid on homes is. Birmingham Alabama by contrast has the 11th lowest property tax.

Bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. When It Comes To Taxes Were Almost No. 3357 State Median Home Value.

As mandated by Connecticut General Statute Sec. The state Office of Policy and Management declares A mill is equal to 100 of tax for each 1000 of assessment. The relatively high interest rate makes tax liens an attractive investment.

Rising property taxes can put a strain on your budget. 1 Connecticut - Across Connecticut CT - A new report gives Connecticut the dubious distinction of having the second highest tax. Finch inherited the 2007-2008 budget so the first budget he prepared was 2008-2009.

In thr Maryland Forum everyone complains about the high taxes but you guys in Ct must be crying. City had a higher tax burden than Bridgeport where a family of three earning 150000 a year paid more than 22 of its income in state and local taxes. The Tax Collectors Office located in the Bridgeport City Hall 45 Lyon Terrace Bridgeport CT 06604 is open Monday through Friday 900 am 400 pm.

Despite a comparatively low median home value of 123300 Nebraska has the fifth highest property taxes in the US. We have extended hours the last week of. 274500 Annual Taxes on Home.

Our Property Tax System Rewards Neglect And Punishes Investment In Struggling Neighborhoods Greater Greater Washington

Our Property Tax System Rewards Neglect And Punishes Investment In Struggling Neighborhoods Greater Greater Washington

Ellsworth Ii At Bethel Crossing In Bethel Conn Luxury Homes New Home Communities Bethel

Ellsworth Ii At Bethel Crossing In Bethel Conn Luxury Homes New Home Communities Bethel

Pay Connecticut Car Taxes Our Ouch Map Hartford S Bill Seven Times Salisbury S For Same Car The Connecticut Story Connecticutmag Com

Pay Connecticut Car Taxes Our Ouch Map Hartford S Bill Seven Times Salisbury S For Same Car The Connecticut Story Connecticutmag Com

Democrats Spend Spend And Spend Letter Las Vegas Review Journal

Democrats Spend Spend And Spend Letter Las Vegas Review Journal

Connecticut Property Taxes Third Highest In U S Cbia

Connecticut Property Taxes Third Highest In U S Cbia

How Did Rich Connecticut Morph Into One Of America S Worst Performing Economies

How Did Rich Connecticut Morph Into One Of America S Worst Performing Economies

Connecticut In Crisis How Inequality Is Paralyzing America S Country Club Center For Public Integrity

Connecticut In Crisis How Inequality Is Paralyzing America S Country Club Center For Public Integrity

Connecticut S Sales Tax On Cars

Connecticut S Sales Tax On Cars

2015 S Most Least Ethno Racially Diverse Cities Racial Diversity City Racial

2015 S Most Least Ethno Racially Diverse Cities Racial Diversity City Racial

Connecticut Property Taxes In Every Town Who Pays The Most Fairfield Ct Patch

Connecticut Property Taxes In Every Town Who Pays The Most Fairfield Ct Patch

Connecticut S 20 Safest Cities Of 2021 Safewise

Connecticut S 20 Safest Cities Of 2021 Safewise

The Best Time To Buy A House In Connecticut Clever Real Estate

The Best Time To Buy A House In Connecticut Clever Real Estate

Report Finds Municipalities Over Taxing Low Value Homes Yankee Institute For Public Policy

Report Finds Municipalities Over Taxing Low Value Homes Yankee Institute For Public Policy

Report Finds Municipalities Over Taxing Low Value Homes Yankee Institute For Public Policy

Report Finds Municipalities Over Taxing Low Value Homes Yankee Institute For Public Policy

Will Hartford S Crisis Force A Ct Property Tax Overhaul

Will Hartford S Crisis Force A Ct Property Tax Overhaul

Connecticut S 20 Safest Cities Of 2021 Safewise

Connecticut S 20 Safest Cities Of 2021 Safewise

1001 East Main St Bridgeport Ct 06608 1 275 000 Real Cash Cow Great Opportunity To Have Income Produc Investment Property For Sale Property Real Estate

1001 East Main St Bridgeport Ct 06608 1 275 000 Real Cash Cow Great Opportunity To Have Income Produc Investment Property For Sale Property Real Estate

Every Nj Town S Average Property Tax Bill In Newly Released List Point Pleasant Nj Patch

Every Nj Town S Average Property Tax Bill In Newly Released List Point Pleasant Nj Patch

Our Property Tax System Rewards Neglect And Punishes Investment In Struggling Neighborhoods Greater Greater Washington

Our Property Tax System Rewards Neglect And Punishes Investment In Struggling Neighborhoods Greater Greater Washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home