Property Tax In Belton Texas

3 rows The Bell County Tax Collector located in Belton Texas is responsible for financial. Welcome to Belton TX.

Killeen TX 76541 Phone.

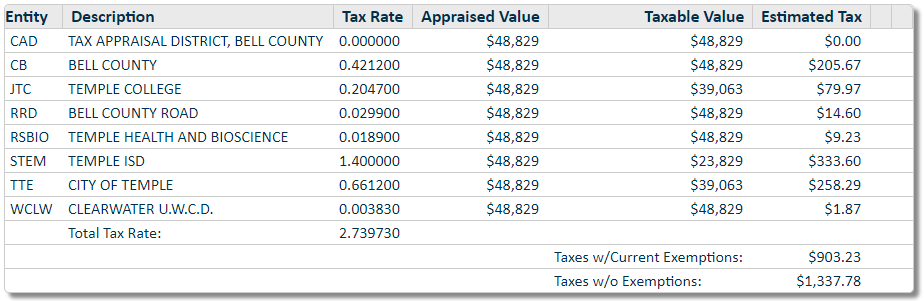

Property tax in belton texas. Tax Estimates listed below are ONLY estimates and NOT DEEMED ACCURATEThey are determined by using the 2021 taxable assessed value multiplied by the prior year tax rates. The current tax rate is 06598. Central Belton TX 76513 Phone.

The Belton Sales Tax is collected by the merchant on all qualifying sales made within Belton. Central Temple TX 76501. Killeen TX 76541 Phone.

Property tax brings in the most money of all taxes available to local government to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local government. Harris Community Center 401 N. Central Belton TX 76513 Phone.

Mailing Address For ALL Locations. The Tax Appraisal District of Bell County collects property taxes for all the taxing units in Bell County. Median Property Taxes Mortgage 2944.

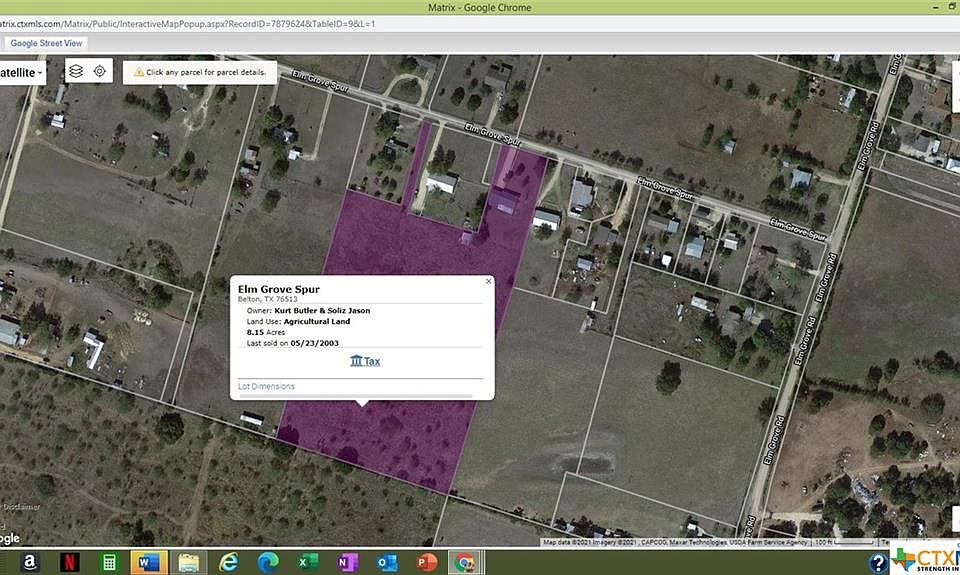

Central in Belton Texas. City Hall 333 Water St. In-depth Bell County TX Property Tax Information.

Central Temple TX 76501. The median property tax on a 11380000 house is 205978 in Texas. The median property tax on a 11380000 house is 119490 in the United States.

There is no state property tax. The main office of the Appraisal District is located at 411 E. Killeen TX 76541 Phone.

Central Temple TX 76501 Phone. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Tax amount varies by county.

Monday Friday 800am 445pm. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Central Temple TX 76501 Phone.

Taxes are billed in October of that same year and become delinquent February 1st of the next year. Texas offers a variety of partial or total absolute exemptions from appraised property values used to determine local property taxes. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Central Belton TX 76513 Phone. More information about the tax rate including historical rates and levies can be found in the tax section of the budget document. 254 rows That average rate incorporates all types of taxes including school district taxes city taxes.

159722 - 25000 134722. Box 390 Belton TX 76513. Central Belton TX 76513 Phone.

If the tax rate is 1400 and the home value is 250000 the property tax would be. Tax Sales in Bell County. Box 390 Belton TX 76513.

The Belton Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Belton local sales taxesThe local sales tax consists of a 050 county sales tax and a 150 city sales tax. Mailing Address For ALL Locations. 13651 183909.

Bell County Property Tax Payments Annual Bell County Texas. Monday Friday 800am 445pm. 1663 The property tax rate shown here is the rate per 1000 of home value.

King County collects the highest property tax in Texas levying an average of 506600 156 of median home value yearly in property taxes while Terrell County has the lowest property tax in the state collecting an average tax of 28500 067 of median home value per year. Killeen TX 76541 Phone. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home