Home Buyers Tax Credit Quebec

Home Buyers Tax CreditTP-752HA-V. Quebec First-Time Homebuyers Tax Credit beginning in 2018 TaxTipsca Resources.

How To Claim Your 2016 Energy Tax Credits For Greening Your Home Home Improvement Loans Sustainable Home Green Building Materials

How To Claim Your 2016 Energy Tax Credits For Greening Your Home Home Improvement Loans Sustainable Home Green Building Materials

The Home Buyers Amount HBA is a non-refundable credit that allows first-time purchasers of homes and purchasers with disabilities to claim up to 5000 in the year when they purchase a home.

Home buyers tax credit quebec. The Quebec First-Time Home Buyers Tax Credit is a non-refundable tax credit which implies that the credit cannot be claimed if the taxpayer has no income tax payable before claiming the credit. The tax credit for the purchase of a first home in Quebec has the same eligibility criteria as the federal tax credit. To be eligible for the Home Buyers Tax Credit you must meet both of these criteria.

This link will open a new tab. Find out how to qualify and how to apply for the rebate. The credit may be split between spouses or common law partners or between two individuals buying a qualifying home on a joint basis.

However the maximum amount you can claim on your federal and provincial returns will remain 750. Quebec Home Buyers Tax Credit You may be entitled to a maximum 750 tax credit if you were resident in Québec on December 31 or on the day in the tax year you ceased to be resident in Canada and during that tax year either. Eligible homebuyers may receive a tax credit of up to 750.

You can also claim this credit jointly with the co-owners. You or your spouse or common-law partner acquired a qualifying home. At the provincial and federal levels the maximum amount of the tax credit for acquiring a first home is 750.

This non-refundable tax credit can be claimed on the TP-752HA-V form if. Home Renovation Tax Credits Canada Revenue Agency CRA and Finance Canada Resources Line 31270 Home Buyers Amount. If you are a first-time home buyer in Québec you can claim the Québec First-Time Home Buyers Tax Credit on the TP-752HA-V.

Important If you are completing this form for a person who died in the year the person must have been resident in Québec on the date of his or her death. 1 2018 will give Quebecer. If youre buying the property in partnership with a friend partner or spouse the total of both your claims cannot go over 750.

You must claim the nonrefundable credit in the year when you purchase the house. This results in a maximum tax savings of 750. Its also a 750 tax credit with similar eligibility criteria.

You can claim 5000 for the purchase of a qualifying home in the year if both of the following apply. First-Time Home Buyer Incentive FTHBI to fund part of your purchase. The tax credit which applies to housing units purchased after Jan.

First-Time Home Buyers Tax Credit HBTC If you or your spouse bought your first home in 2020 you might qualify for the First-Time Home Buyers Tax Credit HBTC. At prevailing taxation rates the Home Buyers Tax Credit allows first-time homeowners a rebate of 750. First Time Home Buyer Tax Credit 750 Tax Rebate Learn about the first-time home buyers tax credit of 750.

You were a resident of Québec on December 31 2020 and. It does require you to have bought and live in a home in Quebec of course. You did not live in another home owned by you or your spouse or common-law partner in the year of acquisition or in any of the four preceding years first-time home buyer.

Recently Parti Québécois also said that it plans to increase the amount of the provincial tax credit to 1250 a 500 increase. Its an effective means of offsetting some of the upfront costs associated with buying a home. To claim the credit you must complete form TP-752HA-V Home Buyers Tax Credit and enclose it with your income tax return.

Complete this form to claim the home buyers tax credit. Quebec says it will help defray the costs of such expenses as inspection and notary feeds. It is also calculated in the same way by multiplying the amount of the credit 5000 by the lower tax rate for the year 15.

The First Time Home Buyers Tax Credit can help you save hundreds on the upfront cost of purchasing a home and you should use it. To complete the form save it to your computer and open it in Adobe Reader. GSTHST Rebate for New Housing and Substantial Renovations.

You or your spouse or common-law partner purchased a qualifying home. You are a first-time home. Home Buyers Tax Credit.

The odds for people having better access to ownership increased when the Government of Québec granted a 750 non-refundable tax credit for the purchase of a first home in its 2018-2019 budget. In Quebec there is a provincial Home Buyers Tax Credit you may be eligible for. The Home buyers amount You get access to this tax credit when you purchase your first home and submit a tax return.

You or your spouse bought a qualifying home for the first time in 2020 and you intend to make it your principal residence no later than one. If you or your spouse bought your first home in 2020 you might qualify for the Québec First-Time Home Buyers Tax Credit.

Owning Two Homes Automatically Has Tax Implications Montreal Gazette

Owning Two Homes Automatically Has Tax Implications Montreal Gazette

De Nouveaux Chalets Aux Inspirations Scandinaves En Banlieue De Quebec Renovation House In The Woods Architecture House Small House

De Nouveaux Chalets Aux Inspirations Scandinaves En Banlieue De Quebec Renovation House In The Woods Architecture House Small House

10 Things To Know About Quebec Notarial Records Ancestry Blog Things To Know Genealogy Canada

10 Things To Know About Quebec Notarial Records Ancestry Blog Things To Know Genealogy Canada

Effective Ways To Get Rid Of Ladybug Infestation In Your House Ladybug Ladybug House How To Get

Effective Ways To Get Rid Of Ladybug Infestation In Your House Ladybug Ladybug House How To Get

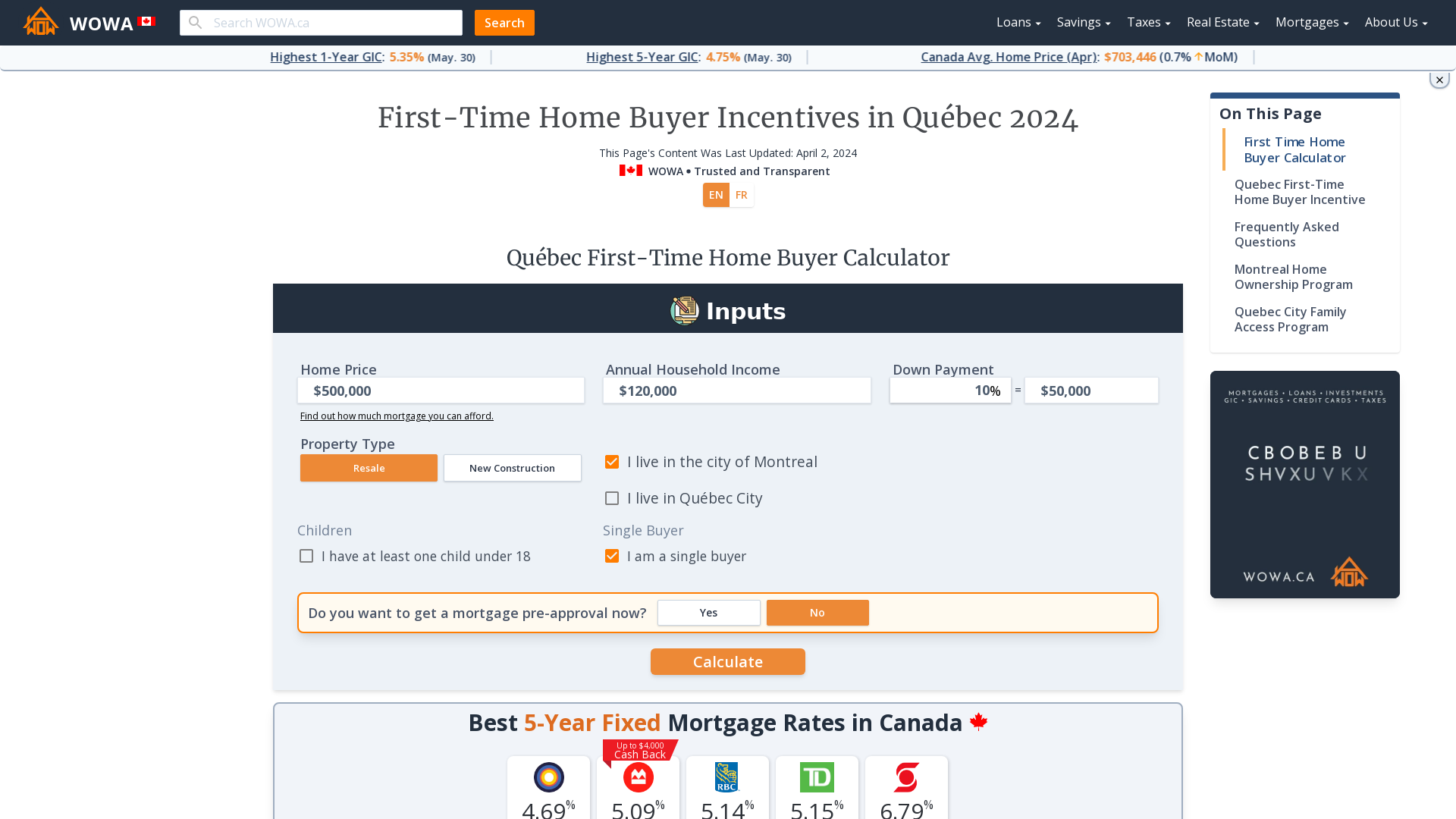

Quebec First Time Home Buyer Incentives Wowa Ca

Quebec First Time Home Buyer Incentives Wowa Ca

First Time Home Buyers Tax Credit Hbtc H R Block Canada

First Time Home Buyers Tax Credit Hbtc H R Block Canada

Home Equity Line Of Credit Heloc Home Equity Loan Home Equity Home Equity Line

Home Equity Line Of Credit Heloc Home Equity Loan Home Equity Home Equity Line

Delean Can T Figure Out Where To Claim Work From Home Expenses You Re Not Alone Montreal Gazette

Delean Can T Figure Out Where To Claim Work From Home Expenses You Re Not Alone Montreal Gazette

Canadian Homeowners Canada Real Estate British Home Homeowner

Canadian Homeowners Canada Real Estate British Home Homeowner

U S A Tax Procedures The Accounting And Tax Accounting Tax Procedure

U S A Tax Procedures The Accounting And Tax Accounting Tax Procedure

Congratulation To Our Winner Location Maximum Our This Week S Free Banner And 3 Month Free Front Page Advertisin Free Front Free Banner Classified Ads

Congratulation To Our Winner Location Maximum Our This Week S Free Banner And 3 Month Free Front Page Advertisin Free Front Free Banner Classified Ads

This Went Under Contract In Just 2 Days With Multiple Offers Received Contract Multiple Building

This Went Under Contract In Just 2 Days With Multiple Offers Received Contract Multiple Building

Ingham County Land Bank About The Land Bank Ingham County Bank Ingham

Ingham County Land Bank About The Land Bank Ingham County Bank Ingham

Quebec Income Calculator 2020 2021

Quebec Income Calculator 2020 2021

What Are Monthly Homeownership Costs In Montreal Home Ownership Home Buying Cost

What Are Monthly Homeownership Costs In Montreal Home Ownership Home Buying Cost

Montreal Ditching Welcome Tax For Families Buying 1st Home Cbc News

Montreal Ditching Welcome Tax For Families Buying 1st Home Cbc News

Calculate Your Mortgage Payment Now With The Most Accurate And Easy To Use Mortgage Calculator Mortgagecalculato Mortgage Calculator Mortgage Mortgage Lenders

Calculate Your Mortgage Payment Now With The Most Accurate And Easy To Use Mortgage Calculator Mortgagecalculato Mortgage Calculator Mortgage Mortgage Lenders

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

What Is A Corporate Tax Investopedia Income Tax Income Tax Return Business Tax

What Is A Corporate Tax Investopedia Income Tax Income Tax Return Business Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home