How To Challenge Property Tax Assessment In Texas

Texas property tax appeals can be filed using the form provided by the appraisal district or. But by learning how property taxes are computed in Texas you can investigate whether the assessed value of your home is too high and the basis of an excessive property tax bill.

How To Protest Your Property Taxes In Texas Home Tax Solutions

How To Protest Your Property Taxes In Texas Home Tax Solutions

The next step is to figure out whether your assessed value actually matches up with.

How to challenge property tax assessment in texas. Steps to Protesting and Reducing Your Property Value Annually Step 1. Texas property tax notices confuse homeowners and dont comply with state constitution. This post was originally published on April 26 2014 and was updated most recently June 17 2020.

The process only takes a few minutes and the results last for years. You may make this appeal only if the property. How long you have to appeal varies.

You should know that there is a small window to dispute your property assessment. OConnor is the largest property tax consulting firm in the US. If you elect to formally challenge your property assessment you must file an appeal with your local appeals board.

This directory contains contact information for appraisal districts and county tax offices and includes a. File a formal request for appeal with the Travis County Appraisal District or the CAD in the County the property is located and review the rules controlling the procedure. Challenge your taxes If you decide to proceed contact your county auditors office for instructions.

He said people will still get appraisal notices in the spring that they can challenge. This usually involves filling out a special form and sometimes appealing before a. The appraisal district in your county has a record.

Our clients dont pay anything unless we save them money. Research the Central Appraisal Districts Record Card. In Texas that makes the deadline generally on or around May 15th each year.

Check with your appraisal district for details. Choose OConnor to appeal your high property taxes. The deadline for filing your property protest appeal is May 15th unless that day is a holiday or weekend then the next business day or 30 days after the date your notice of appraised value was mailed whichever is the later date.

Other information related to paying property taxes Questions about a taxing unit that is not listed as consolidated in a county should be directed to the individual taxing unit. Make sure to do so within the appeal period. The ARBs decisions are binding only for the tax year in question.

Take A Closer Look. If homes similar to yours are selling for 250K and your appraisal value is at or less than 250K then you may not be able to make the case that your property value should be. This article describes the tax assessment process in Texas.

First off carefully read the assessment and make sure that the home described actually matches your home. Step 1 Find Out Your Homes Current Value The first thing you need to know is the current value of your home. In most counties and cities you must file an appeal within 30 to 90 days after you receive your annual property assessment notice or letter.

If you lease property and are required by the lease contract to pay the owners property taxes you may appeal the propertys value to the ARB. It seems obvious but. Thinking of filing a property tax protest in Houston Harris County.

Texas legislators recently instituted laws that will force property appraisers to create more transparent notices requiring online real-time pages where homeowners can see why tax rates are. That period is 30 days from the time you receive it in the mail. Before challenging your rate you should decide if it is worth your effort.

Property Tax Protest Services OVERVIEW. How to challenge a property tax assessment. In Travis County you will need the owner ID and PIN number on your notice of appraised value to file.

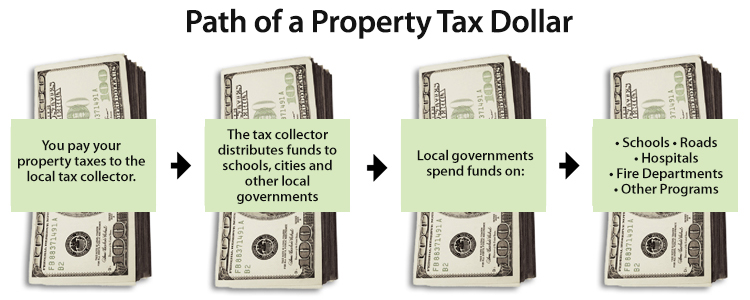

How Are Property Taxes Calculated. Opening a tax bill can cause shock to many homeowners. So if your property is assessed at 300000 and your local government sets your tax rate at 25 your annual tax bill will be 7500.

Some counties will do a reassessment based on a telephone or e-mail request but others require a formal appeal. The deadline to file a protest is May 31 2017.

Property Tax Basics Milam Ad Official Site

Property Tax Basics Milam Ad Official Site

Property Taxes El Paso Tx Villegas Cpa Firm Irs Taxes Problem And Solution Cpa

Property Taxes El Paso Tx Villegas Cpa Firm Irs Taxes Problem And Solution Cpa

Property Tax Arbitration Property Tax Values Austin Tx Final Step When Fighting Taxes Property Tax Austin Tx Tax

Property Tax Arbitration Property Tax Values Austin Tx Final Step When Fighting Taxes Property Tax Austin Tx Tax

How To Protest Your Property Taxes In Texas

Property Tax Property Tax Texas Real Estate Marketing Data

Property Tax Property Tax Texas Real Estate Marketing Data

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

How To Protest Property Tax In Tarrant County Win Youtube

How To Protest Property Tax In Tarrant County Win Youtube

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

Texas Property Tax Appeals Steps How To File A Property Tax Protest

Texas Property Tax Appeals Steps How To File A Property Tax Protest

Think Your Property Tax Bill Is Too High If So Here S How To File A Formal Complaint With The County Auditor To Dispute Your Property Tax Dispute Assessment

Think Your Property Tax Bill Is Too High If So Here S How To File A Formal Complaint With The County Auditor To Dispute Your Property Tax Dispute Assessment

Property Tax Basics Milam Ad Official Site

Property Tax Basics Milam Ad Official Site

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

People Are Not Always Satisfied With Their Property Assessment Most Of The Time Property Assessed By Computerized Syst Tax Protest Property Tax Tax Reduction

People Are Not Always Satisfied With Their Property Assessment Most Of The Time Property Assessed By Computerized Syst Tax Protest Property Tax Tax Reduction

Texas Property Tax Appeals Steps How To File A Property Tax Protest

Texas Property Tax Appeals Steps How To File A Property Tax Protest

Texas Property Tax Appeals Steps How To File A Property Tax Protest

Texas Property Tax Appeals Steps How To File A Property Tax Protest

Understanding The Property Tax Protest Industry Of Houston

Understanding The Property Tax Protest Industry Of Houston

If A Property Tax Assessment Is Above Market Value Luongo Bellwoar Can Appeal Your Property Tax Assessment And Reduce Pr Property Tax Estate Planning Property

If A Property Tax Assessment Is Above Market Value Luongo Bellwoar Can Appeal Your Property Tax Assessment And Reduce Pr Property Tax Estate Planning Property

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home