Property Tax California Age 55

Give Californians 55 or older a big property tax break when buying a new home. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year.

Fill Out Your Info To Learn More Click The Photo To See Our Website If You Live In California And Are Over The Tax Advisor Buying A New Home Property Tax

Fill Out Your Info To Learn More Click The Photo To See Our Website If You Live In California And Are Over The Tax Advisor Buying A New Home Property Tax

You or a spouse residing with you must have been at least 55 years of age when the original property was sold.

Property tax california age 55. Thats because property taxes here are based mostly on the value of your home when you bought it. Your original property must have been eligible for the Homeowners or Disabled Veterans Exemption. Typically when Californians buy a new home their property taxes shoot way up.

The median property tax in California is 283900 per year for a home worth the median value of 38420000. For residents age 55 and older severely disabled or a victim of a wildfire or natural disaster there is much to like about Prop. Although this law may have similar counterparts in other states were only discussing the benefits to those living in the Golden State.

This is a one-time only benefit. If Prop 60 or Prop 90 relief was filed and received neither claimant nor spouse are eligible for filing again. The claimant has not previously been granted as a claimant the property tax relief provided by this.

Please continue to visit the California State Board of Equalization BOE website for updates as additional legislation will provide further clarification. For assistance or questions please contact the Property Tax Department by phone at 1-916-274-3350 or by e-mail. 9 rows At the age of 55 several options for tax savings become available for those considering.

With the claimant is at least 55 years of age or severely and permanently disabled. Age The claimant or a spouse residing with claimant must be at least 55 years old when the original property is sold. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes.

California homeowners 55 and older can get a one-time opportunity to sell their primary residence and transfer the property tax assessment to a new home under Proposition 60. If co-owners only the co-owner who is the claimant must be age 55 or disabled. Overview Until April 1 2021 Propositions 6090 allow persons aged 55 and over to transfer the taxable value of their existing home to their new replacement home so long as the market value of the new home is equal to or less than the existing homes value and located in Marin County or one of nine other participating counties in California.

California homeowners 65 and older should check their property tax bills and make sure they are getting any senior exemptions on school parcel taxes to which they are entitled. Most require seniors to apply by a certain date often in May or June to get an exemption for the tax year that starts July 1. In 1988 voters approved Proposition 90 which allowed qualified homeowners age 55 or older to transfer the current taxable value of their original home to a replacement home in another county but only if the county in which the replacement home is located agrees to participate in the program.

You or a spouse residing with you must at least 55 years of age when the original property is sold. The over-55 home sale exemption was a tax law that provided homeowners over the age of 55 with a one-time capital gains exclusion. The claimants spouse need not be an owner of record of the original property.

California homeowners 65 and older should check their property tax bills and make sure they are getting any senior exemptions on school parcel taxes to which they are entitled. Its just 61 in Washington State and New Hampshire will increase your exemption over the years as you age sort of like giving you a birthday present each year although you do have to be at least age 65. The replacement property must be purchased or built within two years before or after of the sale of the original property.

Tax amount varies by county. One-time benefit The is a one-time benefit. To fund that new tax break it would curtail a separate tax break Californians may receive on homes inherited from parents and grandparents.

Individuals who met the requirements could exclude up to 125000. The caveat here is the market value of the new house generally must be lower or equal to the home being sold. Texas will do this as well but only if the surviving spouse is age 55 or older.

Age 65 is by no means a universal rule however. Once you have filed for and received this tax relief neither you nor your spouse who resides with you can ever file again even upon your spouses death or if the two of you divorce. Effective April 1 2021.

In the late 1980s California voters approved a pair of propositions that give homeowners older than 55 a property tax break when they sell their primary residence and buy a. California Prop 60 is an excellent property tax break that directly and exclusively benefits homeowners 55 or older living in the state of California. For married couples only one spouse must be 55 or older.

California Property Taxes Explained Big Block Realty

California Property Taxes Explained Big Block Realty

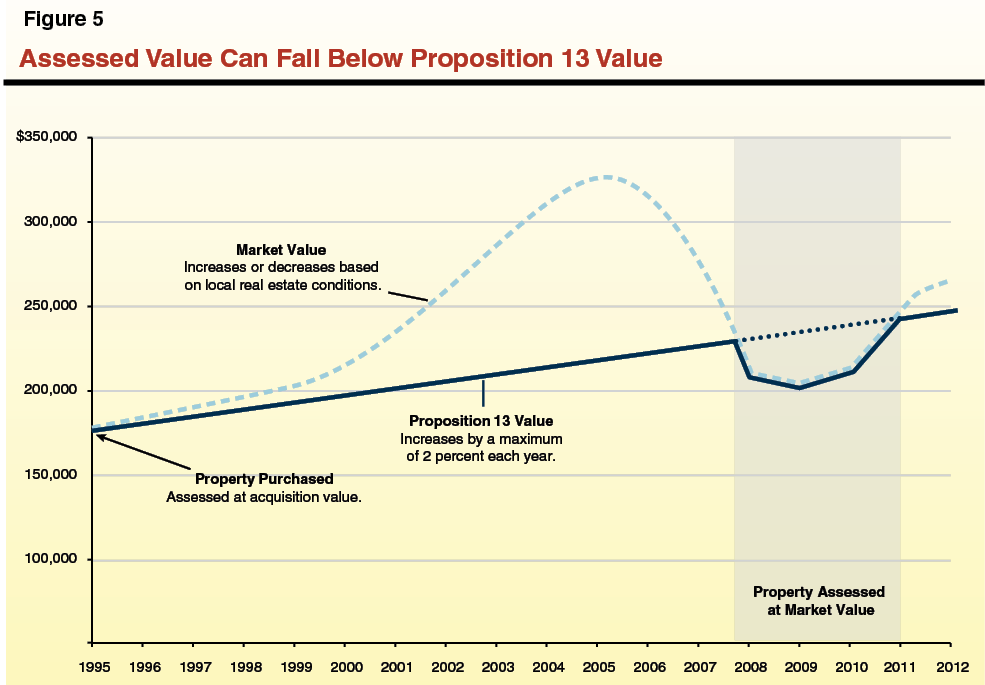

Understanding California S Property Taxes

Understanding California S Property Taxes

California Proposition 60 And Proposition 90 Transfer Of Base Property Tax

California Proposition 60 And Proposition 90 Transfer Of Base Property Tax

How To Transfer California Property Tax Base From Old Home To New

How To Transfer California Property Tax Base From Old Home To New

If You Re A Senior Citizen Homeowner In California You Re In Luck The State Offers A Variety Of Property Social Security Benefits Tax Exemption Property Tax

If You Re A Senior Citizen Homeowner In California You Re In Luck The State Offers A Variety Of Property Social Security Benefits Tax Exemption Property Tax

Proposition 19 Creates A Complicated Property Tax Scheme And Reinforces Racial Inequities In California California Budget Policy Center

Proposition 19 Creates A Complicated Property Tax Scheme And Reinforces Racial Inequities In California California Budget Policy Center

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

California S Prop 19 Key Things The New Property Tax Law Gives And Takes Away Press Enterprise Property Tax New Property Estate Planning

California S Prop 19 Key Things The New Property Tax Law Gives And Takes Away Press Enterprise Property Tax New Property Estate Planning

Emerge Emergency Saving Money Webinar

Emerge Emergency Saving Money Webinar

What Is A Homestead Exemption California Property Taxes

What Is A Homestead Exemption California Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Labels: california, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home