What Is The Homestead Exemption In Wv

The Virginia Homestead Exemption Amount Under the Virginia exemption system homeowners can exempt up to 5000 of their home or other property covered by the homestead exemption. The West Virginia legislature has considered increasing the exemption in the past few years but no bill has been passed.

Homestead Exemptions By State With Charts Is Your Most Valuable Asset Protected 2020 Update

Homestead Exemptions By State With Charts Is Your Most Valuable Asset Protected 2020 Update

The savings can add up to hundreds of dollars a year in property taxes.

What is the homestead exemption in wv. If you cannot satisfy this requirement then federal law caps your homestead exemption at 170350 regardless of your state exemption amount as of April 1 2019 and 160375 for cases filed between April 1 2016 and March 31 2019--the figures adjust every three years. If a resident of West Virginia establishes a residence in another state or country and returns to West Virginia within five years then the resident may be allowed a Homestead Exemption in West Virginia if the person was a resident of this State for two calendar years out of the ten calendar years immediately preceding the tax year for which the Homestead Exemption is sought. Homestead Exemption WV Code 11-6B-3 provides for an exemption from ad valorem property taxes on the first 20000 of assessed valuation on a personal residence.

The Homestead Exemption is a tax relief measure that provides for a reduction in the real property assessment of those who qualify. Household goods and personal effects not used for commercial purposes. A homestead exemption is a legal mandate that shields a homeowner from the loss of his or her home usually due to the death of a home-owning spouse a debilitating illness or if the homeowner.

We would like to show you a description here but the site wont allow us. -- An exemption from ad valorem property taxes shall be allowed for the first 20000 of assessed value of a homestead that is used and occupied by the owner thereof exclusively for residential purposes when such owner is sixty-five years of age or older or is certified as being permanently and totally disabled provided the owner has been or. The homestead exemption is permanent as long as the homeowner continues to own and permanently reside at that location.

Persons who are 65 years of age or older or permanently and totally disabled are entitled to an exemption from property taxes on the first 20000 of assessed value on their owner-occupied residence. Persons who are 65 years of age or older or permanently and totally disabled are entitled. The details of West Virginias homestead laws are highlighted listed.

Twenty thousand dollar homestead exemption allowed. Passed by the voters in 1981 and adopted by the Legislature the Homestead Exemption enables many West Virginians to enjoy a reduction in their real property taxes. Homestead Exemption December 1st of the year before your 65th Passed by the voters in 1981 and adopted by the Legislature the Homestead Exemption enables many West Virginians to enjoy a reduction in their real property taxes.

All applications must be filed between the dates of January 2 and April 1 of each year. Homestead Statutes in West Virginia State homestead laws vary in the amount of acreage or value of property they allow to be designated as a homestead. Homestead Exemption The Homestead Exemption Office accepts applications for the various residential exemption applications and agricultural land use applications.

The homestead exemption allows that the first 7500 of assessed value on an owner occupied home will be exempt from property taxation. Debtors aged 65 and older and veterans disabled by 40 or more can exempt up to 10000. To qualify for a homestead exemption the residence must be owner occupied.

Participate in the Homestead Exemption program contact your county assessors office for more information Have paid their property tax and Have income which is less than 150 of federal poverty guidelines based on the number of people in the household. See Table 1 below. The first 20000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is permanently and totally disabled is exempt.

The Homestead Act lops off 20000 from the assessed value of an eligible taxpayers property. West Virginia statutes limit the homestead exemption to 5000 of real estate and 1000 of personal possessions. Debtors may add 500 to this amount for each of their dependents.

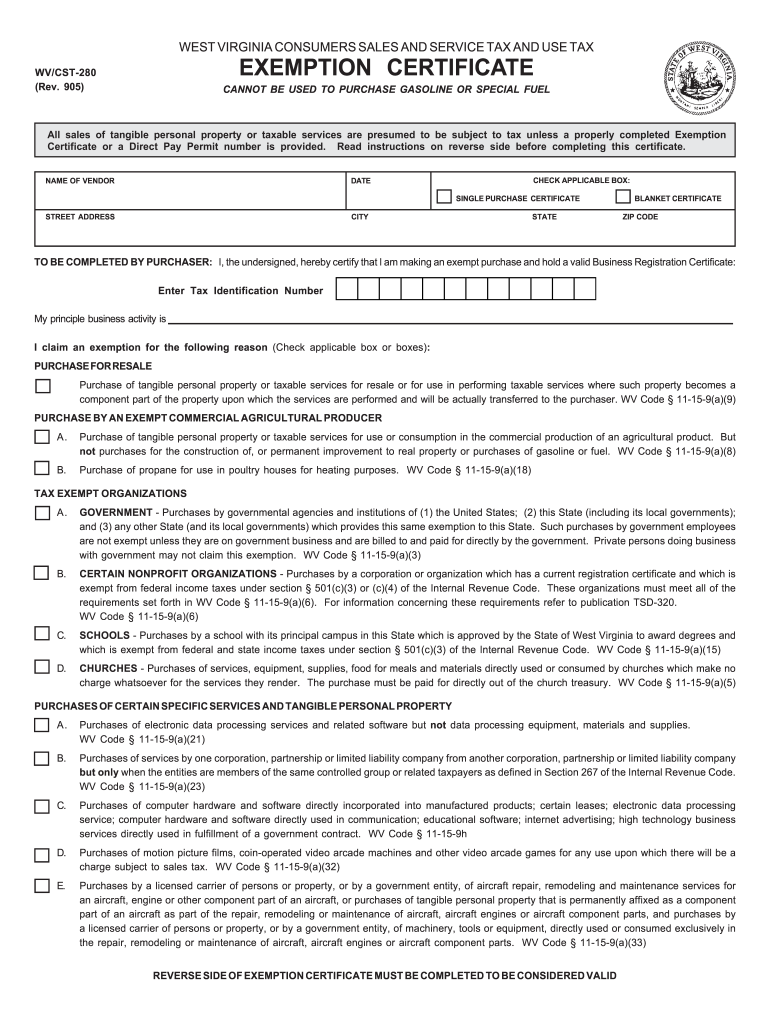

Wv Dor Cst 280 2005 2021 Fill Out Tax Template Online Us Legal Forms

Wv Dor Cst 280 2005 2021 Fill Out Tax Template Online Us Legal Forms

Https Greenbriercounty Net Wp Content Uploads Homestead Exemption Application Pdf

Https Www Assessor Org Documentcenter View 5738

Http Preston Wvassessor Com Forms 2014ppbrochure Pdf

2021 West Virginia Bankruptcy Exemptions Wv Homestead Exemption West Virginia Bankruptcy Law Legal Consumer Com

2021 West Virginia Bankruptcy Exemptions Wv Homestead Exemption West Virginia Bankruptcy Law Legal Consumer Com

Information Lincoln County West Virginia

Information Lincoln County West Virginia

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Putnam County Assessor Homestead Exemption Credit

Putnam County Assessor Homestead Exemption Credit

Mountain Statesman Personal Property Assessment Deadline Quickly Approaching

Mountain Statesman Personal Property Assessment Deadline Quickly Approaching

Homestead Exemption Wv Form Page 1 Line 17qq Com

Homestead Exemption Wv Form Page 1 Line 17qq Com

Http Www Marioncountywv Com Document Center Assessment Form Replacement Pdf

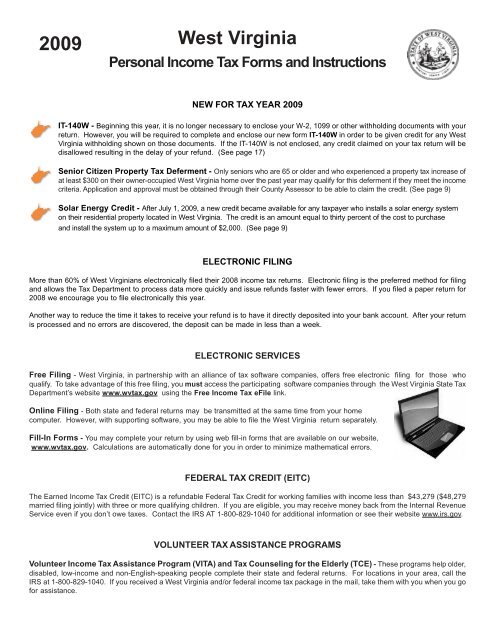

Personal Income Tax Forms And Instructions State Of West Virginia

Personal Income Tax Forms And Instructions State Of West Virginia

Fillable Online Homestead Exemption Wv Assessor Fax Email Print Pdffiller

Fillable Online Homestead Exemption Wv Assessor Fax Email Print Pdffiller

Homestead Exemption Wv Form Page 1 Line 17qq Com

Homestead Exemption Wv Form Page 1 Line 17qq Com

Scam Pretends To Offer Homestead Tax Exemption

Scam Pretends To Offer Homestead Tax Exemption

Homestead Exemption Wv Form Page 1 Line 17qq Com

Homestead Exemption Wv Form Page 1 Line 17qq Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home