Property Tax Exemption Palm Beach County

An additional exemption up to 25000 also may apply to your property. 2005-004 on February 15 2005 and amended same through Ordinance No.

Equestrian Estate For Sale In Palm Beach County Florida This Home Located In The Very Desirable Gated Deer Run Co Maine House Pool Houses Equestrian Estate

Equestrian Estate For Sale In Palm Beach County Florida This Home Located In The Very Desirable Gated Deer Run Co Maine House Pool Houses Equestrian Estate

These documents and forms may be reproduced upon requrest in an alternative format by contacting the Palm Beach County Tax Collectors ADA Coordinator 561-355-1608 Florida Relay 711 or by completing our accessibility feedback form.

Property tax exemption palm beach county. Welcome to Homestead Exemption online filing. Also make sure your address is up to date with the Palm Beach County Property Appraisers Office. If your tangible personal property value remains below 25000.

My office is pleased to provide this service to business owners in Palm Beach County. Persons under the age of 65 may defer the portion of their property tax that is more than 5 of the household adjusted gross income. The amount of the exemption is equal to the taxable value of the homestead of the service member on January 1 of the year the exemption is sought multiplied by the number of days that the service member was on a qualified deployment in the preceding calendar year and divided by the number of days in that year.

A person may be eligible for this exemption if he or she meets the following requirements. Gannon today is announcing her full support of the March 19 2021 Executive Order 2020-012 extending the. The exemption amount remains at 25000 for a property with an assessed value up to 50000.

Owns real estate with a just value less than 250000. The Palm Beach County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax. Individual and Family Exemptions.

2012-042 on December 21 2012 to establish an exemption from certain ad valorem taxation County taxes only for new and expanding business properties to encourage economic development in Palm Beach County. Constitutional Tax Collector Anne M. The Palm Beach County Property Appraisers Office is committed to compliance with the Americans with Disabilities Act ADA and WCAG 20 and WCAG 21.

We mail over 600000 property tax bills to the owner and address of the record on file with the Property Appraisers Office. My office is pleased to provide this service to new homeowners in Palm Beach County. In the state of Florida a 25000 exemption is applied to the first 50000 of your propertys assessed value if your property is your permanent residence and you owned the property on January 1 of the tax year.

This exemption applies to all taxes including school district taxes. A board of county commissioners or the governing authority of any municipality may adopt an ordinance to allow an additional homestead exemption equal to the assessed value of the property. Homestead Exemption can provide significant property tax savings and this interactive system will walk you through the qualifications and application process.

In order for you to qualify for the following additional exemptions you must have a homestead exemption on your property. An additional exemption of up to 25000 will be applied if your propertys assessed value is between at least 50000 and 75000. The Board of County Commissioners BCC adopted Ordinance No.

The Palm Beach Property Appraiser is who you need to contact to file for Homestead Exemption. Limited Income Senior Citizen Exemption for Persons 65 and Older Widow Widowers Civilian Disability. West Palm Beach Fla.

Timely filing of a Tangible Personal Property Tax Return can provide significant property tax savings by granting up to a 25000 exemption and avoiding late filing penalties. Florida grants a standard 25000 exemption on the assessed value of qualified residential property. It does not discriminate on the basis of disability in the admission or access to or treatment or employment in its services programs or activities.

For properties considered the primary residence of the taxpayer a homestead exemption may exist. The Property Appraisers Office determines the value of tangible personal property. If valued at 25000 or less you must file an initial return but do not need to pay tangible personal property tax.

This interactive system will. Beginning at 50000 and continuing through an assessed value of 75000 the new additional benefit will increase with the increase in the propertys value. Persons 65 years or older may defer the portion of their property tax that is more than 3 of the household adjusted gross income.

Homestead Exemption is granted to permanent Florida residents only. Employees and clients in all tax collector offices continue to be required to wear facial masks. We will do the math for you.

Total Permanent Disability Quadriplegic Legally Blind Living Quarters of Parents or Grandparents Exemption also known as the Granny Flat exemption Veteran and Active Duty Military.

Invest Palm Beach 2020 By Capital Analytics Associates Issuu

Invest Palm Beach 2020 By Capital Analytics Associates Issuu

Tangible Personal Property Tax Constitutional Tax Collector

Tangible Personal Property Tax Constitutional Tax Collector

Palm Beach County Property Taxes

Palm Beach County Property Taxes

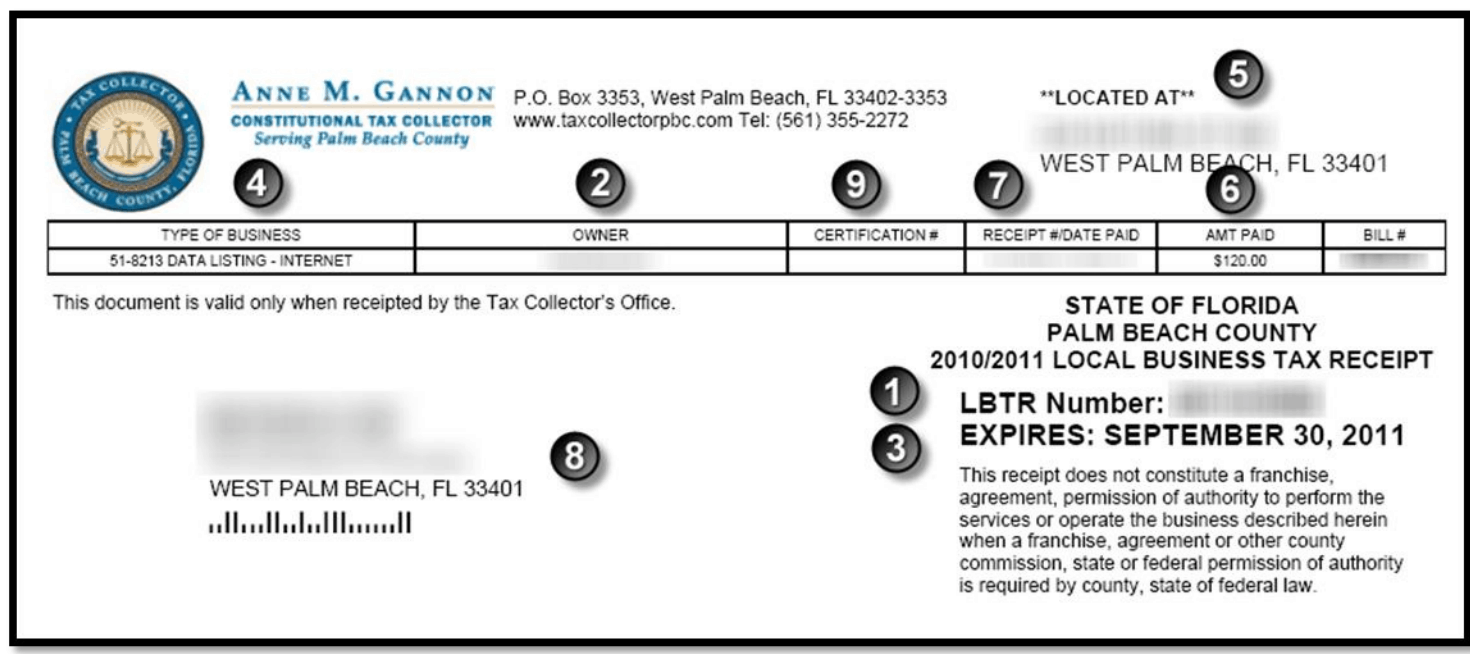

Local And County Tax Receipt Laws In Palm Beach County

Local And County Tax Receipt Laws In Palm Beach County

Pin By Emma Persad On Accountant Property Tax Palm Beach County Real Estate

Pin By Emma Persad On Accountant Property Tax Palm Beach County Real Estate

Palm Beach County Map With Cities Maps Location Catalog Online

Palm Beach County Map With Cities Maps Location Catalog Online

Palm Beach County Business License Financeviewer

2020 Property Tax Constitutional Tax Collector

2020 Property Tax Constitutional Tax Collector

Palm Beach Market Focus December 2020 Palmbeachdecember2020 Palmbeach In 2021 Beach Palm Beach Palm Beach County

Palm Beach Market Focus December 2020 Palmbeachdecember2020 Palmbeach In 2021 Beach Palm Beach Palm Beach County

Search Homes For Sale In Palm Beach County San Antonio Real Estate Las Vegas Real Estate Tampa Real Estate

Search Homes For Sale In Palm Beach County San Antonio Real Estate Las Vegas Real Estate Tampa Real Estate

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Palm Beach County Property Appraiser How To Check Your Property S Value

Palm Beach County Property Appraiser How To Check Your Property S Value

Palm Beach County Property Appraiser Free Property Records Search

Palm Beach County Property Appraiser Free Property Records Search

Palm Beach County Property Appraiser S Office 2019 Assessment Roll Receives Approval

Palm Beach County Property Appraiser S Office 2019 Assessment Roll Receives Approval

Cities And Communities In Palm Beach County Corporate Relocations

Cities And Communities In Palm Beach County Corporate Relocations

Information And Resources Legal Aid Society Of Palm Beach County

Information And Resources Legal Aid Society Of Palm Beach County

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home